Pricing borrower-paid deals just got easier and more flexible

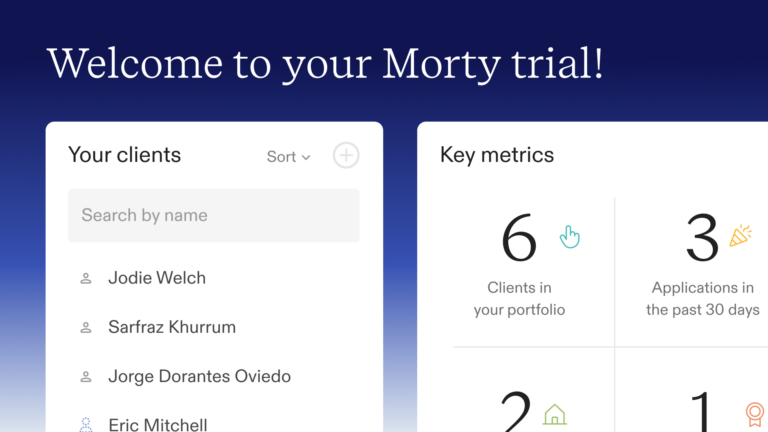

At Morty, we’re on a mission to modernize the mortgage experience, not just for borrowers, but for the brokers and loan officers who power it. That means delivering tools that reduce friction, enhance transparency, and give you more control at every step of the loan process.

One area where control and flexibility matter most? Compensation.

We build with and for our partners; this week, we launched support for Borrower Paid Compensation (BPC), one of our most requested pricing features from the field. It’s a small change with a big impact: giving brokers the flexibility to run borrower-paid deals directly in pricing.

Why does this matter? Because independence shouldn’t mean limitations. Whether you’re pricing a loan, quoting a borrower, or building your business, you deserve tools that reflect how you work, not the other way around.

This update reflects a core belief at Morty: listening closely, building fast, and turning broker feedback into real product improvements that support their bottom line.

Why borrower paid comp matters to mortgage brokers

In a fast-moving and highly competitive mortgage landscape, brokers need the flexibility to meet borrower needs and business goals on a deal-by-deal basis. Compensation structure is a critical part of that.

With our latest Hemlock update, BPC is fully supported across the platform. Whether you’re pricing a deal, updating a transaction, or managing broker settings, you now have the ability to configure Borrower Paid Compensation exactly how you need—quickly, clearly, and accurately.

The limitations of lender-based BPC

Historically, brokers could only offer Borrower Paid Compensation if the lender on the deal was already set up to allow it. That meant:

- You couldn’t price borrower-paid scenarios in Hemlock if the lender wasn’t pre-configured.

- Switching between LPC and BPC was limited to certain loan programs or lenders.

- It was harder to provide accurate pricing upfront to borrowers exploring their options.

That’s not ideal when you’re trying to deliver a seamless borrower experience—or run your brokerage efficiently.

What the new BPC features unlock

With this release, Hemlock users now have full flexibility to set BPC regardless of lender setup. That means:

- More accurate loan pricing across more scenarios

- Simplified disclosures for borrower-paid deals

- Cleaner, more consistent loan data for your team and Morty’s support staff

- Better visibility into how compensation is tracked and applied across your pipeline

For independent brokers especially, where margins, client expectations, and lender preferences can vary significantly from deal to deal, this feature opens up new ways to structure your business.

What’s new: BPC support across Hemlock

This release includes several key updates to how compensation is configured and managed in Hemlock.

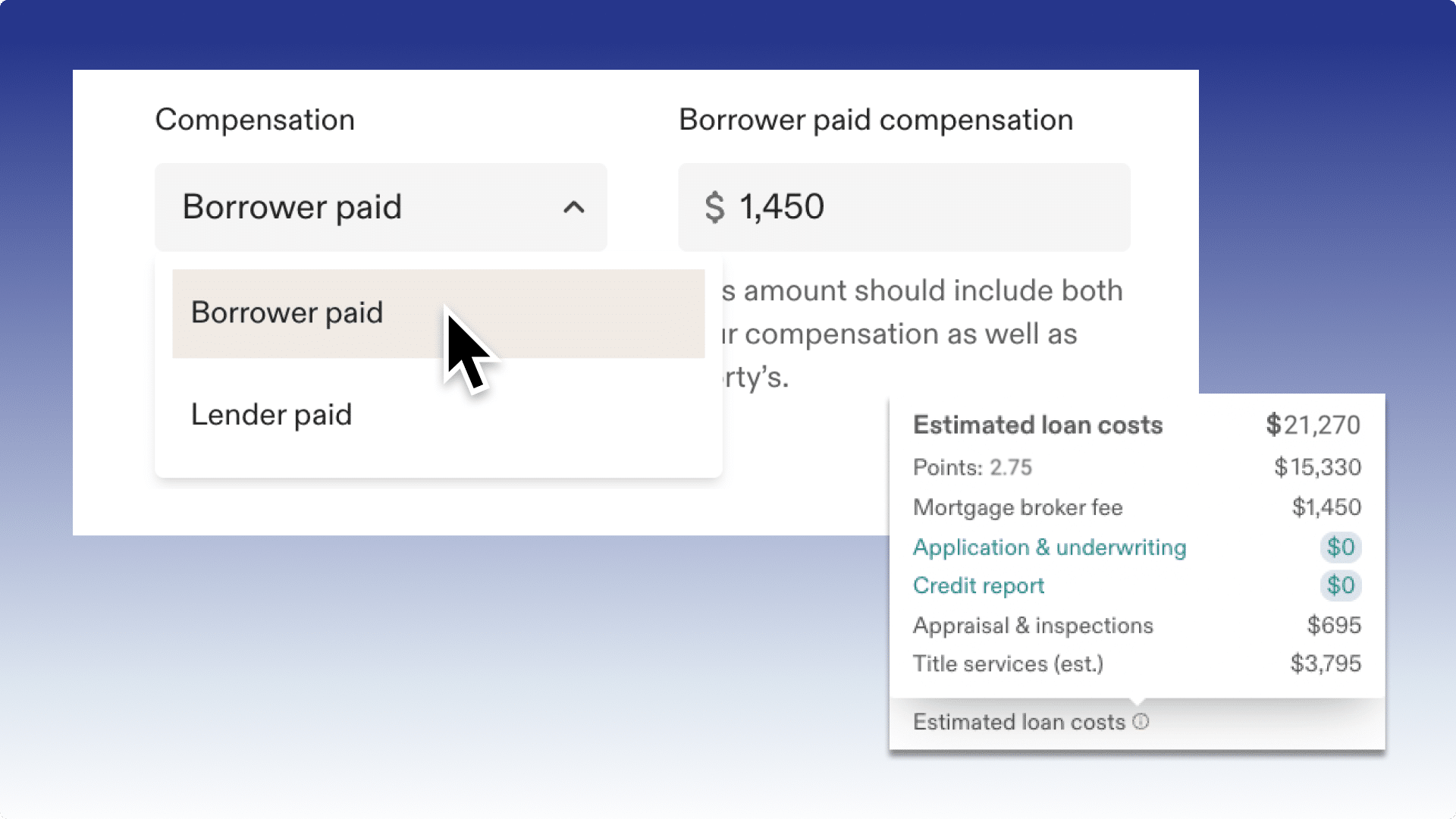

1. Price borrower-paid deals directly in Hemlock Pricing

You can now run borrower-paid pricing scenarios right from the pricing tool, even if the lender isn’t explicitly set up for BPC. This gives you a real-time view of pricing options across borrower-paid and lender-paid structures, so you can offer more tailored advice to clients from the start.

Use case: You’re working with a self-employed borrower who’s trying to qualify with lower monthly costs. You want to run pricing comparisons between LPC and BPC options to see which structure offers better rate trade-offs. With this update, you can do that instantly—without needing to switch lenders or change backend configurations.

2. Set BPC on a loan-by-loan basis

In the Edit Transaction View, you can now set the entire transaction to Borrower Paid Compensation. This makes it easy to lock in the compensation structure once the borrower chooses their path—and ensures that disclosures, data tracking, and processing align with the selected option.

Pro tip: If you update compensation after a loan is priced, be sure to recheck fees and borrower disclosures to confirm everything aligns correctly.

3. Default BPC settings for partners

In the Admin tab, broker profiles can now be configured to default to BPC. This is ideal for partners or branches that primarily operate under a borrower-paid model. It saves time during setup and ensures consistency across all loan transactions created under that profile.

Who benefits most from this update?

This update is designed for any broker or loan officer looking for:

- More control over compensation structure

- Flexibility in how loans are priced and presented

- A seamless way to offer borrower-paid deals without jumping through configuration hoops

But it’s especially helpful for:

- Independent mortgage brokers working with multiple lenders and diverse borrower profiles

- Branch managers looking to standardize compensation structures across teams

- Loan officers serving savvy clients who want transparent, customizable pricing

The bottom line

Borrower Paid Compensation isn’t new, but having real flexibility to use it when and how you want is. With this latest update, Morty is removing roadblocks that slow down brokers and confuse borrowers—replacing them with clarity, control, and confidence.

Whether you’re pricing loans, managing a team, or scaling your brokerage, Hemlock’s new BPC support gives you one more way to work smarter.