A decision-making guide for mortgage tech purchases and how to simplify instead.

Independent brokers wear a lot of hats — and that often includes “head of technology.” It’s easy to fall into a pattern of “just one more tool” to solve a specific need. A better CRM here. A document tool there. Maybe a POS add-on. Before long, you’re spending more time managing your tech stack than your pipeline.

But before you sign up for yet another monthly subscription, ask yourself: “Is this solving a real problem — or just adding complexity?”

That one question can save you thousands of dollars and hours of friction.

Here’s how to use it as a filter — and what to do instead.

The Trap: More Tools, More Problems

We get it — your needs are real:

- You want to track leads better

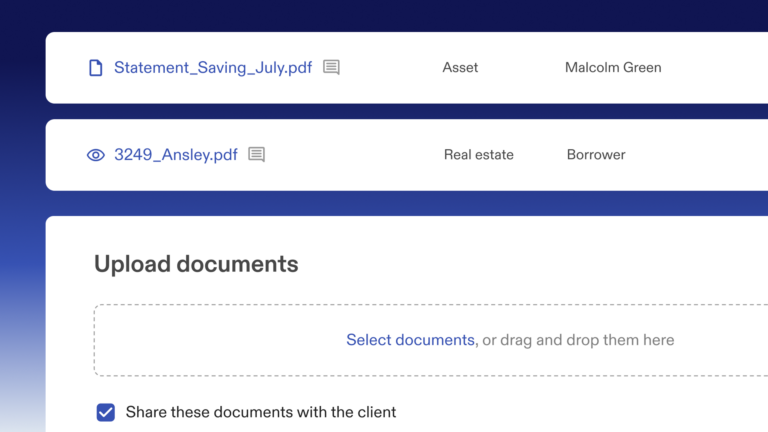

- You’re drowning in document requests

- You need visibility into your pipeline

But the common response is to add a standalone solution for each problem. The result? A disjointed experience for you, your team, and your borrowers.

- Tools don’t talk to each other: You collect borrower info in your POS, but then have to manually enter it into your pricing engine or LOS. That means double data entry — and double the chances for error.

- Data lives in 5 different places: You track lead notes in a CRM, store docs in Dropbox, quote loans in a pricing tool, and update files in Excel. Nothing is centralized, and you lose time hunting for info.

- Workflows get more complicated, not less: Every new tool adds its own login, training, and “process.” Instead of saving time, you’re stuck building workarounds just to make things flow together — which usually means you’re doing the work yourself.

What starts as “solving problems” turns into managing subscriptions, integrations, and duplicate data entry.

The Better Question: Is This Tool Adding Simplicity or Complexity?

Before clicking “Start Free Trial,” take a step back and assess:

| Ask Yourself | Why It Matters |

| Is this tool replacing something — or just adding to the stack? | Redundancy adds cost and confusion. |

| Will I use this every week? | Tools you don’t use consistently become distractions. |

| Does it integrate cleanly with what I already use? | Manual workarounds cancel out the benefits. |

| Will this help me grow — or just help me tread water? | Tools should scale with your business, not just patch holes. |

If you’re answering “no” or “not sure” to most of those, it’s a red flag. Time to pause and reconsider.

What to Do Instead: Simplify First

Here’s what seasoned brokers recommend:

- Audit Your Existing Stack

Make a list of what you’re paying for, what you actually use, and where you feel gaps. You’ll likely find overlaps or unused features — especially between your POS, CRM, and pricing tools.

→ Explore how Morty combines lead intake, borrower docs, and product search in one platform — so you can cut back on multiple logins and duplicate workflows. - Look for All-in-One Solutions

Tools designed specifically for brokers often solve multiple problems in one system — from lead management to lender search to compliance.

→ Morty’s platform helps you manage your full pipeline, search across dozens of lenders, and automatically track compliance—all in one place. No integrations required. No third-party plug-ins. Just one streamlined experience for you and your borrowers. - Invest in Platforms, Not Plug-ins

A good platform supports your full workflow and evolves with your business. Think fewer logins, smoother handoffs, and less room for error.

→ Morty gives you one login for everything from quoting to closing — so your systems scale as you grow your volume, hire support, or expand your lender relationships.

The Cost of “Just One More Tool”

Every new subscription brings hidden costs:

- Time: Learning, training, maintaining

- Money: Monthly fees add up fast

- Complexity: More places for things to go wrong

And for brokers, time = money. Every hour you spend managing tech is an hour not spent closing loans or growing your pipeline.

The Takeaway

You don’t need more tools. You need better systems — ones that remove friction, not add it.

So the next time you’re about to add a new subscription, pause and ask: “Is this solving a real problem — or just adding complexity?” If it’s the latter, you already know the answer.

? Want to see what simplifying your stack looks like in practice?

Discover how Morty helps independent brokers run their business on one integrated platform — no patchwork required.