A step-by-step guide to creating a high-performing loan officer website that builds trust, captures leads, and grows your business.

Your website has the potential to be a powerful tool for building relationships and bringing in new business. For many borrowers, it’s their first real introduction to you. A well-structured site can answer questions, create confidence, and make it easy for someone to take the next step.

Here’s how to build a mortgage website that earns trust and turns traffic into actual leads.

Step 1: Choose the Right Platform

Start with the foundation. The right website platform should offer more than basic design options. It needs to support your business goals with tools built for the mortgage process.

Look for a builder that includes mobile-optimized templates, built-in lead forms, CRM or LOS integrations, and fast loading times. These features help your site stay efficient and useful over time, while keeping the user experience smooth on any device.

Generic builders might cover the basics, but a platform designed for loan officers will better support your day-to-day work.

Step 2: Get Clear on Branding and Messaging

A visitor should understand who you are and how you help within seconds. That means clear messaging, consistent visuals, and professional presentation.

Add your headshot, a concise bio, and your license details in a visible spot. Use client testimonials or recognizable partner badges to show credibility. Choose colors and imagery that reflect your approach and remain consistent throughout the site.

Clarity beats cleverness every time. People want to know who they’re working with and why they should trust you.

Step 3: Guide People Toward Action

SEO: loan officer website tips

Your website should do more than display information. It should give people a clear reason to act.

Add buttons or links that encourage a specific next step, such as starting an application, scheduling a call, or requesting a quote. Keep the language straightforward and easy to follow.

Avoid cluttering the page with too many options. Focus on one or two actions that are most valuable for your business, and place those options where they’re easy to find on both desktop and mobile.

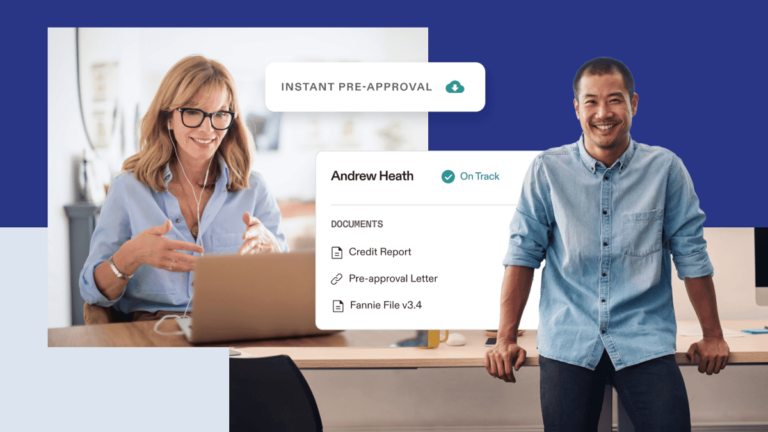

Step 4: Set Up Smart Lead Capture

Turning visitors into contacts requires more than just a contact page. Make it easy for people to share their information and give them a reason to do it.

Use short, simple forms that ask for key details like name, email, and loan type. You can also offer a downloadable guide, rate quote, or educational resource in exchange for an email address. These tools help you collect qualified leads and begin meaningful follow-up.

The fewer steps in the process, the more likely someone will complete it.

Step 5: Improve Visibility Through SEO

Your website should be easy to find through search, especially in the markets you serve.

Focus on keywords that include your location and services, such as “home loans in Tampa” or “Denver mortgage broker.” Create separate pages for your main service areas, and make sure your business appears in local directories and Google Business Profile.

Adding helpful blog content or an FAQ section can also improve search rankings while giving visitors more reasons to stay on your site.

Step 6: Keep It Current and Track Results

Once your site is live, keep an eye on performance. Regular updates show that your business is active and give search engines more reasons to feature your content.

Review analytics to understand which pages people visit most, how they find your site, and where they drop off. Update your site with fresh testimonials, updated loan program info, and new content every month or two.

Even small changes can improve how your site performs over time.

Wrapping Up

An effective mortgage website doesn’t need to be complicated. What matters most is clarity, relevance, and making it easy for people to connect with you.

If your current site feels outdated or disconnected from your business goals, now’s a great time to rethink how it supports your brand and your clients.

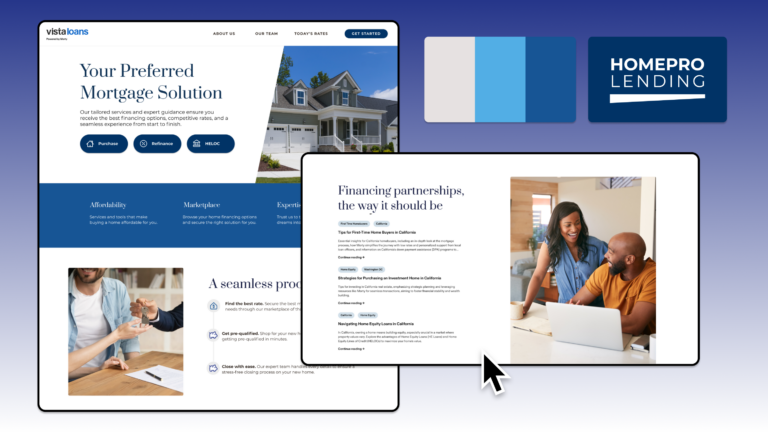

Want a site that helps you close more loans?

Morty offers mortgage website templates built specifically for loan officers. They’re easy to personalize, fast to launch, and designed to help you grow.

Explore Morty’s web templates for Loan Officers, talk to our team today 👇