As the mortgage market evolves, loan officers and brokers are increasingly looking beyond traditional loan options to meet the needs of today’s borrowers. Enter non-QM loans—a flexible, fast-growing segment of the mortgage space that’s helping originators close more deals and grow their businesses.

In this post, we’ll break down what non-QM means, who it’s for, and how you can start offering it through Morty.

What does “non-QM” mean?

Non-QM stands for non-qualified mortgage—a type of home loan that doesn’t meet the CFPB’s strict definition of a “qualified mortgage” (QM). Qualified mortgages must follow rules around debt-to-income ratios (DTI), fully documented income, and specific product structures to reduce risk.

Non-QM loans fall outside those requirements—but are still responsibly underwritten. Importantly, they are not backed by Fannie Mae, Freddie Mac, or government programs like FHA or VA. Instead, they’re funded and held by private lenders, who set their own qualification criteria.

And no, non-QM does not mean subprime. These loans are designed for qualified borrowers who simply don’t fit the conventional mold.

Who are non-QM loans for?

Non-QM borrowers often have strong credit and finances—but their income or credit profile doesn’t match agency guidelines. Common examples include:

- Self-employed borrowers who may not have consistent pay stubs or traditional W-2 income. Many self-employed borrowers still qualify for conventional loans, but those with irregular income patterns or unique tax profiles may benefit from a non-QM solution.

- Real estate investors who qualify based on rental income or property cash flow.

- High-net-worth individuals who rely on assets instead of traditional income streams.

- Borrowers with recent credit events, like a bankruptcy or foreclosure, who are still financially stable.

- Foreign nationals or ITIN borrowers who don’t have a U.S. credit history but can demonstrate ability to repay.

These borrowers are increasingly common—especially as the mortgage broker channel continues to expand. Mortgage brokers now account for over 24% of originations, up from 11.9% in 2019—largely because they’re able to serve these specialized borrower needs.

Common types of non-QM mortgages

Non-QM isn’t one product—it’s a category of flexible loan programs designed for different borrower types. Popular options include:

- Bank statement loans – Use 12–24 months of personal or business bank statements to document income

- DSCR loans – Use property cash flow instead of personal income to qualify investor deals

- Asset depletion loans – Calculate income from retirement or investment assets

- Interest-only mortgages – Lower initial payments by paying only interest for a fixed period

- ITIN / foreign national loans – Designed for non-U.S. residents and borrowers without SSNs

Why non-QM is growing in 2025

Several trends are driving the surge in non-QM lending:

- More borrowers are self-employed or working in non-traditional income models.

- Real estate investors are active and looking for scalable financing options.

- Some borrowers are recovering from credit events during the pandemic.

- Conventional underwriting guidelines are tighter, making alternatives more necessary.

- Borrowers want faster closings and more flexibility—and at Morty, we’ve closed non-QM deals in under two weeks.

For loan officers and brokers, non-QM isn’t just a niche—it’s a smart way to serve more clients and unlock more revenue.

How to offer non-QM loans as a loan officer or broker

To offer non-QM products, you need access to the right lenders and tech infrastructure that supports more complex scenarios.

At Morty, you can:

- Submit non-QM applications directly through our platform, powered by our Point-of-Sale system for intake, document collection, and disclosures.

- Work with a large and growing network of non-QM lenders, offering diverse loan programs across borrower types.

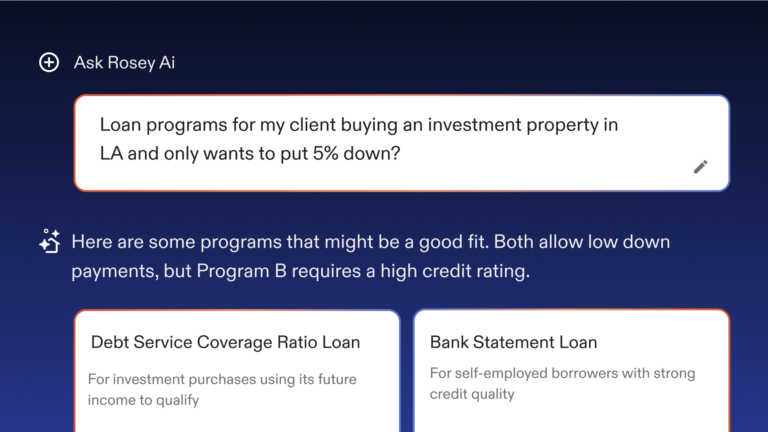

- Use Rosey AI, our smart assistant, to get real-time answers to non-QM qualification questions as you’re working a file.

- Rely on our experienced processing and fulfillment support, built to support fast timelines and unique workflows across all loan types—including non-QM.

We believe non-QM is one of the biggest opportunities in lending right now—and we’re building the tools to help you lead.

Ready to offer non-QM loans?

Non-QM is growing fast—and LOs who embrace it are winning more business.

Whether you’re just exploring your options or looking to scale your non-QM pipeline, Morty gives you everything you need to succeed.