Reverse mortgages have long been misunderstood. Often viewed as a last-resort option, they’re actually one of the most strategic tools available to homeowners aged 62 and up—especially when used for retirement planning, income smoothing, or aging in place.

For loan officers, understanding reverse mortgages opens up an entirely new market. In this guide, we’ll break down how reverse mortgages work, compare HECM and proprietary offerings, and explain how you can now offer them through Morty.

What is a reverse mortgage?

A reverse mortgage is a type of home loan available to homeowners aged 62 or older. Unlike traditional mortgages, it allows borrowers to convert a portion of their home equity into tax-free cash—without making monthly mortgage payments. Instead of paying the lender each month, the lender pays the borrower, either as a lump sum, monthly distribution, or line of credit.

The loan is repaid when the borrower sells the home, moves out, or passes away. The borrower retains the title and is still responsible for property taxes, insurance, and maintenance.

Reverse mortgages are considered a non-QM loan product—meaning they don’t conform to traditional underwriting standards like DTI caps or fully documented income. Instead, they’re evaluated based on age, equity, and homeownership status.

HECM vs. Proprietary Reverse Mortgages

There are two main types of reverse mortgages:

| Feature | HECM (Home Equity Conversion Mortgage) | Proprietary Reverse Mortgage |

|---|---|---|

| Backed by | FHA (HUD) | Private lenders |

| Loan limits | FHA limit (~$1.1M in 2024) | Higher limits (often $4M+) |

| Ideal for | General retirement cash flow | High-value homes, jumbo markets |

| Credit/counseling | HUD counseling required | Lender-dependent |

| Flexibility | Standardized | May allow more customization |

A HECM, or Home Equity Conversion Mortgage, is the most common type of reverse mortgage and is insured by the Federal Housing Administration (FHA). Proprietary reverse mortgages are offered by private lenders and serve borrowers with high-value homes or needs that exceed the HECM cap.

Who are reverse mortgages for?

Reverse mortgages can be a smart option for:

- Seniors with significant equity but limited income

- Retirees who want to eliminate monthly mortgage payments

- Homeowners looking to stay in their homes as they age

- Borrowers planning for future medical or long-term care costs

- Financially secure individuals using reverse as a tax or liquidity strategy

These products can also benefit adult children or caregivers helping parents manage housing and care expenses.

Common misconceptions about reverse mortgages

- “The bank takes your house.”

Not true. The borrower retains full ownership and title, just like any other mortgage. - “You lose all your equity.”

Reverse mortgage balances grow over time, but remaining equity depends on property appreciation and how long the loan runs. Many borrowers still have equity left when the loan ends. - “It’s only for financially desperate people.”

Reverse mortgages are increasingly used by financially stable clients with wealth advisors to manage drawdowns and improve retirement outcomes.

Frequently asked questions

- Can I offer reverse mortgages as a broker?

Yes—with access to the right lenders and operational support, reverse loans are fully brokerable. Morty handles the hard parts. - Do reverse borrowers need to meet credit or income requirements?

Not in the traditional sense. Most reverse products use a financial assessment to ensure borrowers can pay taxes and insurance—but no DTI or income ratios are required. - Is the loan repaid by the borrower’s heirs?

Not personally. The home is typically sold to repay the balance. If it’s worth more than the loan, heirs keep the difference. If it’s worth less, FHA insurance (in the case of HECMs) covers the gap.

Reverse mortgage payout options

Borrowers can choose how to receive the proceeds from a reverse mortgage, depending on their financial goals and needs:

- Lump sum: A one-time payout, typically used to pay off an existing mortgage or make a large purchase. This option is common when borrowers want to eliminate monthly payments entirely.

- Monthly payments: Borrowers receive fixed monthly payments for a set period or as long as they live in the home.

- Line of credit: Offers the most flexibility. Borrowers can draw funds as needed, and the unused balance grows over time—providing access to more equity later.

These structures allow reverse mortgages to serve a wide range of needs—from steady income to financial contingency planning.

Real-world borrower example

Consider a 72-year-old borrower who owns their home outright, valued at $850,000. They’re on a fixed income and struggling to cover rising healthcare costs and property taxes.

A reverse mortgage gives them access to $300,000+ in tax-free proceeds. They choose to pay off their existing property tax debt, keep a cash reserve, and set up a line of credit they can draw from as needed. They continue living in their home, with no monthly mortgage payment.

This setup offers both financial stability and flexibility—without requiring the borrower to sell or downsize.

How to offer reverse mortgages through Morty

Morty now supports both HECM and proprietary reverse mortgage products, giving brokers the tools to serve a wider range of older clients.

Here’s how it works:

- Intake borrower details through Morty’s digital Point-of-Sale

- Get matched with lenders offering reverse options that fit borrower goals

- Work with Morty’s Processing & Fulfillment team to handle disclosures and overlays

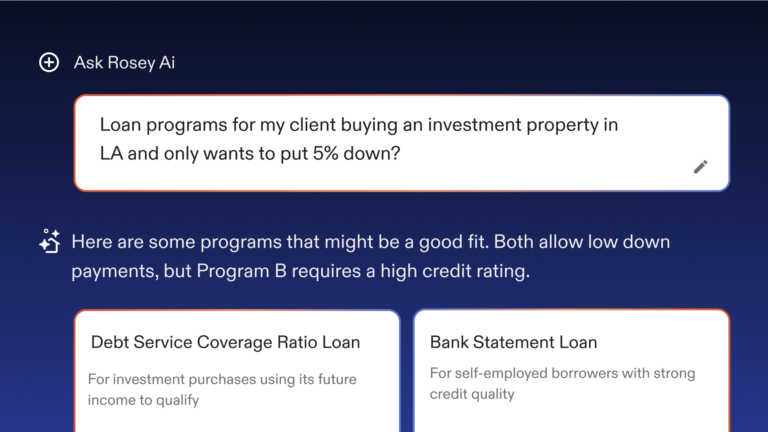

- Use Rosey AI for real-time answers about product eligibility, age, equity requirements, and documentation

- Submit reverse mortgage applications directly through Morty

You don’t need to be an expert—Morty’s infrastructure and support make it easy to bring this offering into your business.

Start offering reverse mortgages today

Reverse mortgages are no longer niche—they’re a key part of the modern LO toolkit. Whether you’re helping a client eliminate their mortgage payment or supporting a family with long-term housing goals, reverse loans can be a strategic solution.

And now that Morty supports both HECM and proprietary reverse products, you can offer them confidently—backed by a platform you already know and trust.