The mortgage industry is filled with jargon that can overwhelm and confuse the best of us. Perhaps no two terms are easier to muddle than mortgage broker and mortgage lender. Understanding their differences and where they overlap can be a helpful first step to managing the home-buying journey.

To help remove any confusion, we’ll cover the difference between a broker vs. lender, the pros and cons of each and how to find the right mortgage company to work with. Finally, we’ll help you determine when you should work with a mortgage broker.

Related: A list of mortgage acronyms to be aware of

What is a mortgage broker?

Think of a mortgage broker as a matchmaker between you, the homebuyer, and your perfect lender “match.” When buying a home or refinancing, a mortgage broker doesn’t lend you money directly, but acts as a liaison between you and your lender.

A mortgage broker, such as Morty, is tasked with finding the loan option for home loans that fits your needs best. A mortgage broker helps homebuyers navigate the entire homebuying process, from finding a lender to helping you close your mortgage.

You can expect mortgage brokers to:

- Offer extremely competitive mortgage rates from their network of lenders which can include national banks, local credit unions and non bank lenders

- Help you find the best mortgage rates for your profile from across all of their lender to help save you time and money on mortgage.

- Review your credit score and financial profile to help you understand the types of loans that make sense for you

- Leverage their existing partnerships with lenders to show you a variety of loan options at different loan amounts

- Have relationships with real estate agents, home owners insurance agents and real estate attorneys that they can refer you to throughout the transaction.

- Answer any questions throughout the mortgage loan application process so you can close on time

Like lenders, not all brokers are the same. Some of the criteria you should consider while evaluating different brokers include: the quantity and quality of lenders they work with, their online reviews, and the level of guidance and support from their team.

What is a mortgage lender?

Mortgage lenders offer loan products to homebuyers and brokers. You’ve no doubt heard of the major mortgage lenders and financial institutions. But the market is becoming increasingly diverse, with local lenders and online tech companies joining in.

Each lender offers their own set of lending products. They also provide different experiences for borrowers—as proven by the reviews on sites like LendingTree. You can work directly with a lender’s in-house mortgage loan officer (MLO) to get your loan. Just remember that their incentives are based on you closing with their institution. This can ultimately bias the insights and recommendations they offer.

Finally, mortgage brokers might differ in how they make money. Some may charge you directly by a small percentage of your loan—think 1-2% of the total loan value. More commonly, they’ll charge the lender by a percentage in that range, which is typically built into the origination fees.

Related: The key differences between annual percentage rates and interest rates

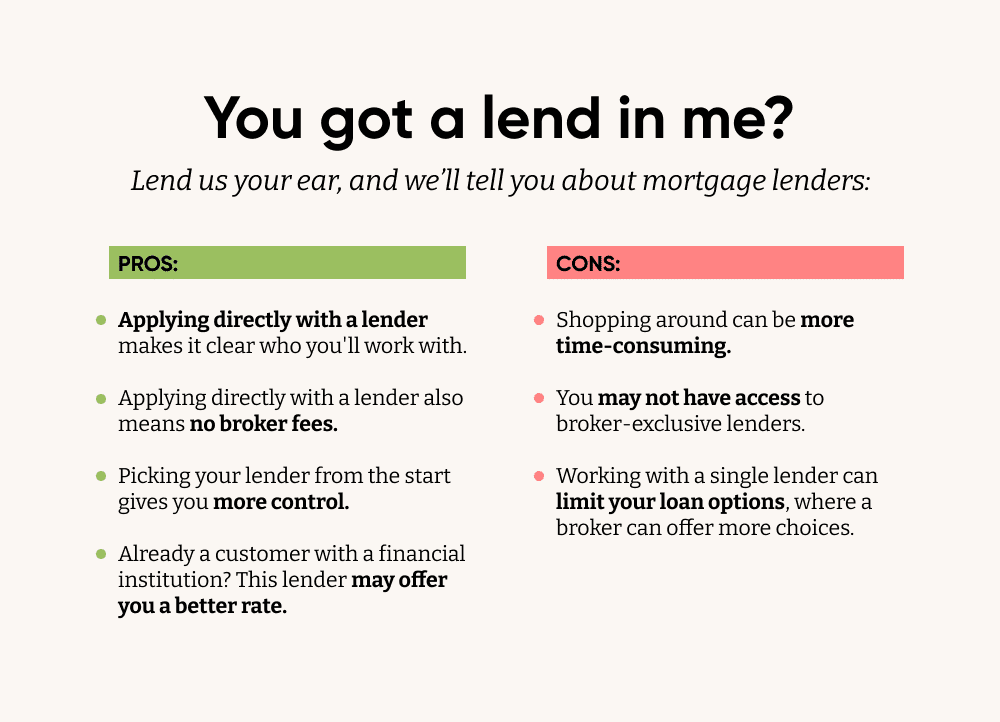

Mortgage broker vs lender: Which is better for you?

So when should you work with a mortgage broker? Here are some situations that can help inform your decision.

Scenario A: You want to shop around for the best rate.

If managing your budget is a priority, you should evaluate as many lenders as you can to ensure you find the loan option with the lowest rate and closing costs. Mortgage brokers can help you do this quickly and effectively.

Here at Morty, we work with more than 20 of the top lenders, giving us access to thousands of loan options. We’ll not only provide you with options from these lenders, but we’ll also quickly scan through them and identify those that fit your needs best.

Scenario B: You need to work fast to close your loan on time.

If there are just weeks between now and when your signed purchase contract is set to close, time is of the essence.

Getting mortgage insurance, title insurance, reviewing and signing the closing disclosure, scheduling the appraisal, among several other steps, can make it near impossible to go it alone quickly. A mortgage broker can expertly handle several of these tasks for you, and keep you on top of things in case there’s something you forget.

At Morty, the customer experience is a priority. We assign industry experts to work with every homebuyer. They’ll answer any of the homebuyers’ questions, provide them with proactive guidance, and work quickly with lenders to close the loans on time.

Scenario C: You’re a relatively inexperienced homebuyer, and you don’t know some of the steps involved in securing a mortgage.

As mentioned in the last scenario, the steps for getting a mortgage are numerous. It’s easy to forget one or do any inadequately. If it were straightforward, mortgage brokers wouldn’t exist!

Morty strives to make the process simple and easy. Our site lets you navigate through each step seamlessly, and our team of experts will handle the more time-intensive, complicated parts so that nothing gets missed!

Scenario D: You’re an experienced homebuyer and have time to shop around.

If you’ve bought a home before and feel comfortable doing it again on your own, you may not need the consulting and support services that a mortgage broker provides. Also, if you have the bandwidth to request and evaluate rates from multiple lenders, the rate shopping services from mortgage brokers may also seem less appealing.

In short, you can try working with a lender directly. Just keep in mind that some lenders work with mortgage brokers exclusively, and others offer lower rates to mortgage brokers. This means that mortgage brokers may help you unlock more competitive rates than you could find on your own. For example, at Morty we can access our lender’s wholesale rates, which aren’t made available to individual homebuyers.

With this background on the two groups in mind, you can feel confident about deciding whether you need a mortgage broker, and the type you’d like to work with.