Starting your own mortgage brokerage is one of the most rewarding, and challenging, moves you can make in the real estate and finance industry. But just like any successful business, it all starts with a solid plan.

Whether you’re an experienced loan officer ready to go independent, or you’re just starting to explore the world of mortgage brokering, having a clear and actionable business plan is key to launching, operating, and growing your brokerage with confidence.

Here’s your step-by-step guide to building a mortgage broker business plan that sets you up for long-term success.

What Is a Business Plan?

A mortgage broker business plan helps you clarify your goals, attract the right clients, and stay focused as your business evolves. Your business plan is more than just a document, it’s your roadmap. At a high level, it outlines:

- Your goals: What success looks like for your brokerage.

- Your strategy: How you’ll get there

- Your services: What you offer and how you differentiate

- Your financials: How you’ll earn, grow, and sustain profitability

Step 1. Executive Summary

The executive summary is the elevator pitch of your business plan. It gives a high-level overview of your brokerage defining what you do, who you serve, and why you’ll succeed. This section includes your mission statement, your niche or focus area, a snapshot of your financial goals, and a brief summary of how you plan to operate and grow.

While it appears at the beginning of the document, it’s often easiest to write it last, after you’ve clarified the rest of your plan. Your executive summary should include:

- A brief overview of your business concept

- Mission statement

- Summary of your goals and how you’ll achieve them

- High-level snapshot of financial projections

Pro Tip: Write this last, even though it appears first. Keep it short and punchy—aim for clarity, not detail. Think of this as your 30-second pitch to a potential partner, lender, or investor.

Step 2. Business Description

This section outlines the foundational details of your mortgage brokerage. Start with your business name, legal structure (LLC, S-Corp, etc.), ownership breakdown, and location. Describe what your brokerage does, whether you focus on residential loans, first-time buyers, or investment properties, and what sets you apart. You should also share your long-term vision and how your business aligns with broader market needs or trends.

Make sure your business descriptions includes:

- Company name, structure (LLC, S-Corp, etc.), and ownership

- Location and operating model (local, remote, hybrid)

- What your brokerage does and how it’s differentVision and long-term objectives

Pro Tip: Use this section to show conviction. Don’t just describe what you do—explain why you started your brokerage and what drives you to serve this market.

Step 3: Market Analysis

Market analysis helps you understand the environment you’re entering. Research your local or target market: Who are the potential borrowers? What kinds of loans are in demand? Who are your main competitors, and how are they positioned? This section should include insights into borrower behaviors, industry trends, and opportunities—such as underserved niches like non-QM loans or VA lending in your area. Demonstrating a clear understanding of your market increases your chances of success and lender trust.

Understand the competitive landscape and borrower demand in your target market:

- Overview of the mortgage market in your area or niche

- Target customer profile(s)

- Competitor analysis and positioning

- Trends and opportunities (e.g., underserved buyer segments)

Pro Tip: Use local housing stats, lender trends, and even conversations with real estate agents to to get insight into what borrowers are looking form and how you can deliver it better in a way that’s specific and strategic.

Step 4. Services and Products

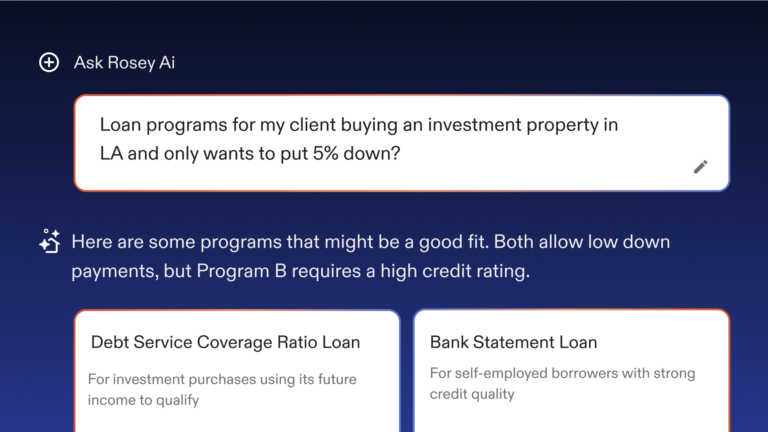

This section breaks down what you offer as a mortgage broker. List the types of loans you’ll help clients obtain (e.g., Conventional, FHA, VA, Jumbo, Non-QM, etc.) and describe any specialty products or services, such as down payment assistance programs or credit repair resources. Also include details about your lender network, who you’re approved with, and how you give clients access to competitive rates and terms. If you offer financial education or homebuyer tools, this is the place to highlight them.

Your services and products sections should cover:

- Types of mortgage loans offered (Conventional, FHA, VA, Non-QM, etc.)

- Value-added services (e.g., credit coaching, DPA programs)

- Lender network and technology platform

Pro Tip: Start with a focused product offering, then expand. It’s better to be known for doing one thing exceptionally well than to overwhelm clients with options.

Step 5. Niche and Marketing Strategy

Here, you define your target audience (your niche) and outline how you’ll attract, engage, and convert clients. Explain who your ideal borrower is—whether it’s first-time homebuyers in Texas, self-employed entrepreneurs, or military families—and how you plan to reach them. Include your branding strategy, website plans, lead generation tactics (like paid advertising, SEO, or referral partnerships), and tools like a CRM or email campaigns. The clearer your go-to-market strategy, the more investable and scalable your business will be.

Make sure your marketing strategy includes:

- Your niche (defined audience + focus area)

- Brand identity and messaging

- Lead generation strategies (referrals, paid ads, content, SEO)

- Client acquisition and retention plan

- Online presence and tools (website, social, CRM)

Pro Tip: The riches are in the niches. Choose a specific audience and speak directly to their problems, it makes your marketing clearer, cheaper, and more effective.

Step 6. Operations Plan

The operations section details how your business runs day-to-day. Describe your workflow from lead intake to loan closing, including key processes like document collection, application review, lender matching, and post-close follow-up. List the software you’ll use (like a loan origination system, CRM, e-signature, and compliance tools) and explain who handles what—whether it’s just you, or you’re working with a loan processor, virtual assistant, or team. This section also covers licensing, compliance policies, and record-keeping practices.

Your operations plan should cover:

- Team structure (solo, partners, processors, assistants)

- Technology stack (LOS, CRM, e-sign, doc storage)

- Compliance, licensing, and record-keeping

- Day-to-day workflow from lead to closing

Pro Tip: Document your processes early. Even if you’re solo, creating SOPs (standard operating procedures) now will save you time when you grow or outsource.

Step 7. Financial Plan

Your financial plan outlines how your brokerage will make money and stay profitable. Include your initial startup costs (licensing, tech stack, insurance, branding, etc.), monthly operating expenses, and revenue projections based on loan volume and commission splits. Highlight your breakeven point, how many deals per month you need to cover your costs, and your goals for growth. It’s also helpful to track key metrics like client acquisition cost (CAC), profit margins, and return on marketing spend (ROAS), even if you’re starting small.

Make sure your financial plan includes:

- Startup costs (licensing, software, insurance, marketing)

- Operating expenses (monthly and annual)

- Revenue projections (loan volume, commission splits)

- Break-even analysis and growth milestones

- Key financial KPIs (e.g., CAC, ROI, profit margin)

Pro Tip: Be conservative with revenue projections and realistic about expenses. Building in buffer room keeps you in control—even when loan volume dips.

Step 8. Growth Strategy

This section shows how you plan to evolve. Will you expand into new states, bring on junior loan officers, or add new products like HELOCs or reverse mortgages? Maybe you plan to scale with automation or build a strong brand that attracts inbound business. Describe what growth looks like for you—whether that’s hiring, franchising, expanding your lender base, or forming strategic partnerships. Be honest about what you’ll need to get there: funding, systems, or new skill sets.

Things to include in your growth strategy:

- Expansion plans (new markets, new hires, new products)

- How you’ll reinvest profits

- Key partnerships or tools needed to scale

Pro Tip: Build scalable systems now, even things like simple CRMs or automations, so you’re ready when demand increases. Growth is easier when you’re not reinventing the wheel.

Step 9. Appendix (Optional)

The appendix includes any supporting documents that add depth or evidence to your plan. This could be copies of your licenses and insurance policies, resumes of team members, sample marketing materials, lender approvals, or market research data. Think of it as the backup to the claims you made earlier in the plan—especially useful if you’re seeking partners, lender approvals, or outside investment.

Some things you might include in a business plan appendix are:

- Resumes or bios of key team members

- Sample marketing materials

- Legal documents, licenses, insurance

- Charts, product breakdowns, or additional research

Pro Tip: Use the appendix to add credibility. A clean resume, lender approval letter, or sample lead magnet can go a long way in showing you’re serious and prepared.

Final Thoughts

Launching a mortgage brokerage takes grit, but a smart business plan can make the path much smoother. Use this guide as your foundation, and revisit your plan regularly as your goals evolve and your business grows.

Ready to turn your business plan into reality?

Morty can help you build your business with built-in technology, lender access, and back-office support, and more. Fill out the form below to get custom solutions for your business.