A closing date is the date agreed upon by the home seller, home buyer, and all of the other relevant participants in a transaction that marks the end of the home buying journey. Think of it like a deadline for a very important project that motivates everyone to focus their energy and hustle to make it happen.

The closing date is the moment where possession of the property officially moves from the old owners to the new ones, which means there’s a lot riding on it—emotionally, logistically and financially. And unfortunately, as with any group project, there’s a lot that can go wrong and cause the project to be turned in late.

As the head of mortgage origination at Morty, my team and I are on the front lines of helping people preempt potential closing date issues before they happen—when it’s possible.

Here are six annoying but true reasons your closing date might move, including some that sadly you won’t be able to do much about.

1. Appraisal Issues

Once a lender receives a home buyer’s application and first payment, they schedule an appraisal. An appraiser’s job is to visit a property and confirm its value and therefore the size of the mortgage. For certain types of loans, an appraisal is required by law. The typical appraisal timeline is one to two weeks from the time a buyer files the application. But sometimes, just getting in an appraiser’s calendar can be tricky.

If you know you’re in a hot property market, appraisers may just have their hands full, which often happens during seasonal buying peaks. Sometimes, there just aren’t enough appraisers to go around. In rural areas, appraisers wield a lot of power when it comes to timelines and costs. We know of at least one appraiser that asked for $5,000 to complete a report in two weeks, about ten times what it usually costs!

We’ve also seen appraisers quietly drop assignments without notice. If they do this without telling anyone, including the Appraisal Management Company (AMC) that is managing the appraisal for the lender, the buyer and seller have no way of knowing that until the inspection doesn’t happen, which may be weeks after the initial order and assignment. Some small lenders and realtors claim that their close relationships with local appraisers can prevent this from happening, but that’s not true. The same pool of appraisers are available to everyone, and the assignments come through the AMC. Unfortunately, everyone has an equal chance of getting a bad apple.

But let’s say you get into an appraiser’s schedule quickly. What they find in the appraisal can also affect your closing date. Sometimes, the appraiser might surface new information that wasn’t previously known, or shared. For example, part of the property might be in a flood zone. The appraiser might also identify that the home is a different type of property than what was originally listed, for example, a condo instead of a townhome, a small but meaningful distinction. If the lender believes that the appraiser has made a mistake, or if the appraiser’s report catches the eye of their loan underwriting or quality control teams, the lender may ask the appraiser for a revision or a second appraisal.

Finally, the appraiser could find issues with the property’s condition. Major structural repairs may be required prior to closing. Sometimes, natural disasters occur during the home buying process that require updated appraisals once it’s safe to do so (think: before and after a hurricane or similar weather event).

As you can see, the appraisal process is a big wild card in a home buying timeline and can impact your closing date in lots of ways. That’s why it’s at the top of our list.

2. Complicated Income

When lenders determine your ability to repay a mortgage, guided by rules set by the federal government, they focus on assessing the stability and continuity of your income. Unfortunately, that makes things complicated for those of us who have what is considered complicated or “variable” income.

What makes your income variable? Everything from self-employment, to a compensation package that includes a bonus or commission structure, to working on an hourly basis. If you’re not anticipating it, you may not realize this curveball is coming until you are already pretty far into the home buying process.

That’s because, unlike Morty, most lenders don’t assess all of your income documentation when you lock a loan and choose a lender. At some point after they’ve acquired you as a customer, they will pass off your information to an underwriting team. The underwriters are the experts on calculating the risk of offering you a mortgage, and they’re going to have a ton of questions and request extra documentation.

So if you fall into a variable income category—especially if you are self-employed—build some wiggle room into your closing timeline. You’re going to need it.

3. Borrowers Blowing Deadlines

Here’s one that is completely within your control as a home buyer: meet your deadlines!

At Morty, we see many buyers add unnecessary time to their closing schedule early in the process, simply by not being prepared to submit the financial information lenders require in order to consider you for a mortgage.

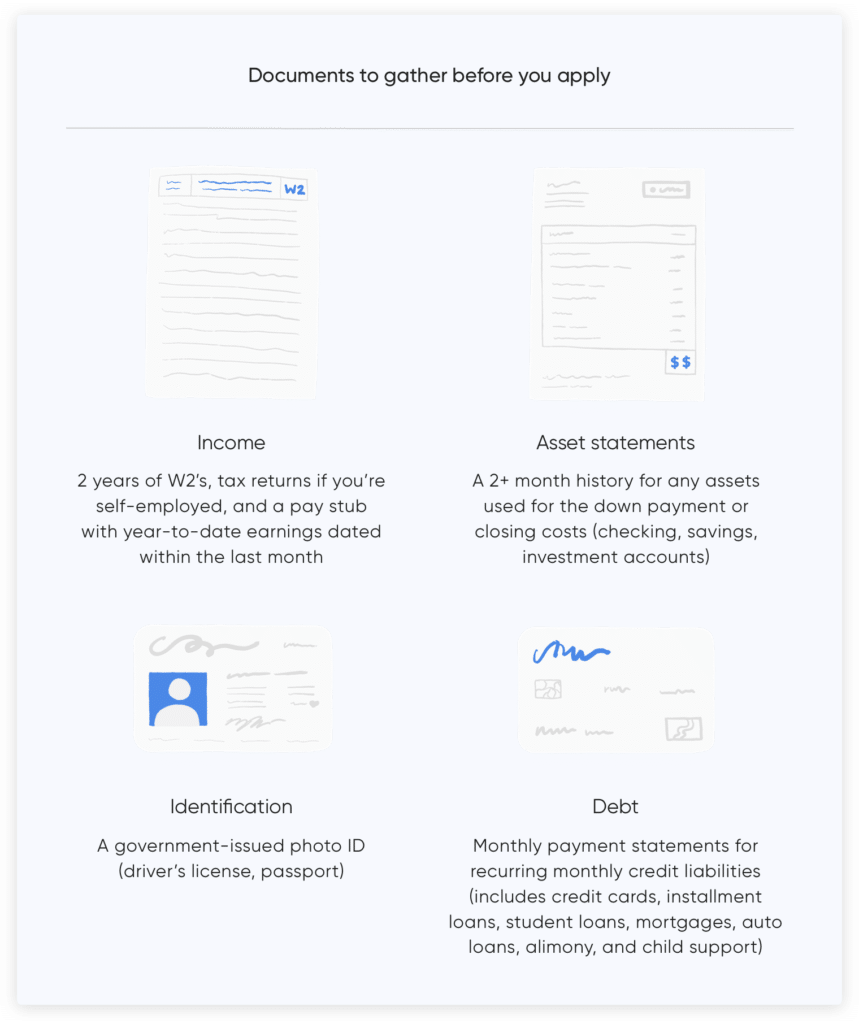

While every application is unique, here is a short list of the core documents you should have on hand before you even start shopping around for rates:

We also commonly see borrowers underestimate the amount of time it will take to acquire certain types of financial information. Buyers who hold cryptocurrency, for example, are often surprised at how difficult it is to prove ownership, and value, of those assets.

Everyone’s finances are uniquely complicated. In general, it’s best to err on the side of including every possible asset or liability in your documentation. That old loan you cosigned for a sibling, or child, but forgot about? Trust me, the lender didn’t forget. Challenge yourself to remember, and include, financial transactions that may seem irrelevant to the process before they slow down your closing timeline.

4. Ownership Complications

While less widely seen, there are some “unknown unknowns” that the seller may not be aware of until the home buying process is well underway. Certain title or recordation issues can pop up unexpectedly at various moments. “Recordation” refers to the records on file associated with a property, like a property deed, the document that proves official ownership of the home.

For example, the seller may have an existing judgment that must be settled prior to transferring ownership of the property. If the seller owes the government money—say, in back taxes—then the government will be first in line to earn money from the sale. Once that happens, things can get really complicated. (Fun fact: sellers aren’t even required to get credit checks to sell their home!)

And, believe it or not, certain counties still store records and deeds (documents of ownership) in paper form. So in cases where there is any confusion around property ownership that come up in the title search, simply locating these paper files may require more time and, therefore, cause delays.

5. Lender Oversight

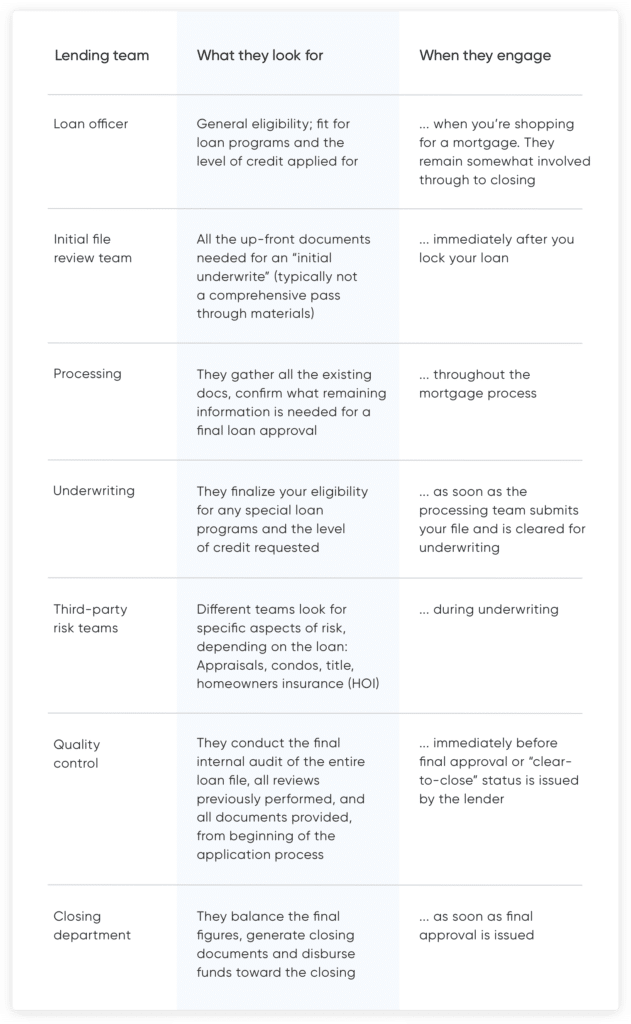

The good and bad news is that your mortgage application will be reviewed by many people. Why? Because it’s an important financial transaction on all sides, and everyone wants to get it right. But every time paper, real or virtual, moves from one desk to another, it adds time, questions and potential failure points.

Here are the common teams on the lender’s side that will look at a borrower’s loan application:

The quality control team ultimately has the final review, so expect them to catch things that may not have come up previously which can impact your timeline. But even earlier in the process, any of the above teams could identify an issue that creates a domino effect and causes all of the other teams to revisit their work and review your entire file. Yes, your entire file.

6. The Great Unknown

We’re not just talking about what the industry calls “acts of god,” like natural disasters. Personal emergencies count, too. What if the home buyer or seller changes their mind? Falls in love? Gets transferred? Falls ill? Loses a family member? Sometimes, things we can’t predict pop up that, whether positive or negative, will have an impact on buyers and sellers’ ability to meet a closing date. So as you embark on this process, open yourself up to the possibility that something completely unpredictable may happen.

Closing date problems are some of the trickiest issues my team and I help Morty customers navigate. We built Morty’s technology to anticipate and prevent many of these common issues, but we also recognize that sometimes you just need someone to vent and strategize with when things go awry.

If you are just embarking on the home buying journey, arm yourself with the above knowledge, more documentation than you think you need, a great appraiser, and a sense of humor. You will need them all to make it to your closing.

Robert Heck is Morty’s head of origination. He leads our team of mortgage experts that guide customers through the home buying process. Have a question about mortgages? Ask us.