Leveraging the support and flexibility of the Morty platform

Morty’s platform is designed to help loan officers maximize their career potential while also enjoying the freedom to work independently and at their own pace.

We provide loan officers with cutting-edge technology, a dedicated support team, and access to a vast marketplace of competitive loan options. Whether you aspire to strike it out on your own, prefer a part-time role, or want to supplement your existing career, our platform can unlock a world of possibilities.

Here’s an overview of the benefits we offer:

Flexibility

We know that each loan officer has unique goals and ambitions, and allow you to work at your own pace. Whether you’re looking to close a few deals per month or become a high-volume producer, our platform adapts to your needs. Take control of your career, strike a balance between work and life, and achieve financial success on your terms.

Reliable Support

Joining our platform means you gain access to our cutting edge tech and a dedicated processing team, providing you with the support necessary to manage your borrower pipeline effectively. Our cutting-edge tools streamline the loan processing workflow, allowing you to process up to 70 loans per month while maintaining exceptional quality.

Marketplace Power

You can tap into the power of the marketplace to offer thousands of competitive loan options and tailor them to specific client needs. Access to our extensive network empowers you to deliver exceptional service, ensuring your clients find the right loan for their financial goals and have a great experience along the way.

Technology

In today’s market, speed remains crucial. With our platform’s advanced technology, homebuyers can close on their dream homes in less than 14 days. Leverage our cutting-edge tools to expedite the loan origination and approval processes, providing an efficient and hassle-free experience for your clients. Our commitment to utilizing innovative technology means that in 2022, fewer than 1% of all deals experienced delays.

State Licenses

Expanding your reach has never been easier. We are licensed in 45 states and Washington, D.C., giving you the power to serve your local market and beyond. Harness the strength of our licensing network to establish yourself as a trusted loan officer in your area, building a solid reputation and serving a broader client base. With our comprehensive coverage, you can confidently offer expertise and service wherever you want to work, knowing that our platform provides the necessary regulatory support.

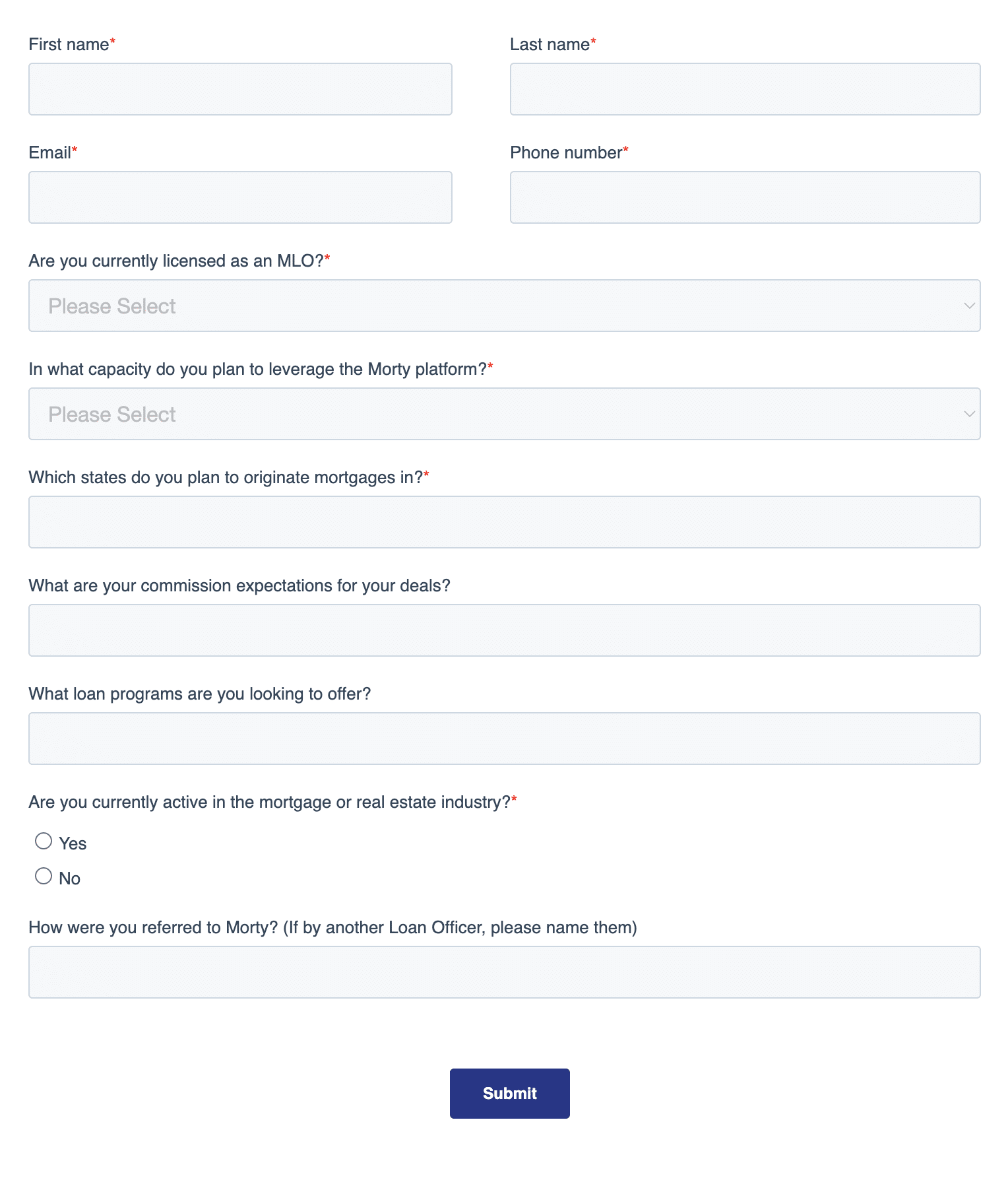

Contact us to learn more about joining our platform and get started today.