Move your mortgage business to a modern platform

Morty makes switching simple — with full onboarding support, built-in lender access, and an all-in-one platform that eliminates legacy costs and complexity.

- 0+

- Customers on Morty

- From local shops to multi-state teams — all building on our platform.

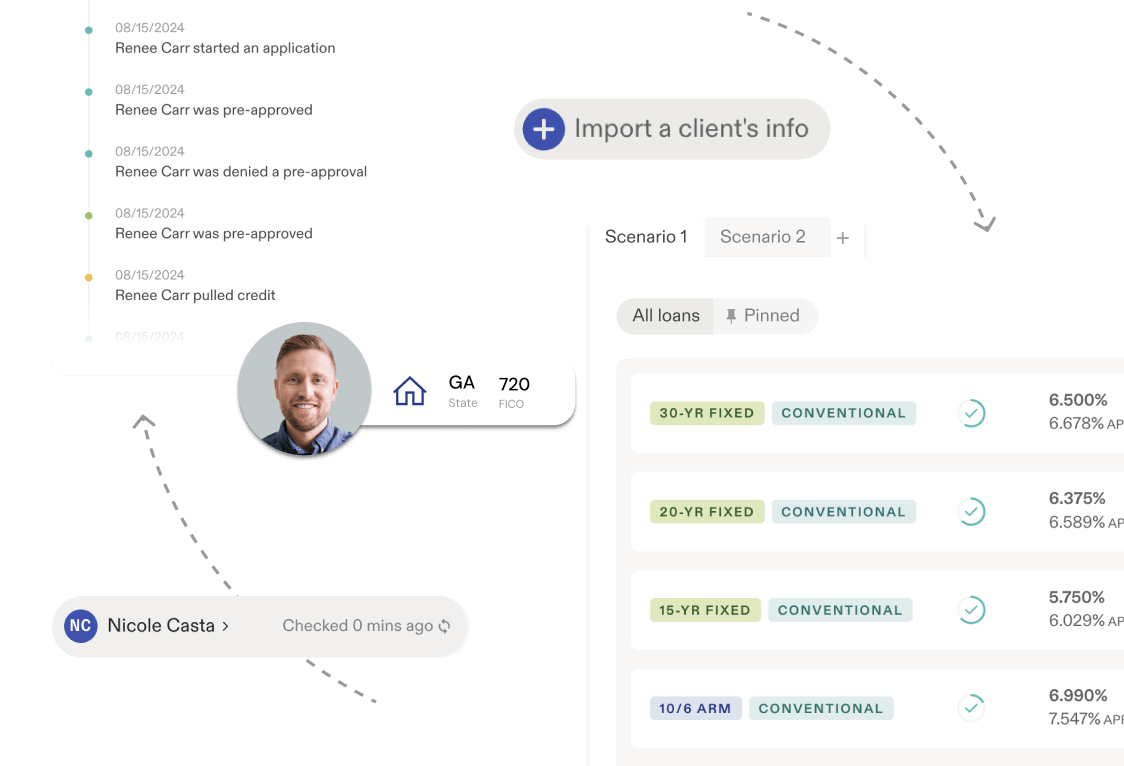

- 0min

- Automated pre-approvals

- Borrowers get auto-preapproved in minutes with Morty's pricing engine + workflow automation.

- 0+

- Lenders integrated

- Pre-approved pricing, eligibility, and overlays — with new lenders added in under a week.

- 0%

- Average cost savings

- Save on tech, fulfillment, and compliance while closing more loans.

Say goodbye to legacy tools — and hello to simplicity

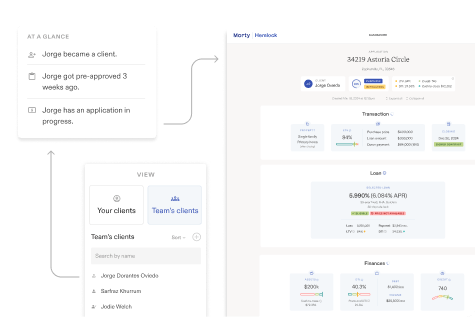

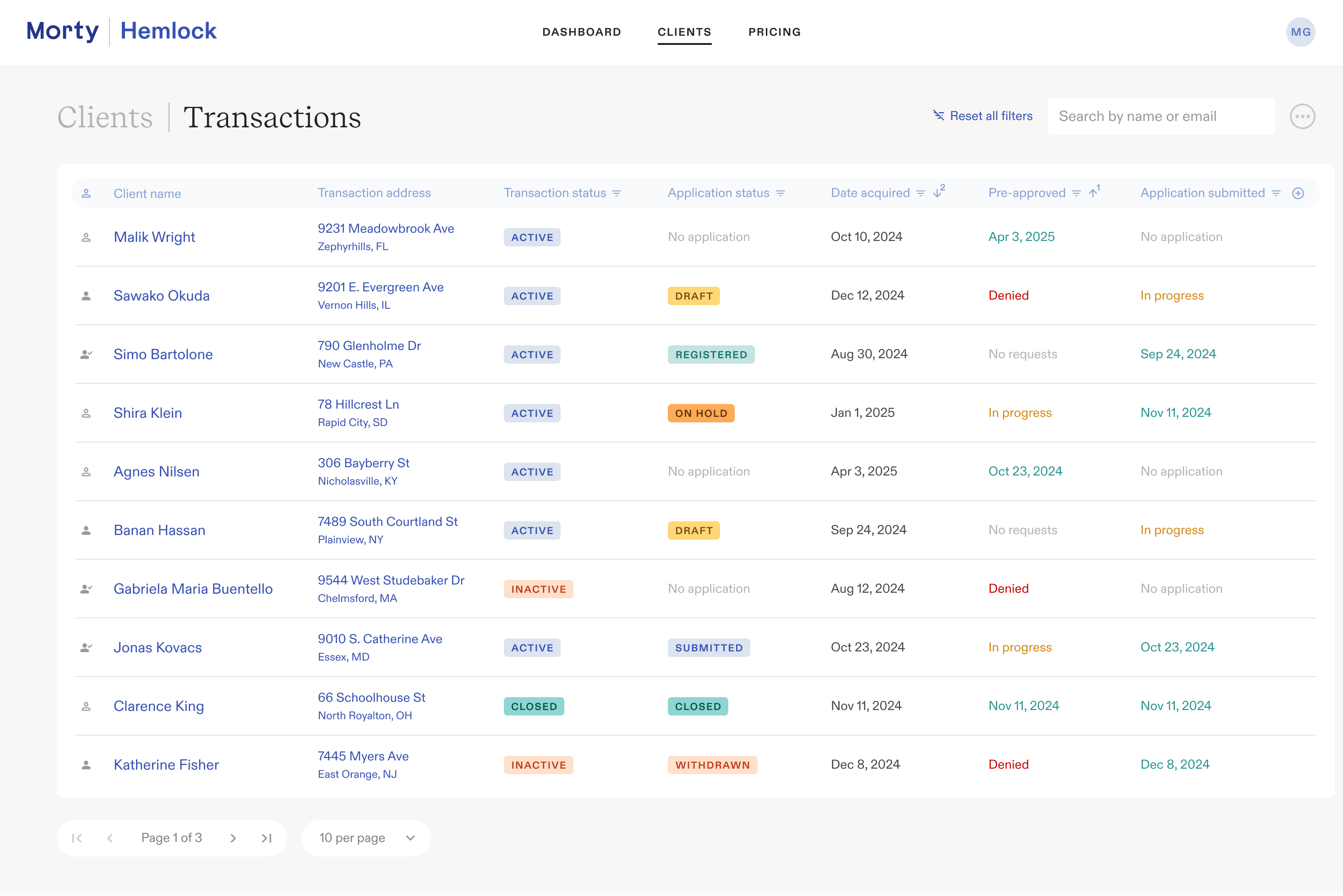

One platform to replace them all

Ditch disconnected systems and subscription bloat. Morty combines your LOS, POS, pricing engine, borrower tools, and fulfillment into one easy-to-use platform.

Explore LOS

Switch with confidence

Our team builds a personalized migration plan for your business — with white-glove onboarding and zero disruption to your pipeline.

Talk to Sales

Eliminate overhead, not opportunity

Reduce tech and staffing costs while improving efficiency. Morty gives you powerful infrastructure at a fraction of what you’re paying now.

View pricing

Stay focused on growth, not audits

Morty handles disclosures, reporting, and audit readiness — whether you're on our license or your own.

Explore compliance

Your go-live plan, from setup to first deal

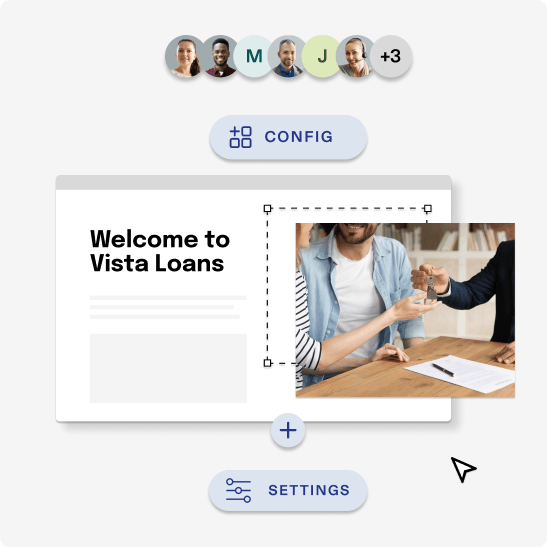

Get your foundation in place

- Configure your brand, pricing, and states

- Submit sponsorship filings and licensing documents

- Establish your commission structure

Train your team and meet your pod

- Live product walkthroughs and role-based training

- Meet your processing & fulfillment pod

- Begin leveraging Rosey AI and efficiency tools

Start submitting and closing deals

- Begin working directly with your pod

- Submit files through Morty’s platform

- Get support on early deals and client workflows

Make Morty your own

- Expand states, team members, or lenders

- Use your branded marketing page and templates

- Track performance and improve with analytics & AI

Frequently asked questions

Spend less time managing, more time originating

With everything built in — pricing, documents, borrower messaging, and more — Morty helps you work smarter and close faster.

Stories and strategies from brokerages that made the switch

“I’m fascinated with Morty. They’ve taken a different approach to the market and having this platform that they’ve built out right now is pretty amazing.”