The fastest way to start a mortgage business

Morty handles the licensing, tech, lender setup, and support — so you can go live in days, not months, and start originating right away.

- 0

- Days to launch

- From setup to your first live deal — including LOS, POS, and pricing.

- 0+

- Businesses on Morty

- From solo operators to growing teams — all building on our platform.

- 0+

- Loans/month per LO

- With automation and support, top producers handle more — without burnout.

- 0

- States supported

- Operate in your key markets — from California to Florida to New York.

Run a better mortgage business with fewer vendors and more support

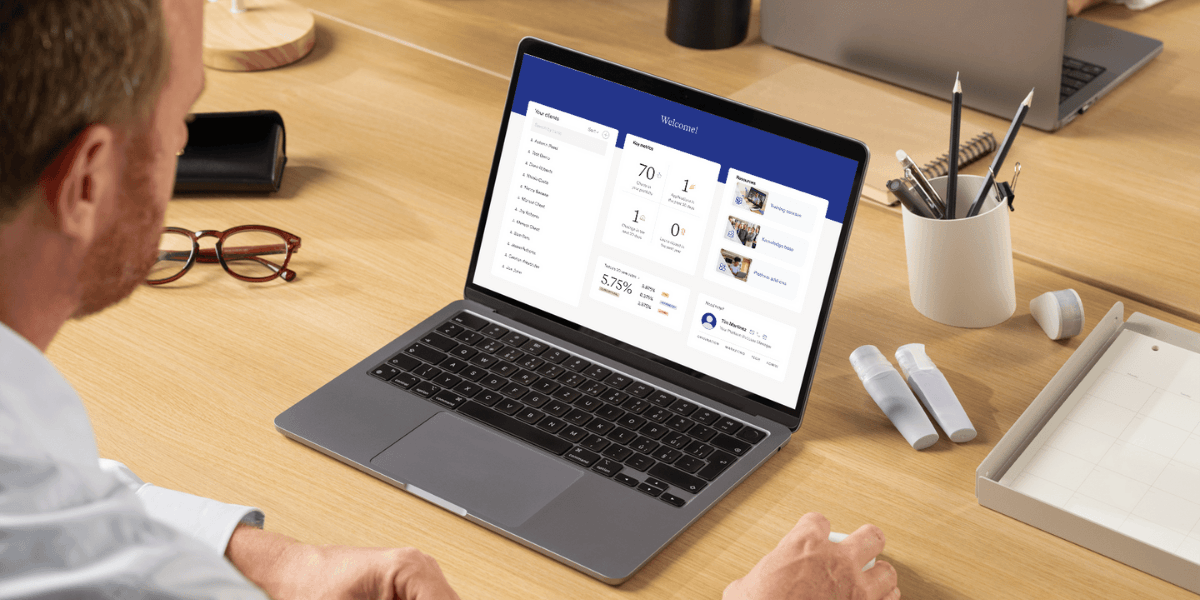

Everything you need to start, already built in

From LOS and POS to pricing tools and borrower experiences — Morty gives you a fully integrated mortgage platform out of the box.

Explore LOS

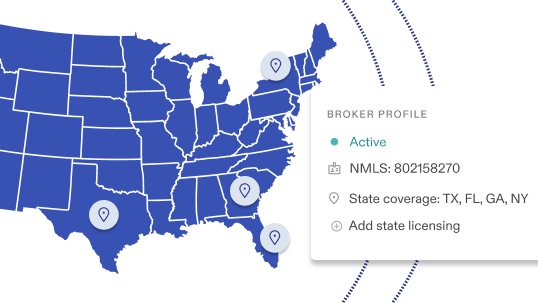

Start under Morty’s license or your own

Launch your business in days — no need to file an MU1 or hire a compliance officer. Morty supports both licensed and unlicensed businesses with no migration required.

Explore licensing options

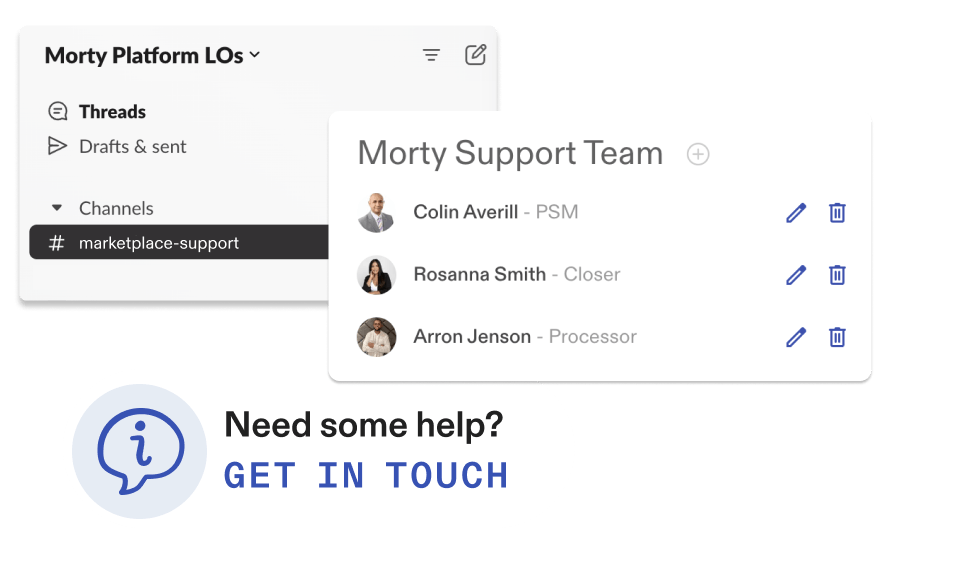

Dedicated teams to keep you lean

Get a processor, closer, and support manager as part of your pod — so you can focus on origination without hiring overhead.

View processing support

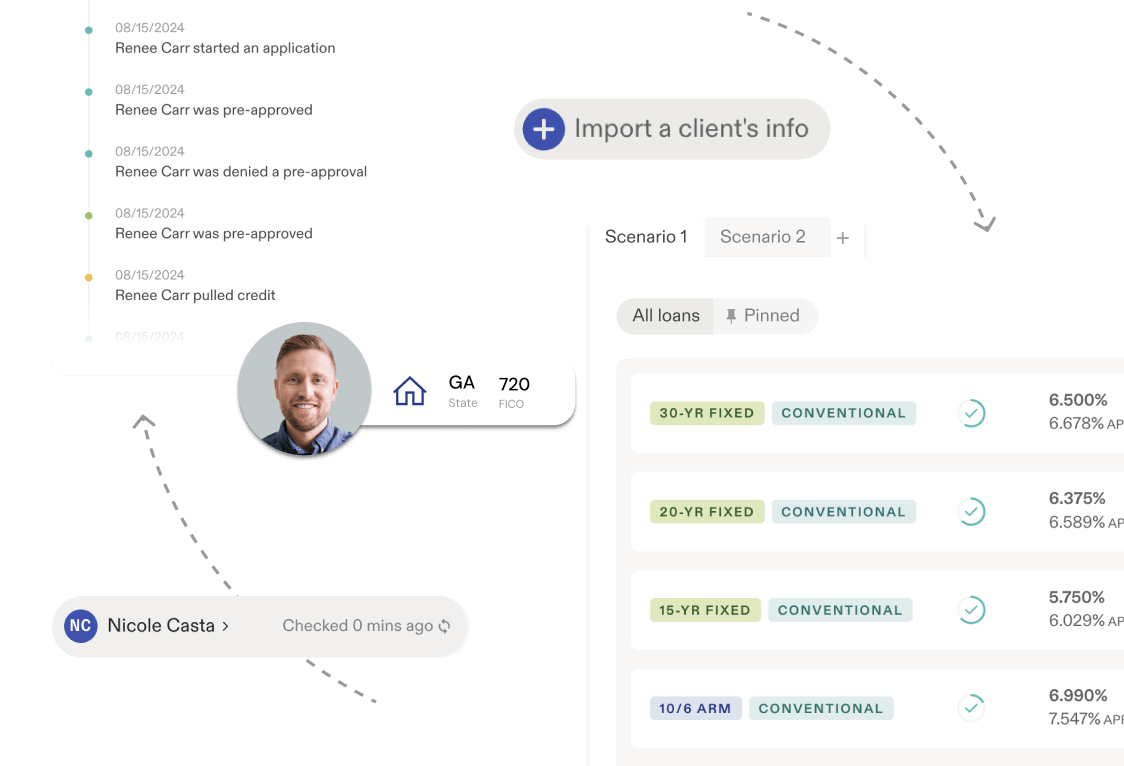

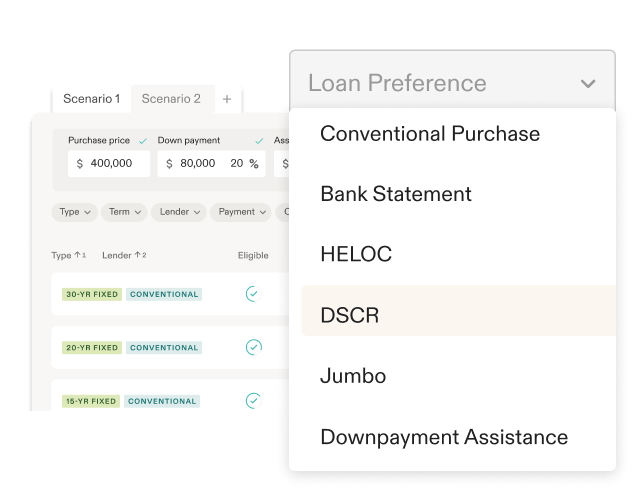

25+ lenders and 100s of programs, pre-integrated and ready

Morty connects you with a wide range of loan products — all with overlays, pricing, and eligibility built into your workflow.

Browse lender access

Your go-live plan, from setup to first deal

Get your foundation in place

- Configure your brand, pricing, and states

- Submit sponsorship filings and licensing documents

- Establish your commission structure

Train your team and meet your pod

- Live product walkthroughs and role-based training

- Meet your processing & fulfillment pod

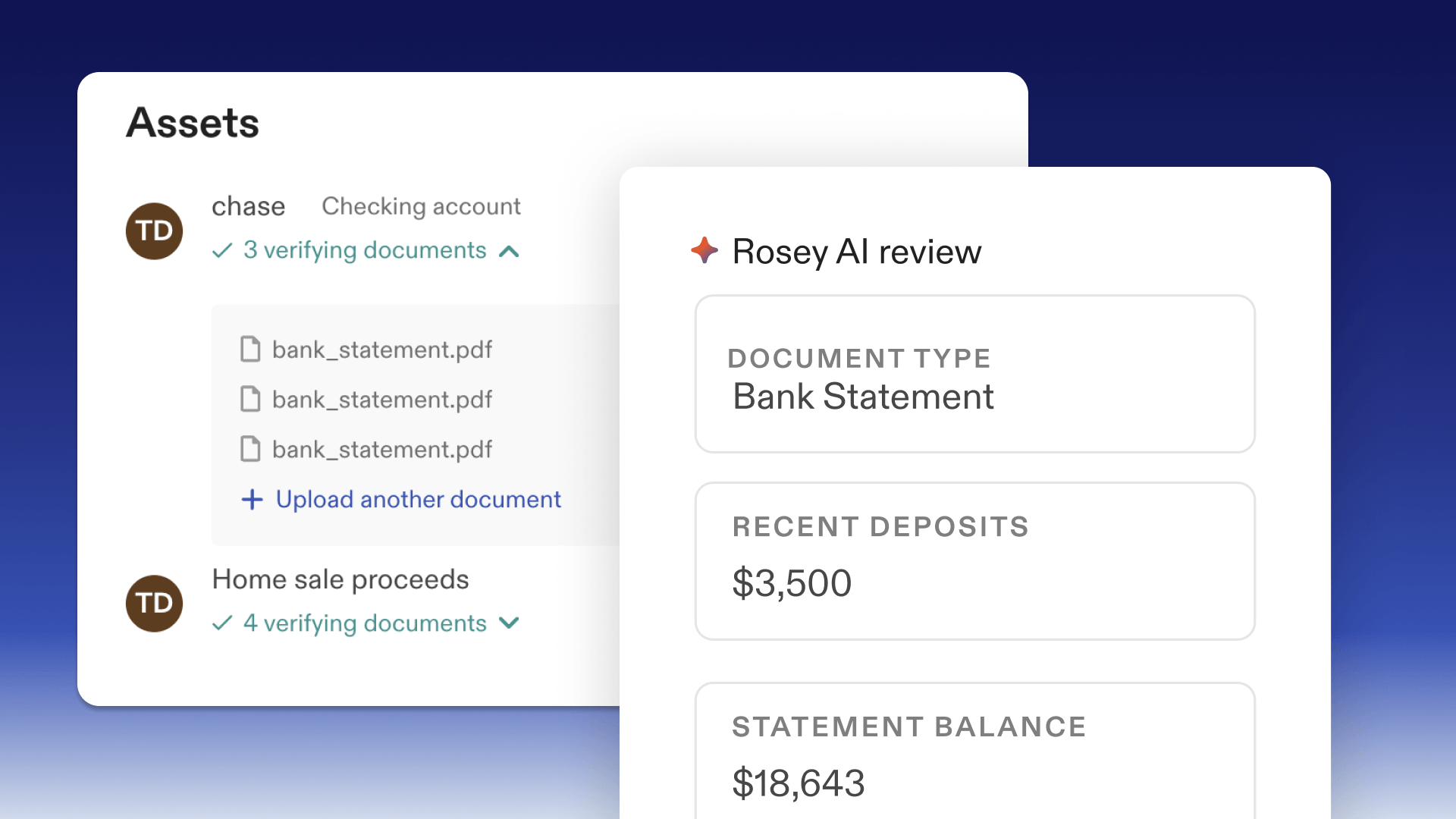

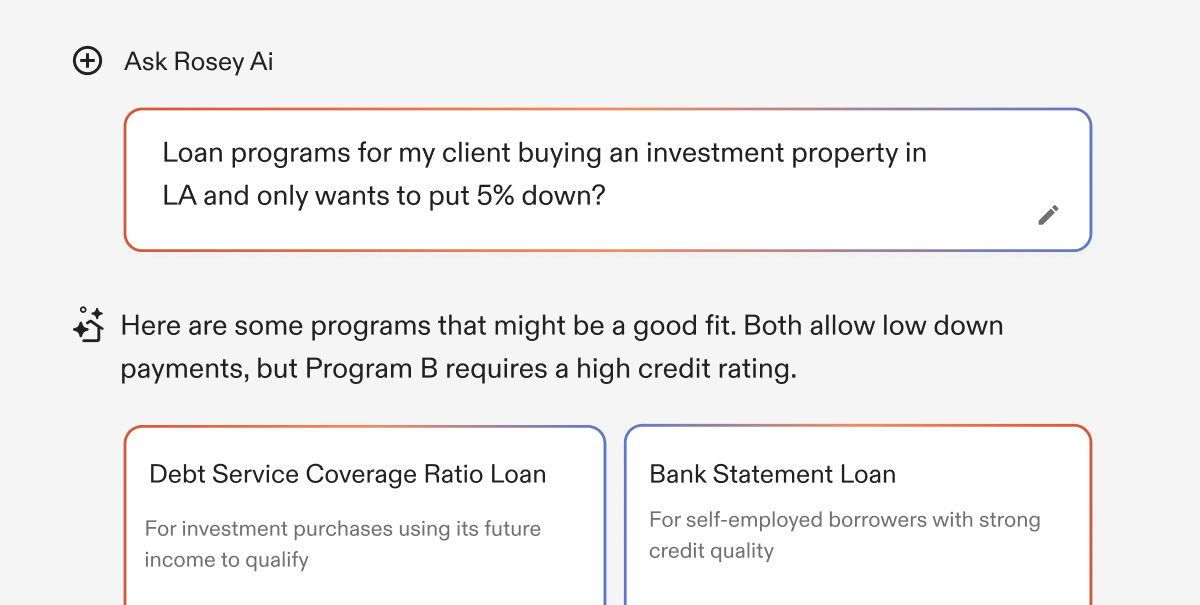

- Begin leveraging Rosey AI and efficiency tools

Start submitting and closing deals

- Begin working directly with your pod

- Submit files through Morty’s platform

- Get support on early deals and client workflows

Make Morty your own

- Expand states, team members, or lenders

- Use your branded marketing page and templates

- Track performance and improve with analytics & AI

Frequently asked questions

Let AI handle the tedious work while you build relationships

Morty's Rosey AI automates document review, verifies assets instantly, and handles routine tasks—reducing processing time by 75% and eliminating human error.

Helping originators focus on what matters most

“In finance—whether it’s banking, financial advising, or mortgages—people just need clear explanations. The ability to get quick, accurate insights is critical. A DTI issue shouldn’t take days to figure out—it should take an hour, or even minutes.”