Plenty of buyers, few sellers

While the Fed raised interest rates again this week, by .25%, mortgage rates remain relatively consistent this week, with that rate hike already priced into the market. Right now, buyers can expect 30-year fixed rates to hover around 7%. The Fed’s path forward from here remains uncertain, with the possibility that rates could remain the same or be increased again at the Fed’s next meeting in September.

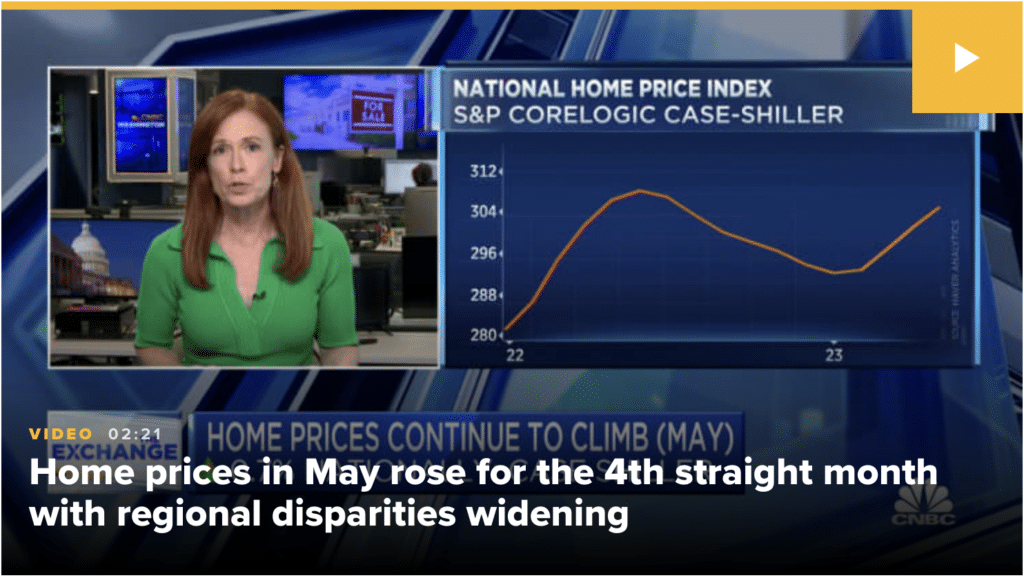

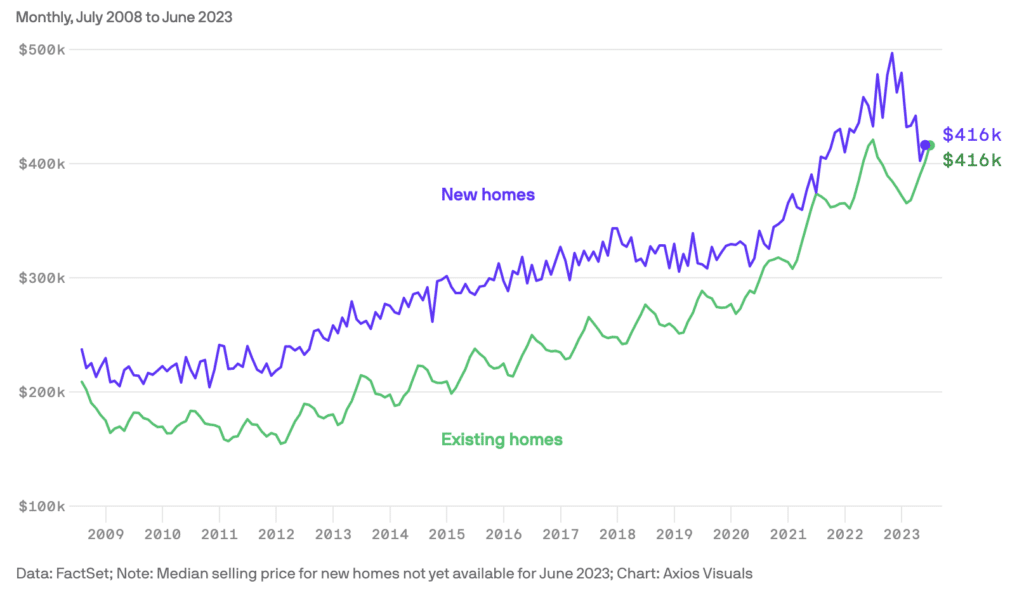

Low inventory continues to limit existing-home sales (a sale of a home that isn’t new construction) market activity and create challenges for buyers. This is driven in large part by what some in the industry have been referring to as “golden handcuffs,” the low mortgage rates of years past that have made would-be sellers reluctant to move on. Those that have mortgage rates in the 3% range are understandably hesitant to enter the market, even if they may want to move. This dynamic won’t last forever – there are many factors that can lead people to list their homes – but for the time being the rate environment continues to fuel this trend, and drive significant increases in new construction. Prices for new construction homes are now similar to those of existing homes, prices (historically they have been tens of thousands of dollars higher) reflecting the lack of existing homes being sold and how developers building more starter homes for first-time homebuyers.

Read below for a spotlight on how self-employed borrowers, a growing segment of the market, can approach buying a home.

-Robert Heck, VP of mortgage @ Morty

In the News

Spotlight: Self-Employed Borrowers

When it comes to buying a home, self-employed buyers face a few unique challenges. Lenders are more cautious when it comes to a self-employed buyer’s income, which is considered to be less predictable than that of a salaried buyer. However, with the right approach and tools, securing home financing as a self-employed buyer is entirely possible.

At Morty, we’re focused on helping borrowers from all backgrounds achieve their homebuying goals. Check out our step-by-step guide to help you navigate the home buying process.