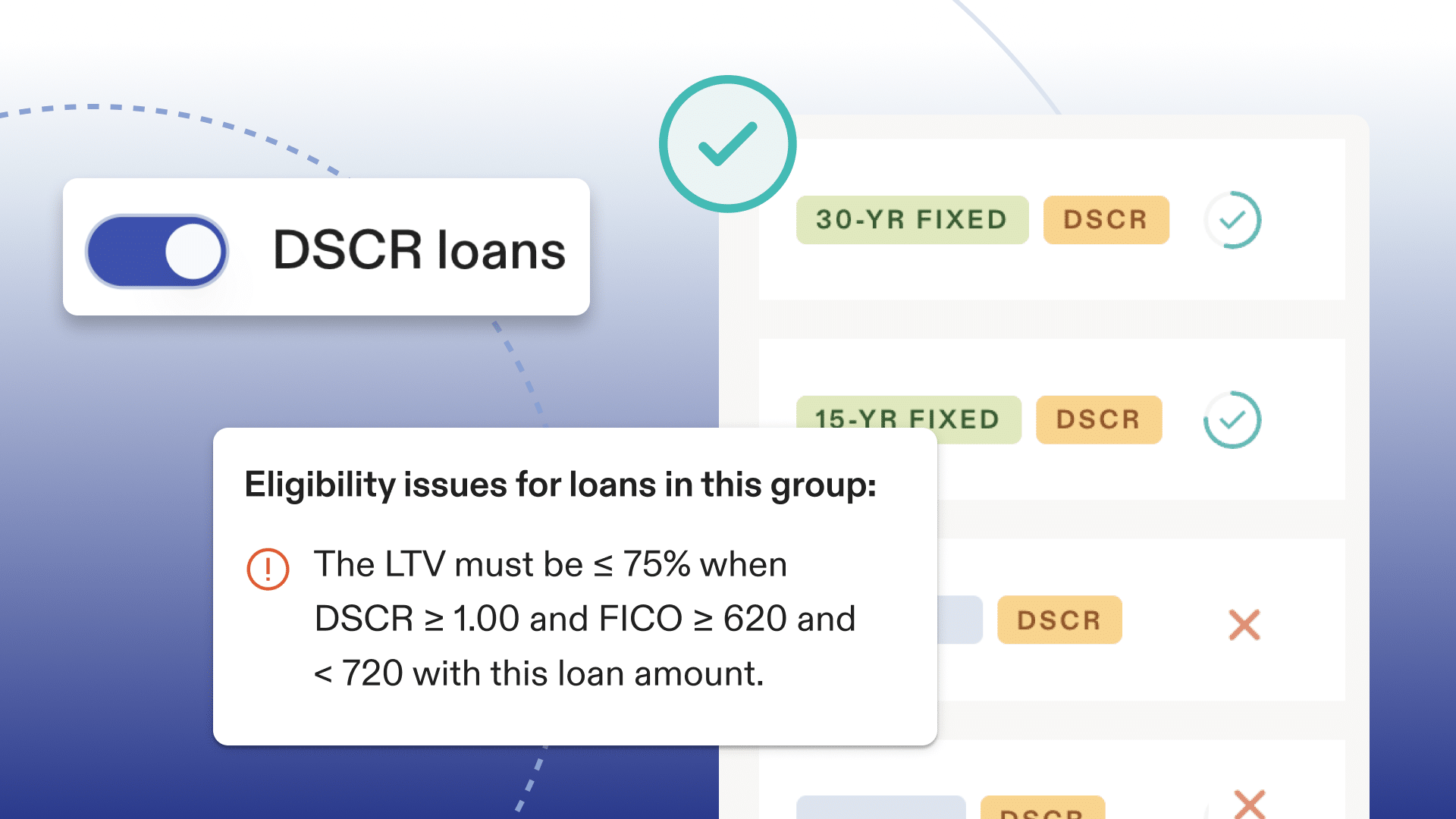

Earlier this summer, we rolled out full pricing engine support for non-QM programs like DSCR and Alt-Docs. Today, we’re taking it a step further: DSCR loan options in Hemlock now include full eligibility messaging.

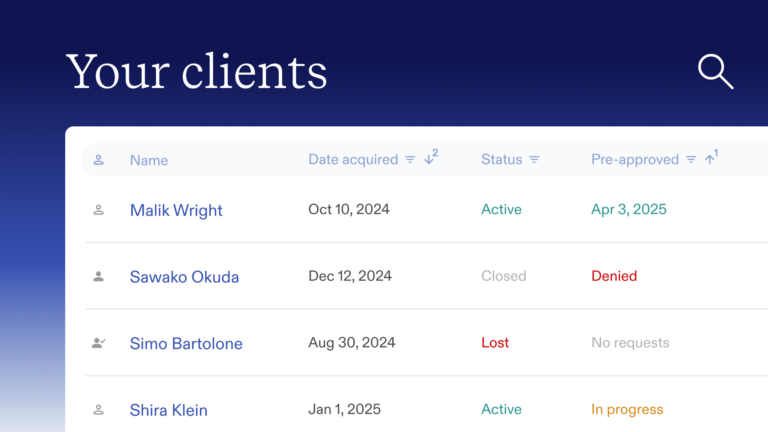

Hemlock LOS now supports DSCR eligibility messaging. Loan officers can review program-specific issues, avoid misused inputs like PPP, and generate fee sheets and manual pre-approval letters for DSCR loans.

DSCR Loans in Hemlock Just Got an Upgrade

Debt Service Coverage Ratio (DSCR) loans are an essential tool for investors and non-QM borrowers. But structuring these scenarios often requires clarity on eligibility rules and program-specific details. That’s why Morty is enhancing Hemlock Pricing with DSCR eligibility messaging — giving loan officers more transparency and control.

Background: Non-QM Programs in Hemlock

Earlier this summer, Morty launched initial pricing support for non-QM programs like DSCR and Alt-Doc. These options opened the door for brokers to serve a wider range of clients — including real estate investors and self-employed borrowers — directly within Hemlock.

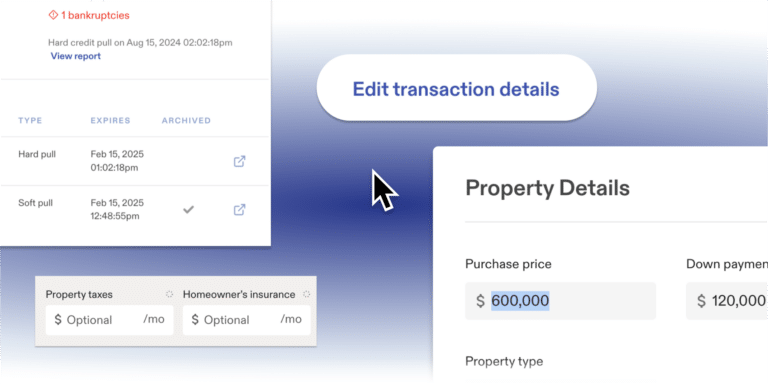

With today’s release, DSCR loans now behave like other internal-only options in Hemlock:

- Eligibility messaging is displayed for each scenario.

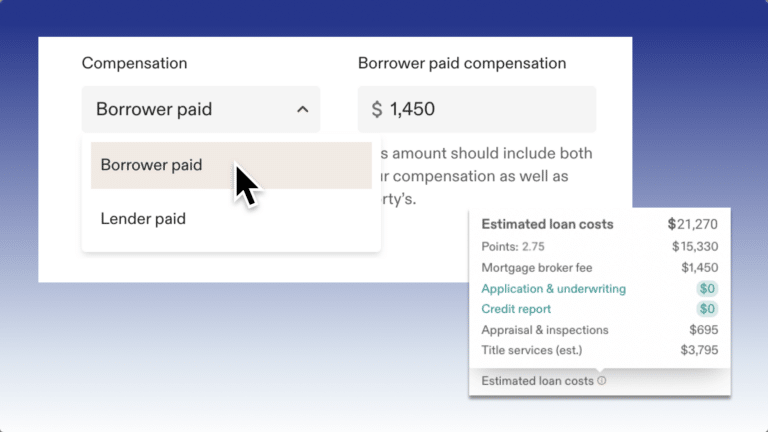

- Fee sheets can be generated.

- Manual pre-approval letters are supported.

This update improves the workflow for loan officers, making it easier to explain to clients why a particular DSCR option may or may not fit their profile.

How DSCR Eligibility Messaging Works

Loan officers can now click into any DSCR option in Hemlock Pricing to see program- or option-specific eligibility issues.

For example:

- If an input doesn’t align with DSCR program requirements, Hemlock will flag it.

- When pre-payment penalties (PPP) are misapplied, the system alerts the LO to adjust inputs.

This ensures that loan officers understand whether an input is the true blocker — or if the borrower remains eligible once corrections are made.

Example: Pre-Payment Penalties (PPP)

Pre-payment penalties are only allowed in certain DSCR scenarios. If “PPP years” is set to anything other than “None” when PPP is not allowed, Hemlock will display an eligibility issue.

Importantly, this does not mean the client is ineligible for the program. Instead, it simply signals that the LO must adjust the PPP input to “None” before proceeding.

This level of feedback ensures loan officers avoid unnecessary confusion, while still maintaining compliance with program rules.

Why This Matters for Loan Officers

The addition of DSCR eligibility messaging offers several key benefits:

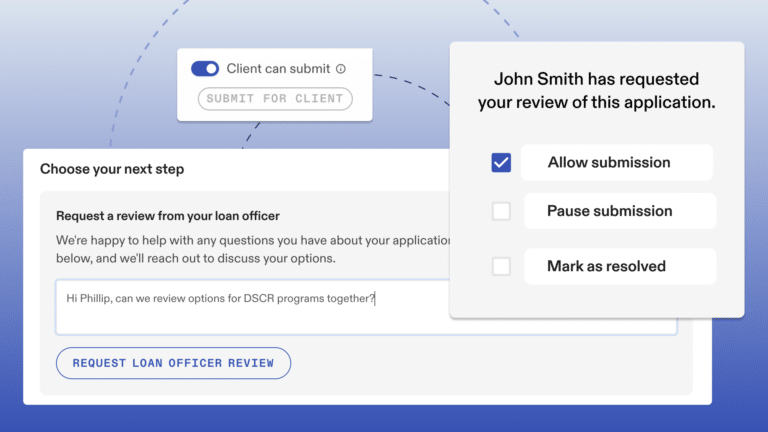

- Clarity at the point of pricing — LOs can identify issues immediately, rather than after running scenarios offline.

- Better client conversations — Clear eligibility notes help explain why a DSCR option does or does not apply to a borrower’s situation.

- Consistency across programs — DSCR loans now behave like other internal-only loan types in Hemlock, with fee sheets and manual PA letters available.

This update allows loan officers to deliver confidence and expertise to clients considering DSCR financing.

What You Can Do Today

- Explore DSCR eligibility messaging by running DSCR scenarios in Hemlock Pricing.

- Use fee sheets and manual pre-approval letters to present DSCR options professionally to your clients.

- Leverage messaging to guide conversations with investors or clients evaluating rental property financing.

DSCR Loans and the Bigger Picture

For brokers, DSCR loans are a powerful way to grow business beyond traditional agency borrowers. By bringing DSCR pricing and eligibility into Hemlock, Morty is helping loan officers:

- Capture more investor clients

- Serve borrowers with unique income profiles

- Differentiate themselves in a competitive market

This release is part of Morty’s broader commitment to expanding non-QM program support across the Hemlock platform.

Key Takeaways

- DSCR loan options in Hemlock now display eligibility messaging.

- LOs can review program-specific issues, such as PPP misapplications.

- Fee sheets and manual pre-approval letters can be generated for DSCR options.

- DSCR is now consistent with other internal-only loans in Hemlock.

👉 Talk to our team to learn more about how Hemlock supports non-QM lending.