Inside the shift transforming mortgage and why the future belongs to LOs who build

Want to get this directly in your inbox?

Not long ago, the path for most originators was predictable: join a large lender or bank, earn your stripes, and hope for better comp or support over time. Infrastructure, technology, and pricing power were concentrated in the hands of institutions. LOs were expected to plug into rigid systems and play by someone else’s rules.

But the cracks in that model have widened. Market volatility, mass layoffs, tightening margins, and shrinking back-office support have left many questioning their place, and their power, in the system.

A transformation has been quietly redefining the mortgage industry. It’s not a seasonal trend or a post-pandemic pivot, it’s a structural shift in how mortgage business is done. And at the center of this change is the rise of the independent loan officer.

More and more LOs are deciding: If I’m already doing the work, why not build something of my own?

From Originator to Operator

Today’s independent LO is less salesperson, more business owner. They want control over their pipeline, their brand, their pricing, and their client experience. They’re not just originating loans. They’re building modern, lean mortgage businesses and doing it without the legacy bloat.

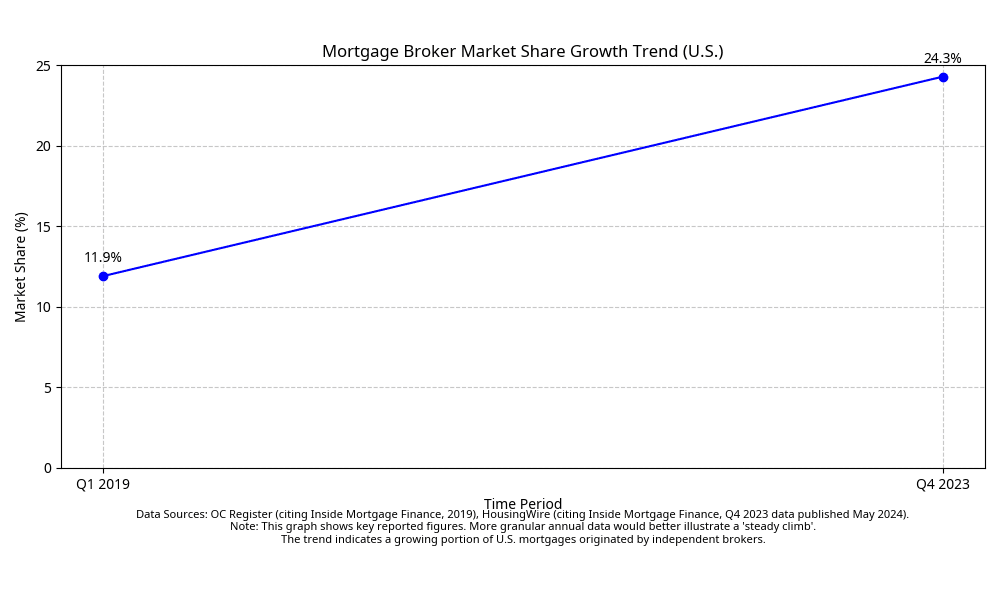

This isn’t a fringe movement. According to Scotsman Guide and MBA reports, broker market share has climbed steadily over the past five years. Independent LOs are originating a growing portion of U.S. mortgages, especially in the purchase market. That trend is only accelerating as borrower expectations evolve.

Why? Because the tools and the mindset are finally here.

What’s Driving the Shift

1. Control beats comp. Retail splits are shrinking. Branch support is thinning. And many LOs are starting to ask the hard question: “What am I getting for my comp?” The answer too often is: not enough. Independence lets LOs keep more of their margin and their autonomy.

2. Modern platforms unlock scale. It used to take a full ops team and a tangle of integrations to run your own shop. Not anymore. All-in-one platforms like Morty provide pricing, compliance, disclosures, P&F and more within in a single system. That levels the playing field, fast.

3. Borrowers want speed and service. Clients expect fast, digital, transparent — but they also want a human they can trust. Independent LOs can deliver both. Without rigid workflows or corporate red tape, they’re free to personalize the experience and move with agility.

4. Recruitment is broken. Every LO has seen the cycle: big promises, bigger disappointment. Switching logos doesn’t solve structural problems. Independence breaks the cycle entirely. No more jumping ship — just building something that lasts.

What Sets the Best Apart

The top independent LOs aren’t just producing volume, they’re running smart, efficient, client-first businesses. This shift isn’t just about better tools or fatter comp. It’s about ownership.

The LOs who are winning are those building something of their own and doing it with intention. They’re choosing partners, not employers. Platforms, not patches. Systems, not silos. Here’s what they do differently:

- Think like operators. They invest in systems, not just lead gen. They’re optimizing for scalability and compliance from day one.

- Simplify the stack. They use fewer tools, more strategically. One platform that does more beats six that do one thing each.

- Build their brand. They understand that trust, visibility, and experience are the new growth levers.

Thinking of Going Independent?

Let’s talk. Morty gives you the tools, infrastructure, and lender access to build a lean, powerful mortgage business on your terms.

✅ Access to dozens of lenders and loan products ✅ A unified workflow from lead to close ✅ Built-in disclosures, compliance, and doc management ✅ Real-time transparency and status updates

Related resources

- Featured Article: W2 vs 1099 Mortgage Broker: Which Compensation Model Is Best for You? Read article.

- Featured Article: Smart Strategies for Increasing Your Income as a Loan Officer. Read article.

- Broker POV: Experience Plus Innovation: A 30-Year Industry Veteran Leveraging Morty’s Tech. Learn more.