Loan Officer Resources > Loan Officers

Considering a career in mortgage lending? Whether you’re embarking on a new journey, aiming to enhance your abilities, or merely exploring the key qualities of a top mortgage loan officer (MLO), the following skills can elevate your career. These skills and loan officer duties are vital regardless of what type of financial institution you may work at, including a national bank, local credit union, online lender or a digital mortgage broker like Morty.

Here are some skills that can help you take things up a notch.

Effective Communication

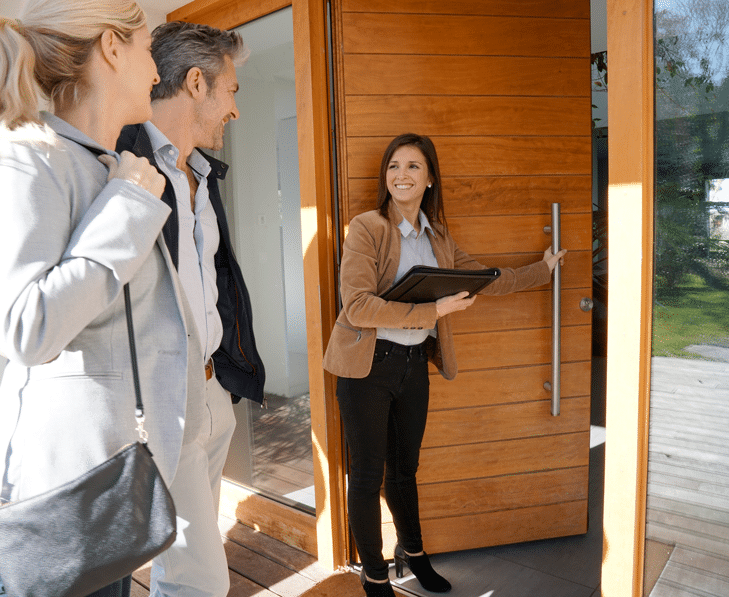

Building rapport with clients is essential. Clear, concise, and effective communication can simplify the often complex process of getting home financing and put your clients at ease. Be a trusted advisor to borrowers by explaining terms, answering questions and guiding them in affordability conversations, while avoiding coming across as condescending. When you walk clients through what types of loans they potentially qualify for, remember to start slow and give them marketing collateral to refer back to.

And remember to expect and entertain questions!

Attention to Detail

When you’re dealing with so many numbers and paperwork, even tiny errors can throw a wrench in things and compromise your clients’ trust. Be eagle-eyed and put in the time to ensure everything is correct and accounted for. Also make sure that anyone else you’re working with on the underwriting and closing process takes the same approach.

Sales Acumen

Selling is integral in this job. It’s not about pushing your clients in one direction or another, but about genuinely guiding them to the best solution for their needs, and making sure they have a full understanding of their options.

Integrity & Trustworthiness

The mortgage journey can be overwhelming. Be forthcoming, honest and lead with integrity to ensure you maintain the trust of your clients. Explain the application process to your borrowers as early as possible, and refer back to consistently. This will help establish trust and stability. To convey your level of trustworthiness, consider spending time to establish your own personal brand — what should clients immediately think about when you come to mind.

Problem-Solving Skills

Challenges? What challenges? They’re just opportunities in disguise. Expecting them to come up and be ready and willing to problem solve. Navigating through complex situations is part of the job, so embrace it!

Time Management

You’ll need to juggle multiple clients, loan applications, and deadlines. Efficiently managing your time is a non-negotiable skill when it comes to being a good MLO and something that will become easier with experience.

Networking Mastery

Building strong relationships with realtors, builders, and other professionals can lead to valuable referrals. Get out there and mingle and remember that anyone you interact with could be the source of your next referral.

Staying Informed

The mortgage and real estate worlds are ever-evolving. Continual learning and staying updated on industry changes are crucial. This is especially true when it comes to loan programs and any eligibility changes that could impact your clients. You’ll also want to be up to date on all the latest news in the industry.

Tech-Savviness

Digital platforms are more prevalent in the mortgage industry and can provide a lot of value to you as an MLO. Familiarity with tech tools enhances efficiency, security, and client experience.

AI-driven tools are further transforming the mortgage industry, especially in client communications. Automated chat assistants, AI-powered email responses, and intelligent follow-up systems help MLOs engage clients more efficiently, provide real-time updates, and ensure a seamless experience.

Be Visible

Top-performing loan officers aren’t just strong communicators—they know how to extend that communication through social media and marketing. But creating content consistently can be time-consuming, especially when you’re focused on serving clients.

That’s why we created the Social Media Starter Kit and the Social Media Content Calendar: ready-to-use tools designed specifically for loan officers. Together, they make it easy to show up consistently and grow your visibility—without the stress.

Empathy & Patience

Understand that for most people, buying a home is a HUGE life event. Being patient and empathetic can make the process smoother and more enjoyable for your clients.

To master these skills, you’ll need to invest time in your communication style, your mortgage education and your mortgage marketing toolset. That investment, combined with working experience with clients, will pay off in dividends and set you on a path to shining success in the mortgage world.

Learn about joining the Morty platform as a loan officer.

Morty makes it quick and easy to for licensed MLOs to get sponsored and work off our platform. Take a look at our Platform Business Tiers. These tiers are specifically designed to give you the independence to start or scale your mortgage brand with the resources, infrastructure and technology you need to be profitable in today’s mortgage industry.