Built for enterprise. Powered by Morty.

Whether you're a fintech, lender, or established brand, Morty’s modular platform and compliance infrastructure make it easy to embed mortgage into your business — fast.

- 0B+

- $ of loan volume

- Flowing through Morty-powered infrastructure

- 0+

- Lenders integrated

- Pricing, eligibility, and overlays built in

- 0M

- Max loan amount supported

- Jumbo-ready infrastructure

- 0

- Time to deploy

- Spin up a branded instance fast

The mortgage infrastructure powering modern lending platforms

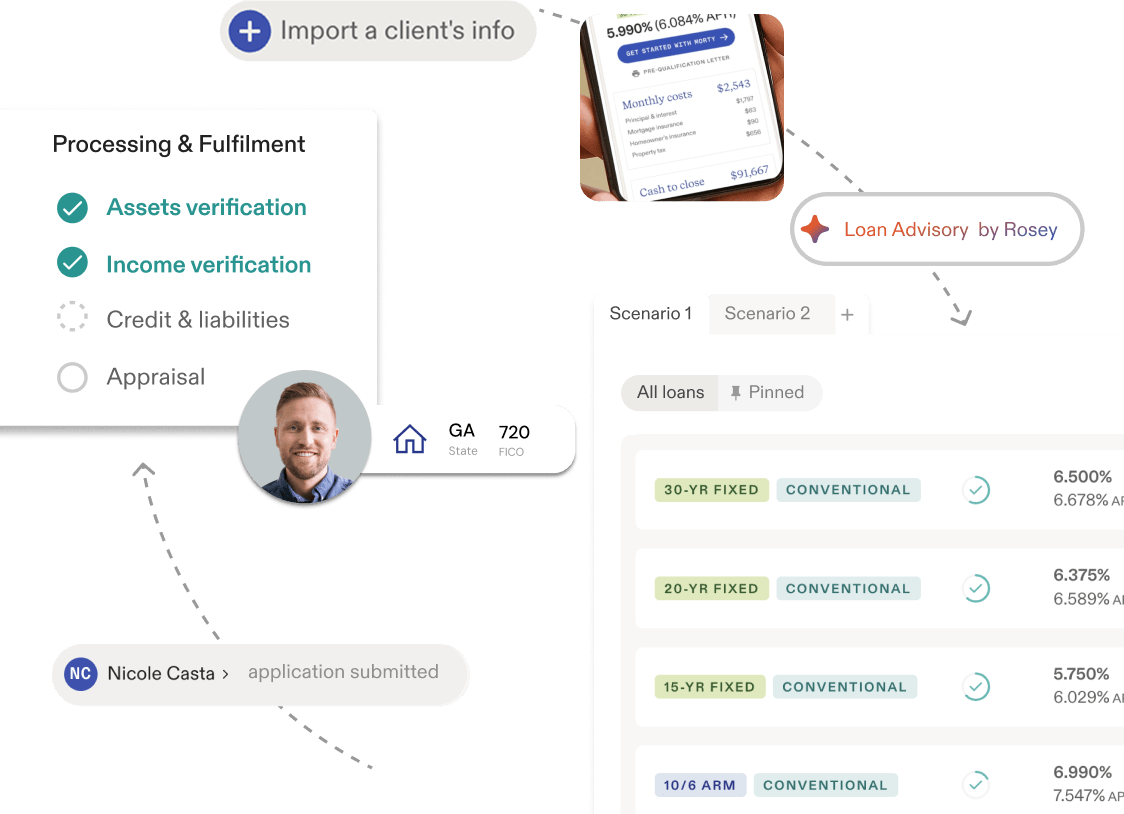

Use just what you need

Pick the components you need — from pricing engine to POS, LOS, or AI-powered loan tools. Built-in compliance and disclosure layers make integration seamless.

Explore components

Plug Morty into your platform

Connect Morty to your existing CRM, lead funnel, or platform via secure APIs. Get granular control over client experience, file visibility, and data sync.

View integration options

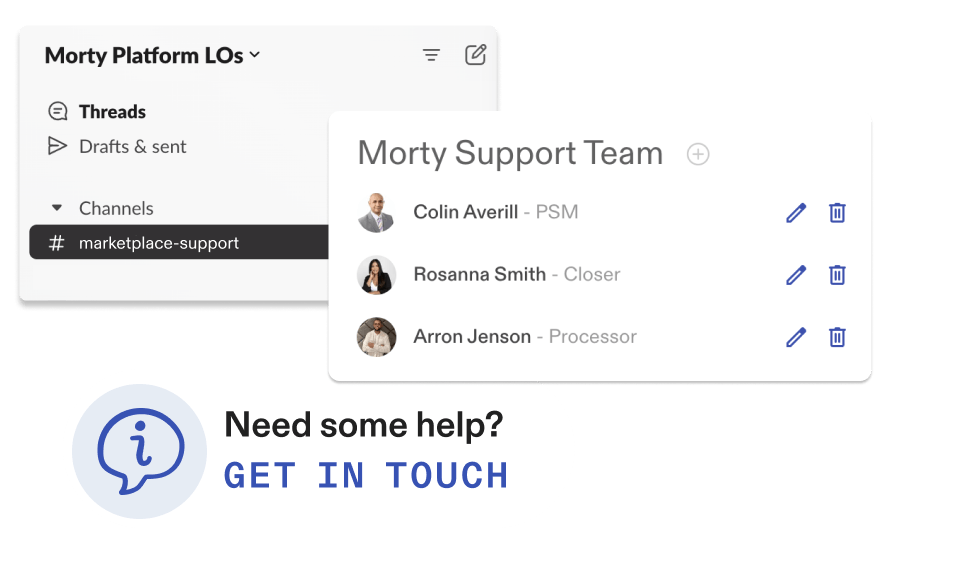

Use your own team or ours

Bring your own staff or use Morty’s fulfillment pods. Supports hybrid models, co-branded workflows, and partner escalation.

Learn about fulfillment

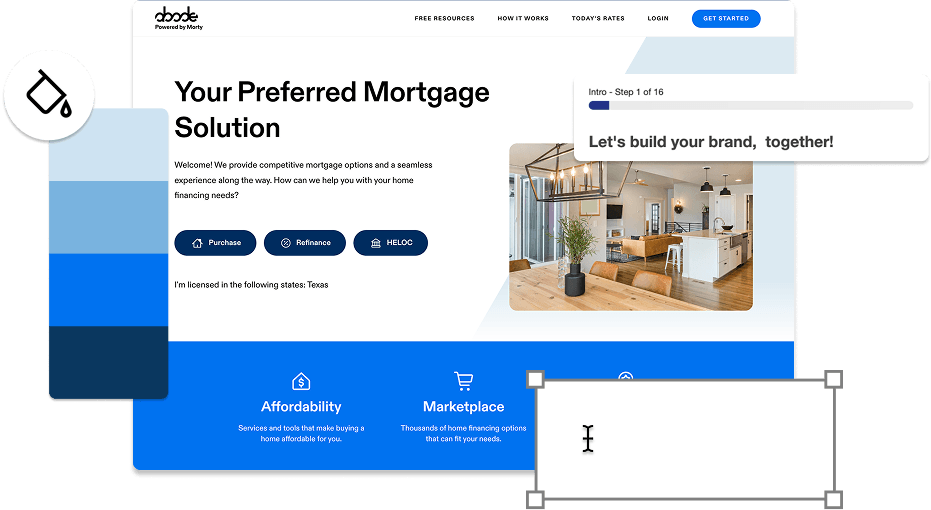

Launch with your brand

Fully branded instances with custom domains, logic, and compliance guardrails. Flexible tiering and SLAs for high-volume teams.

Talk to our enterprise team

Frequently asked questions

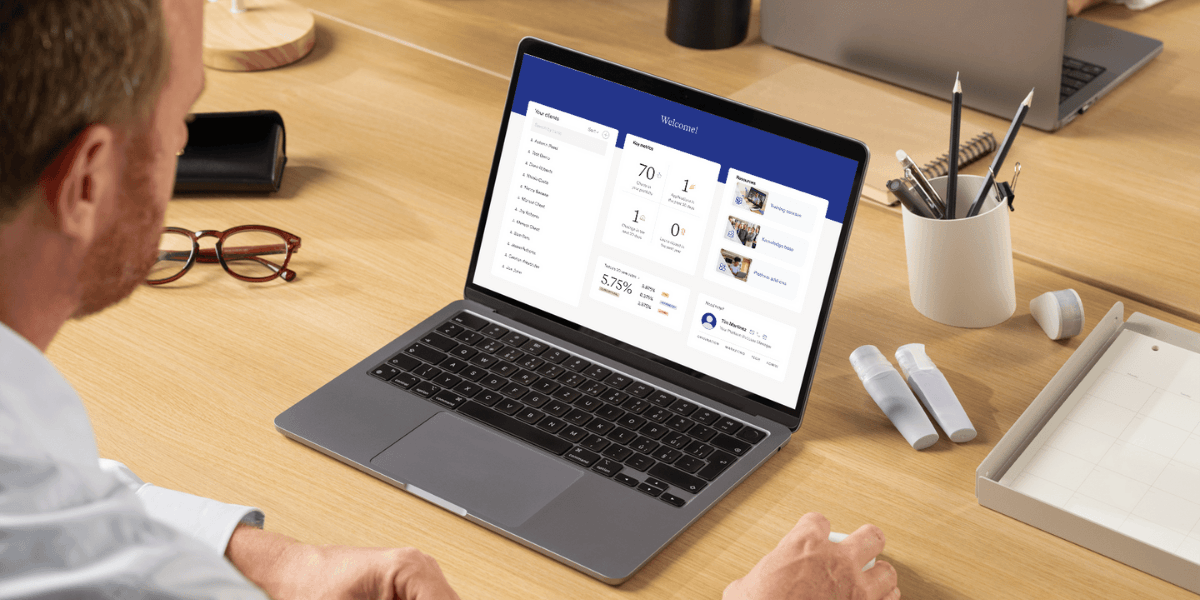

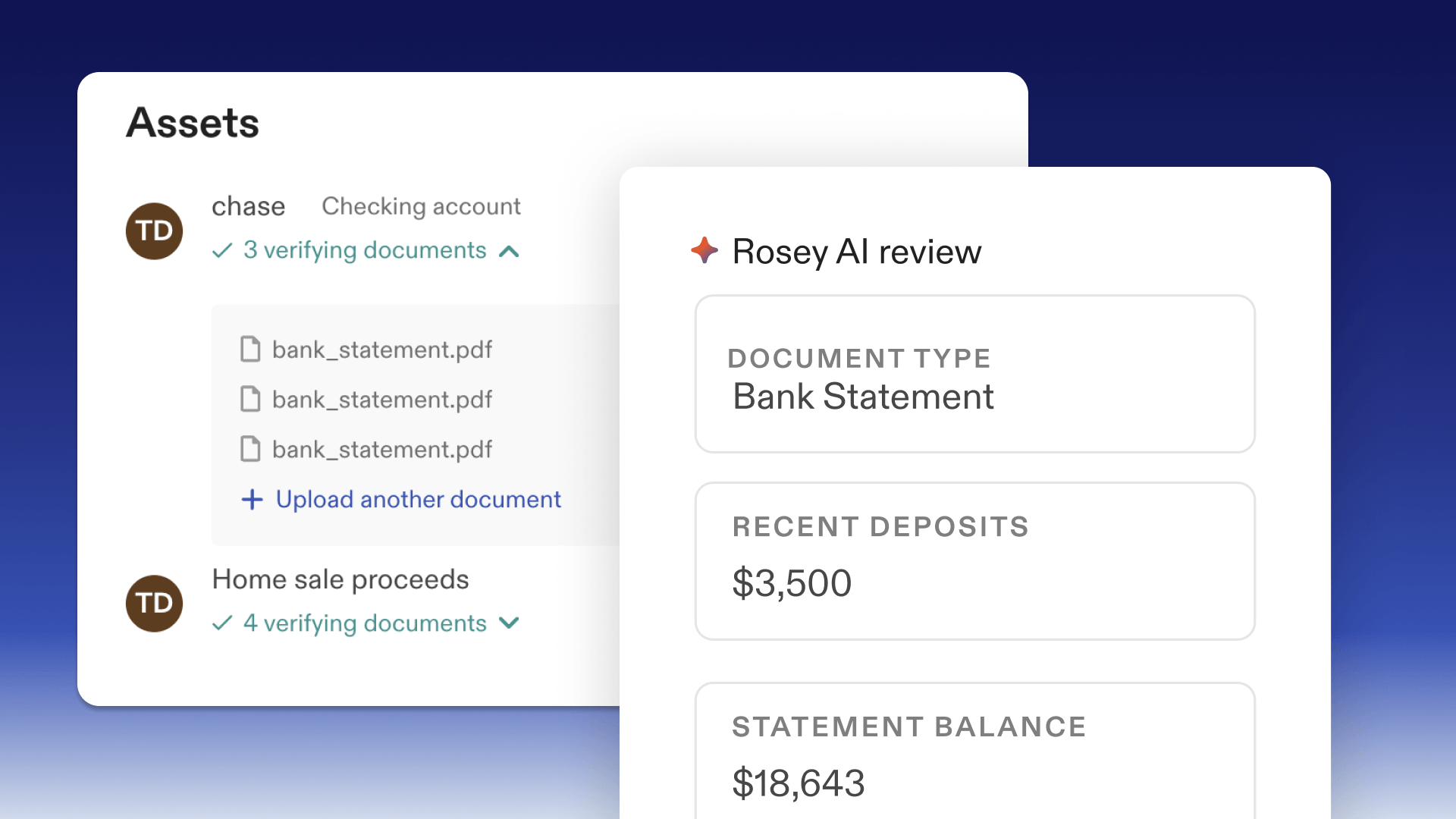

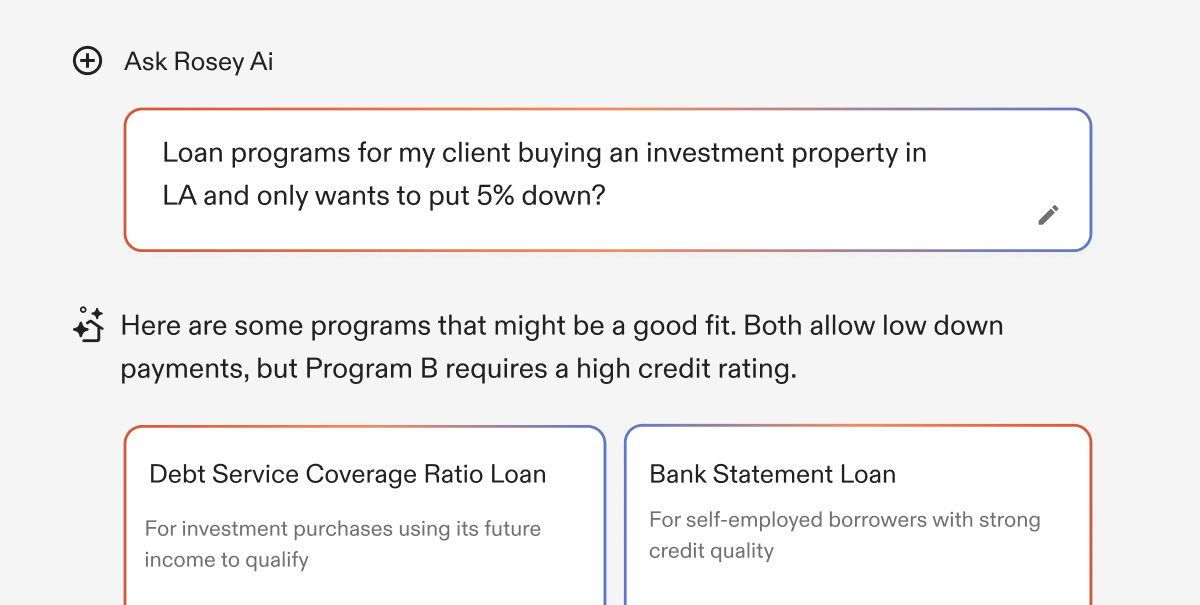

Let AI handle the tedious work while you build relationships

Morty's Rosey AI automates document review, verifies assets instantly, and handles routine tasks—reducing processing time by 75% and eliminating human error.

Powering products, platforms, and partners alike

“In finance—whether it’s banking, financial advising, or mortgages—people just need clear explanations. The ability to get quick, accurate insights is critical. A DTI issue shouldn’t take days to figure out—it should take an hour, or even minutes.”