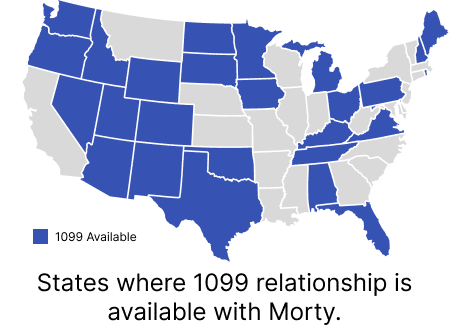

If you’re exploring the freedom and flexibility of working as a 1099 independent mortgage broker, you’re not alone. At Morty, we support both W2 and 1099 partnerships, depending on your goals and your state’s regulatory environment. While some states require W2 employment, many allow licensed loan officers to operate independently. This post breaks down where you can work as a 1099 broker with Morty today.

For a full breakdown of the differences between W2 and 1099 models, check out our guide: W2 vs 1099: What’s Right for Your Mortgage Career?

States Where Morty Supports 1099 Brokers

As of May 2025, you can operate as a 1099 independent contractor with Morty in the following states:

Alabama

Alaska

Arizona

Colorado

District of Columbia

Florida

Idaho

Iowa

Kentucky

Maine

Michigan

Minnesota

New Hampshire

New Mexico

North Dakota

Ohio (if dual sponsorship applies)

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Dakota

Tennessee

Texas

Utah (with some dual sponsorship restrictions)

Virginia

Washington

Wyoming

These states allow independent contractor arrangements, and Morty is licensed to operate in them. In many of these states, you can also work remotely without being tied to a physical branch. Some states (like Oregon and Vermont) may have distance-to-branch requirements on paper, but regulators often permit exceptions when appropriate.

Why Work as a 1099 Broker?

For many mortgage professionals, the 1099 model provides greater independence and earning potential. You operate as your own business, set your own goals, and control your schedule. Morty’s platform empowers you to do that with:

- Built-in compliance support

- Nationwide lender access

- Real-time pricing and eligibility tools

- Branded digital storefront

- Powerful automations and AI tools

Learn more about how we support independent brokers on our Independent Loan Officer page.

States That Require W2 Employment

Some states currently require a W2 employment relationship, which means Morty can only support you as a W2 employee in:

Arkansas

California

Georgia

Illinois

Indiana

Maryland

Mississippi

Montana

New Jersey

North Carolina

South Carolina

Vermont

In these states, either the state’s interpretation of mortgage laws, taxation requirements, or other regulatory barriers prevent independent contractor relationships. For example, Maryland requires employers to withhold taxes, and North Carolina restricts dual sponsorship, which often makes 1099 classification unworkable.

That said, we continue to monitor state policies and aim to offer flexible arrangements wherever permitted. If you’re in a W2-only state and want to learn about launching your own mortgage business, we may still be able to help you start with W2 and transition later.

Remote Work, Branch Proximity, and Dual Sponsorship

In addition to employment classification, several other regulatory nuances affect where and how you can work with Morty:

- Remote Work: Most states allow mortgage brokers to work from home or another remote location. States like Delaware, Louisiana, Nebraska, and Wisconsin have stricter rules.

- Branch Proximity Requirements: A few states (such as Oregon and Idaho) may require that you live within a certain distance from a licensed branch—but many allow waivers if you’re working remotely and your company has oversight tools in place.

- Dual Sponsorship: States like Ohio, Utah, and North Carolina have nuanced rules around dual sponsorship. Morty supports these arrangements where compliant, often with additional documentation like Letters of Explanation (LOX).

If you have questions about sponsorship requirements, talk to Morty’s sales team, we can help clarify.

Are You a Realtor Considering Mortgage?

If you’re a real estate agent thinking about offering mortgage in-house, Morty’s platform can support you too. Our flexible licensing models and embedded compliance support can help you offer mortgages as a value-add to your clients—while keeping you compliant across state lines.

Explore how Morty supports agents in dual capacity as realtors and loan officers.

How Morty Supports 1099 Brokers

Beyond simply enabling 1099 work, Morty provides a structured platform designed for long-term success. From licensing and compliance to pricing tools and automation, we make it easier for independent brokers to grow their business with confidence.

What makes Morty different:

- Speed to market: Get up and running in days—not months

- Operational efficiency: Our tech handles the overhead so you can focus on origination

- Scalability: Tools and support to help you grow, whether you’re a solo LO or building a team

Our infrastructure is built for independence without the isolation—so you can operate like a pro without building everything from scratch.

Working as a 1099 mortgage broker offers autonomy and entrepreneurial flexibility, and with Morty, it’s possible in many states across the country. We’ve built our platform to support both W2 and 1099 models, giving you the freedom to build your business your way.

Want to know what your options look like in your state—or whether dual sponsorship applies? Talk to our team and we’ll help you figure out the right fit for your goals.