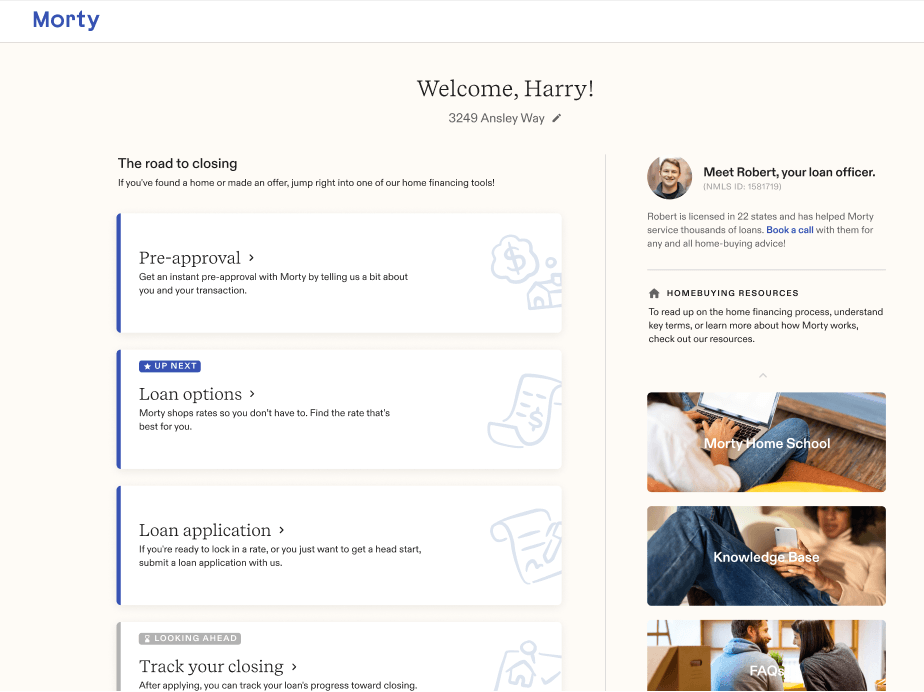

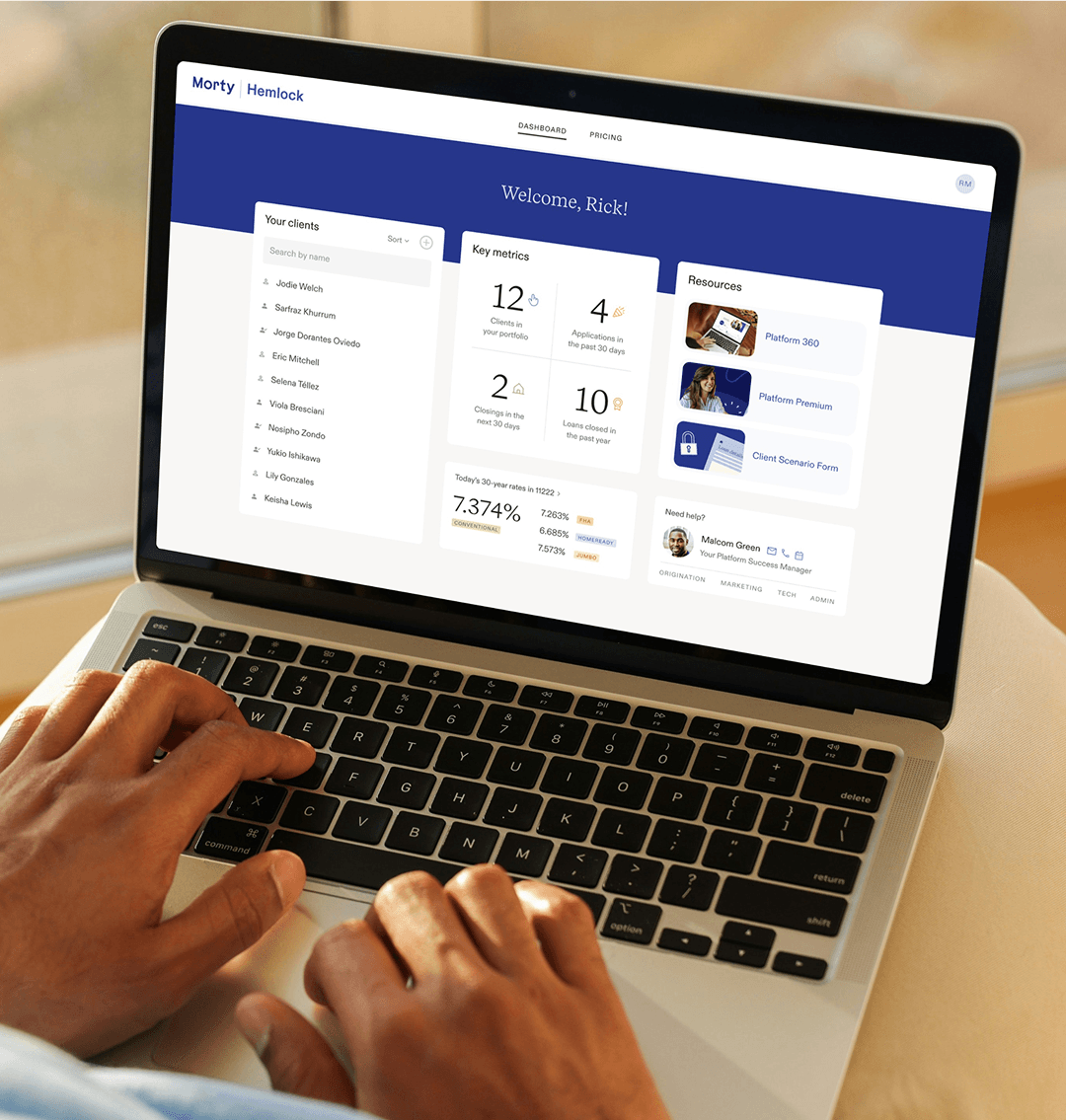

A modern borrower experience, built to help you close

Give your clients a branded, self-serve experience with automated pre-approvals, interactive loan tools, and smart notifications — all connected to your LOS and powered by your pricing configuration.

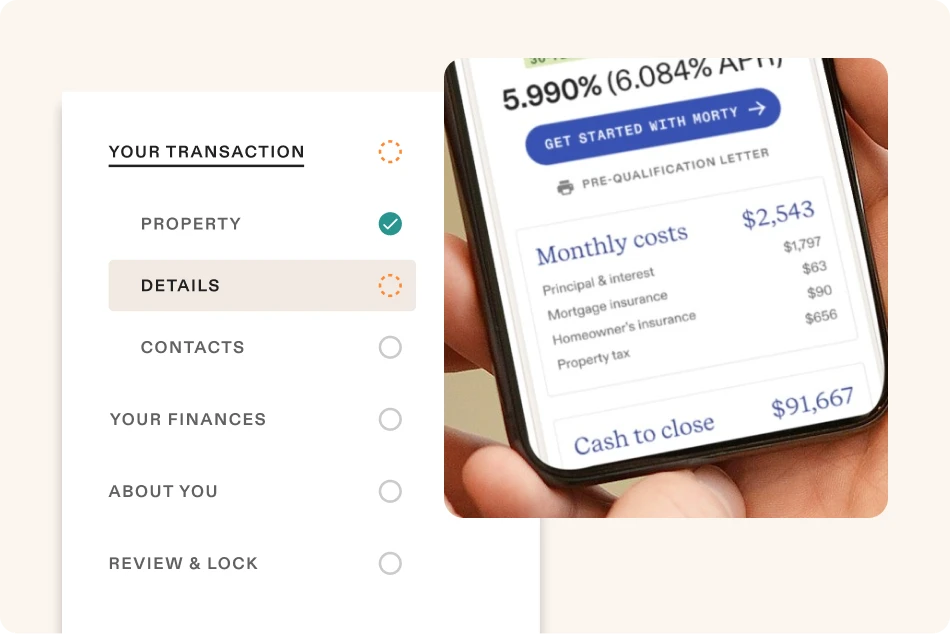

A borrower experience designed to convert

Automatic updates keep clients and partners in sync

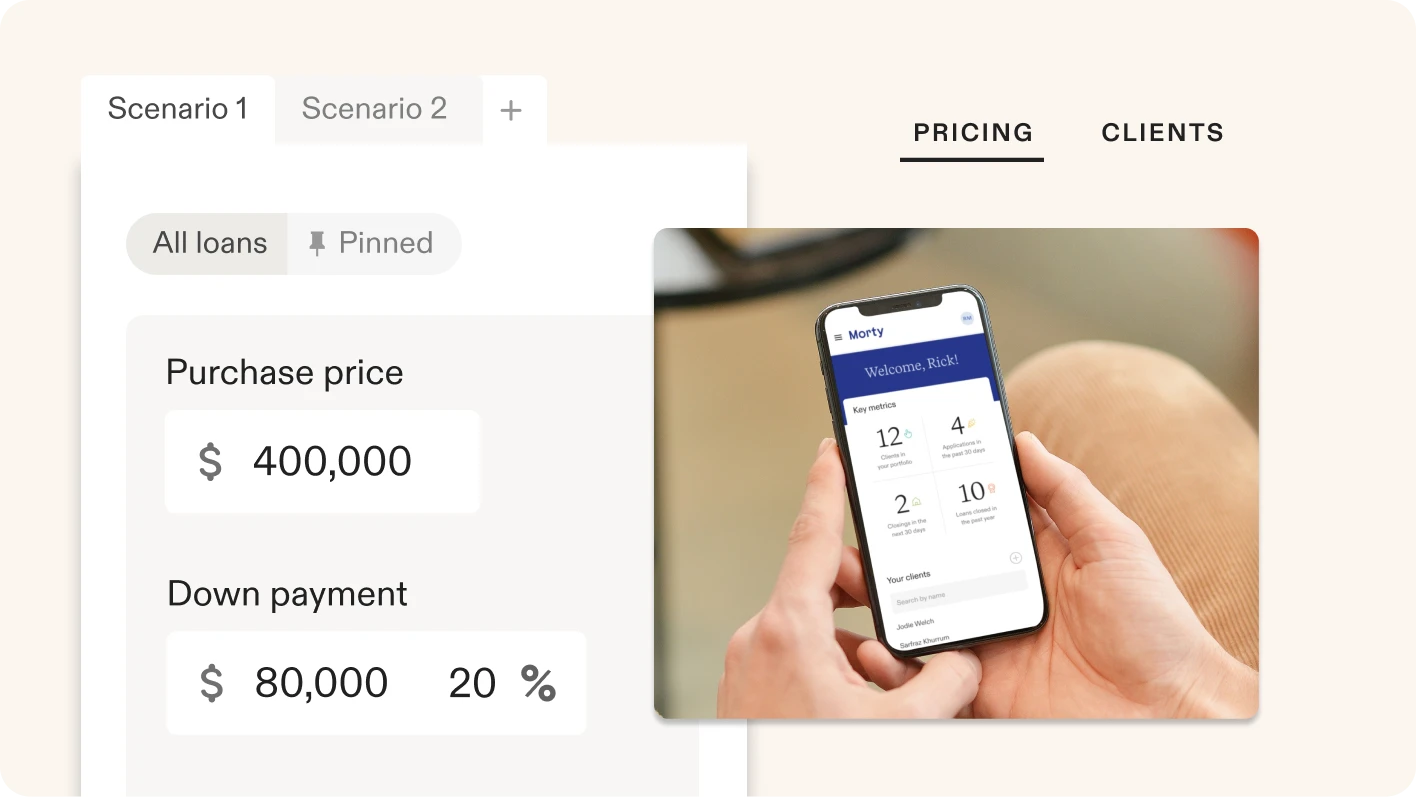

A customizable POS that grows with your business

Explore more of the Morty Platform

- Pricing Engine

- Real time pricing across lenders and clients.

- Data & Integrations

- Access your production data and connect with credit and CRM tools.

- Lender Network

- Access 25+ lenders with built-in pricing, overlays, and eligibility.

“Morty's platform is internet-based and very user-friendly. If you're tech-savvy, it's perfect for you. Morty’s team is great—and something that's very noticeable is if you have an idea or feedback, it doesn't fall on deaf ears. They do what they have to do to implement.”

“In finance—whether it’s banking, financial advising, or mortgages—people just need clear explanations. The ability to get quick, accurate insights is critical. A DTI issue shouldn’t take days to figure out—it should take an hour, or even minutes.”

Smarter intake, faster close — here’s how

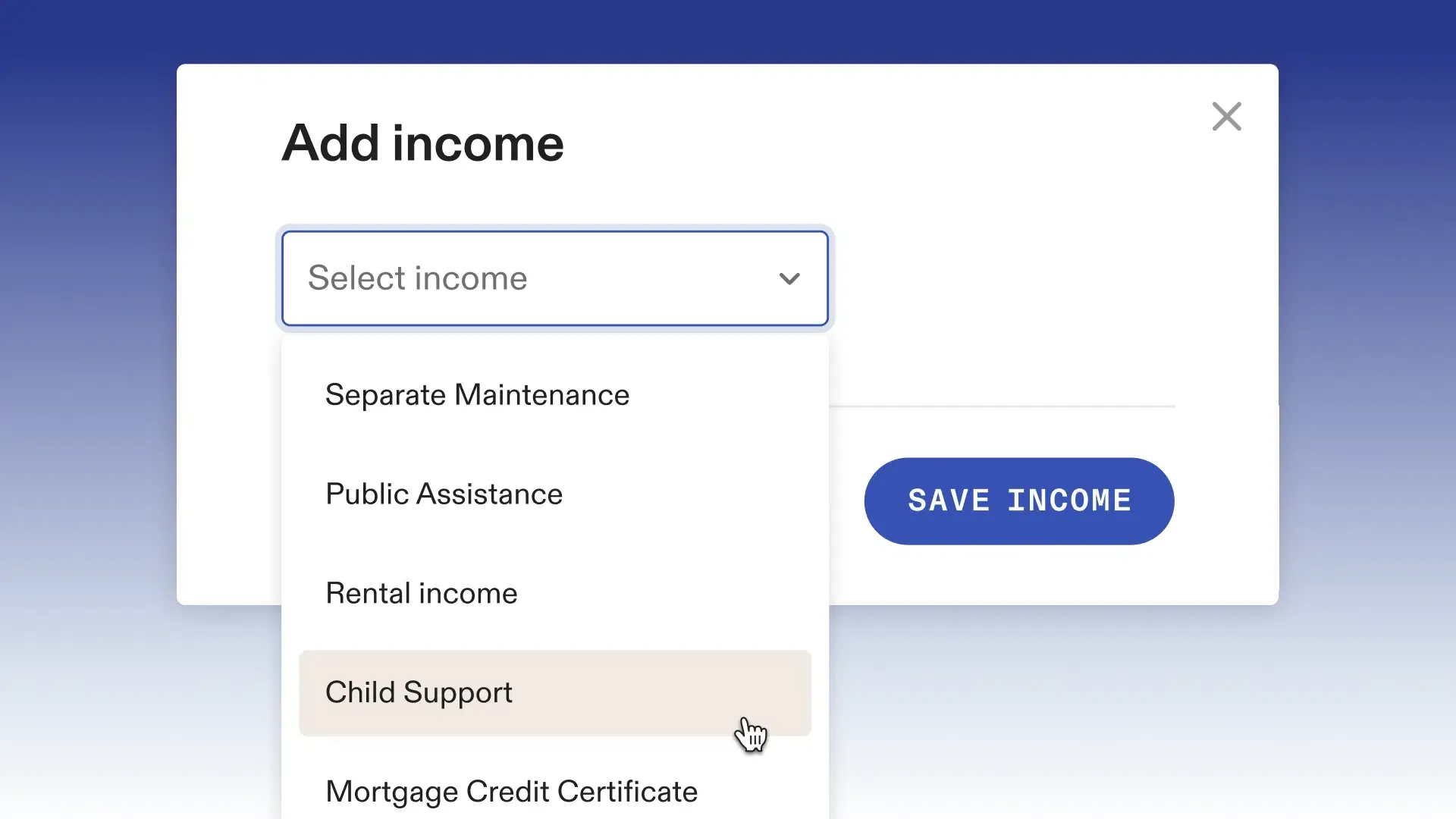

Handle Income and Assets Like a Pro

New POS tools help you document assets and income — even when the deal isn't placed.

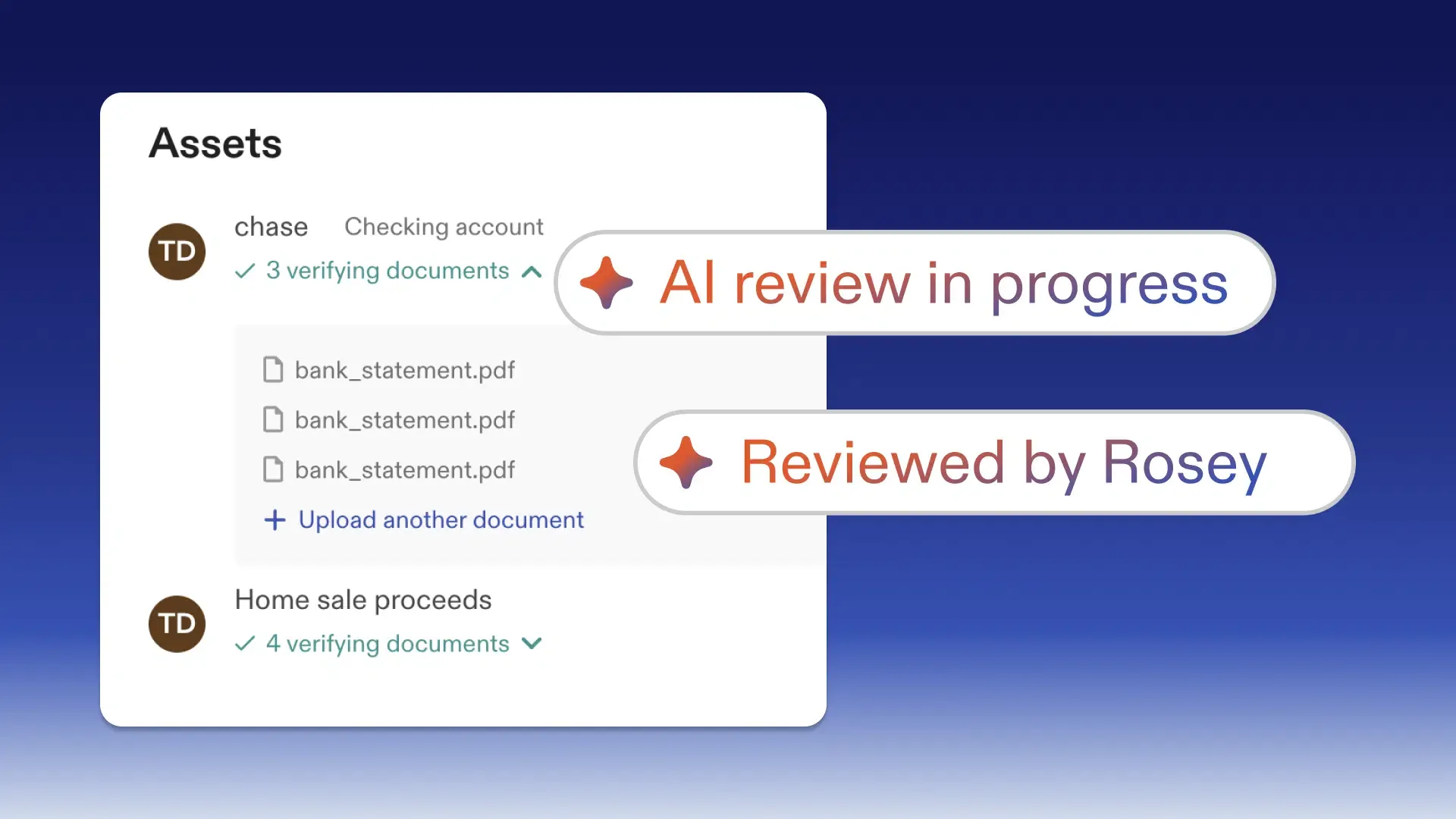

AI-Powered Document Verification

Speed up your workflow with AI that reviews documents right in the POS.

Choosing the Right POS & LOS

What to look for in mortgage software — and why it matters for brokers.