Loan Officer Resources > Licensing

Becoming a mortgage loan officer allows you to combine home financing expertise with customer service skills. As you guide people through the most significant financial decisions of their lives—buying and refinancing homes—it’s important to be well-prepared. Below are some essential resources to help you get started on your journey.

Helpful educational resources to become a loan officer

What online courses can I take to help prepare to become a loan officer?

- Oncourse: Provides coursework needed to get licensed in each state.

- Coursera: Features finance and mortgage lending courses from accredited institutions.

- Udemy: Offers courses focused on specific skill sets such as Excel proficiency or sales techniques.

- LinkedIn Learning: Provides courses on soft skills crucial for customer service roles.

- Morty Blueprint: Support and tools to upstart your career as a loan officer, including everything from licensing test prep to networking and mentorship.

What type of educational background is needed to be a loan officers?

- It is not required to have a degree to become a loan officer. Having a degree in finance, business, or a related field can be helpful because it provides future MLOs with a strong foundational knowledge when it comes to home financing. Courses in these programs often cover essential aspects like risk assessment, financial markets, and lending principles.

Certification programs that are required to attain your mlo license

What is the NMLS and how do I work with it to become a loan officer?

The NMLS, or Nationwide Mortgage Licensing System and Registry, is a system established by the U.S. federal government to facilitate the licensing and regulation of mortgage professionals and companies involved in residential mortgage lending. The NMLS mandates that all mortgage loan officers pass a SAFE (Secure and Fair Enforcement) licensing exam. Various study guides and preparation courses are available online to help you succeed. At Morty, we cover the cost of test prep for loan officers joining the Morty Platform who are getting licensed.

What state-specific certification do I need to become a loan originator?

Different states have additional certification requirements for mortgage loan officers. Make sure to understand the requirements of the jurisdiction where you plan to work. Morty’s state-by-state licensing guides for: Texas, California, Georgia, Florida, North Carolina, Ohio, Maryland, Pennsylvania and Michigan

Will my employer sponsor me for mortgage certification programs?

Many employers offer sponsorship programs to cover some costs associated with certification and exams, seeing it as an investment in their employees. This includes Morty, where we’d love to sponsor you as an MLO. This sponsorship often comes with a commitment to work for the company for a specified period.

Mentorship and networking are valuable tools to become a successful loan officer

What are some great industry podcasts?

Hear directly from the pros and get a sense for the culture surrounding the profession.

How can I use social media to become a more successful loan officer?

Find your network by engaging with other loan officers on Facebook, Instagram and other social sites. Groups exist nationally and for your location. You can also use social media to learn about networking events and trade organizations near you.

Where can I find conferences to network and grow my LO business?

Events like the National Association of Mortgage Brokers (NAMB) conference can provide networking opportunities, keep you updated on industry trends, and offer workshops to improve your skills.

Can I attend local real estate events as a loan officer?

Forming relationships with real estate agents and other industry participants can lead to valuable business referrals. Networking is an important tool for gaining clients!

Mortgage Sponsorship

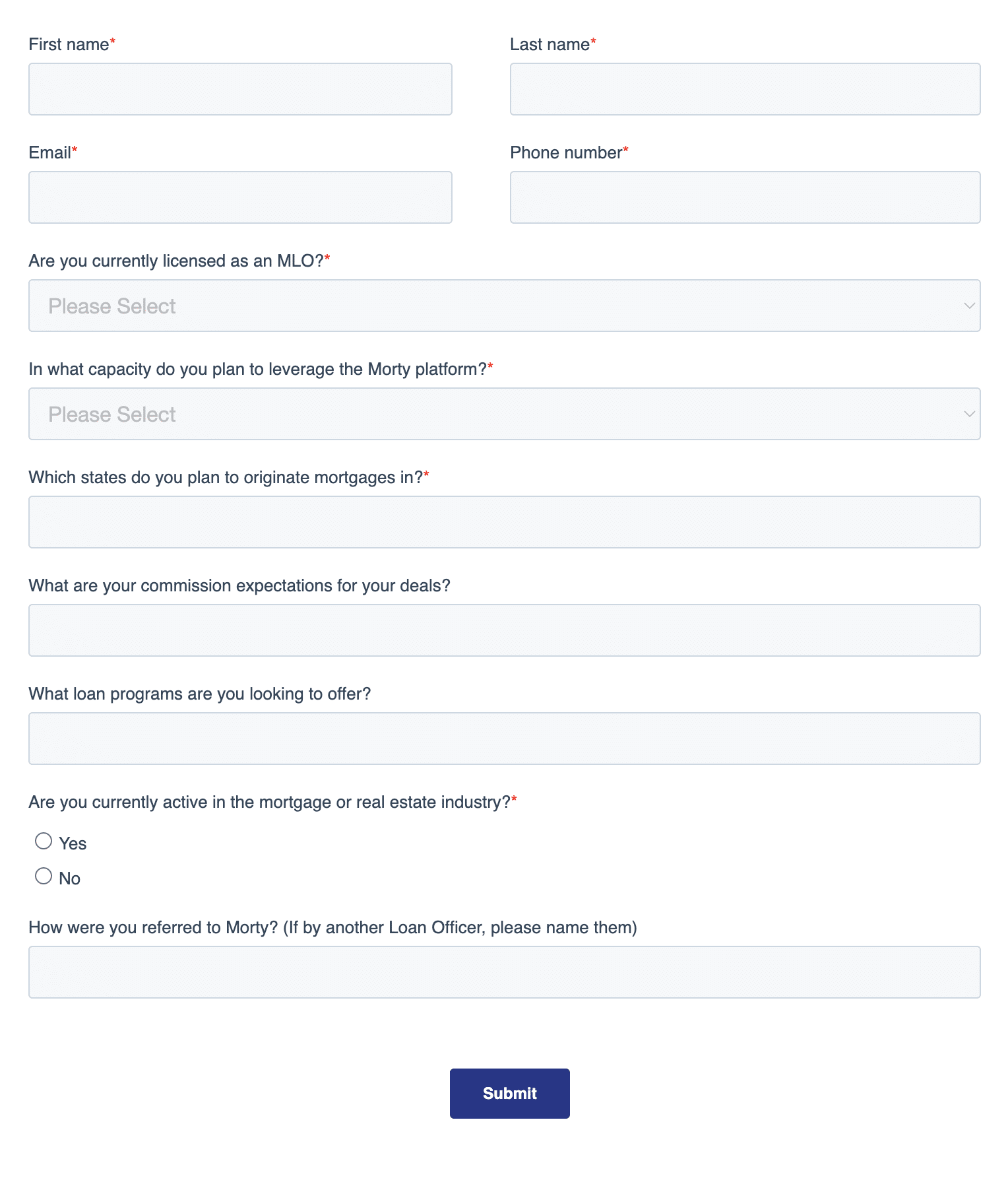

Are you looking for mortgage sponsorship so you can start working as a loan officer and using these rate tracking tools?

You’ve come to the right place! Morty is a tech-enabled online mortgage broker. Working as an mlo at a mortgage broker means you have access to more loan options than a traditional lender through our vast lender marketplace that increases the choices your clients can make. As part of our platform, you’ll also have access to our affordability tools, underwriting technology, and support from our processing and fulfillment teams.

Learn about joining the Morty platform.

Morty makes it quick and easy to for licensed MLOs to get sponsored and work off our platform. Take a look at our Platform Business Tiers. These tiers are specifically designed to give you the independence to start or scale your mortgage brand with the resources, infrastructure and technology you need to be profitable in today’s mortgage industry.