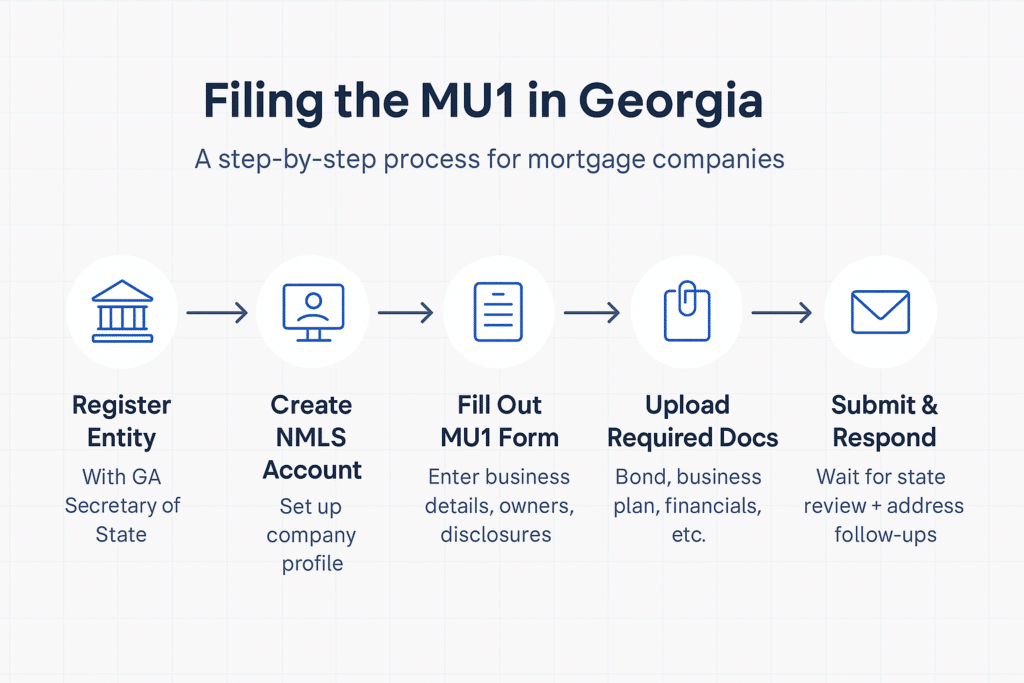

If you’re starting a mortgage company in Georgia, one of the first regulatory steps is filing the MU1 form through the Nationwide Multistate Licensing System (NMLS). The MU1 is the Company Form used to apply for a mortgage broker or lender license. While many guides touch on the MU1 at a high level, this post breaks it down specifically for Georgia applicants, with practical guidance to help you navigate the process from start to finish. For a broader look at getting started in Georgia, check out our guides on how to open a mortgage brokerage in Georgia and licensing requirements in the state.

What is the MU1 Form?

The MU1 is the central application used to license your mortgage entity. It includes business details, ownership structure, disclosure questions, and key documentation uploads. In Georgia, this is required to obtain a Mortgage Broker License or Mortgage Lender License. It must be submitted through NMLS and is typically accompanied by MU2 forms for each control person associated with the business.

The form is not just a data collection tool — it’s a formal declaration of your company’s operational structure and readiness to comply with state mortgage laws. Accuracy and completeness are critical.

Before You Begin: Georgia-Specific Requirements

Before jumping into the MU1, make sure you have the following lined up:

- Registered your business entity with the Georgia Secretary of State

- Obtained a Certificate of Authority (if your company is formed out of state)

- Chosen a Registered Agent with a physical address in Georgia

- Prepared a detailed Business Plan and Organizational Chart

- Gathered personal information and documentation for control persons (officers, directors, and owners)

- Secured a surety bond (typically $150,000 for lenders and $50,000 for brokers)

These materials will be required for upload within the NMLS portal. Ensure all names, addresses, and contact details are consistent across documents to avoid application delays.

If you’re looking for a streamlined way to manage these compliance tasks, explore our Compliance Infrastructure.

MU1 Section-by-Section Walkthrough

Business Information

- Legal name and DBA (if applicable)

- FEIN (Federal Tax ID)

- Main office address

Contact Information

- Designate a primary contact for NMLS communications

- Identify compliance or licensing contacts

Other Trade Names

- List any additional DBAs used in Georgia

Business Activities

- Select appropriate activities: Mortgage Broker or Mortgage Lender

- Be sure to select the correct license class, as this impacts your documentation and financial requirements

Ownership & Control Persons

- Detail all individuals or entities with direct or indirect ownership

- Complete MU2 forms for each control person (including personal history and disclosures)

Disclosure Questions

- Answer a series of yes/no questions about regulatory actions, criminal history, and financial matters

- Attach explanations and documentation for any “yes” answers

Documents Uploads

- Business Plan

- Certificate of Authority

- Surety Bond

- Financial Statements (audited or internally prepared, depending on structure)

- Organizational Chart

Be as thorough and transparent as possible. Missing a single required upload can stall your review.

Submitting the Application

Once your MU1 is complete and all documents are uploaded, submit the application through NMLS and pay the required state and NMLS processing fees. The Georgia Department of Banking and Finance will receive your submission electronically. From there, your application enters a review queue.

Turnaround times vary, but most applicants receive an initial response or request for additional information within 2–4 weeks. If the state has questions or identifies inconsistencies, you’ll be notified through the NMLS system.

Common Mistakes to Avoid

The easiest way to get tripped up during the MU1 submission process is doing one of these four things:

- Submitting incomplete or outdated financial statements

- Omitting key control persons or failing to file MU2s

- Choosing the wrong license type (e.g., applying as a broker when intending to lend)

- Forgetting to upload required documents

- Providing inconsistent information across different documents

These issues often result in “deficiency notices” from the state, which slow down the process and can be costly to fix later.

What Happens Next?

Once your MU1 has been reviewed and accepted, you may receive conditional approval pending any final documents or verifications. When fully approved, your Georgia mortgage license will be issued and visible in the NMLS system.

You’ll be expected to maintain your license through annual renewals, keep your information updated in NMLS, and remain compliant with Georgia’s mortgage laws. Any changes to control persons, office locations, or ownership must be reported via an MU1 amendment.

Frequently Asked Questions (FAQs)

Do I need to file the MU1 if I’m operating under someone else’s license? No. The MU1 is required for entities seeking their own mortgage license. If you’re joining an existing company or operating under a sponsoring entity, they will manage the MU1.

How long does it take to get approved in Georgia? Timelines vary, but with complete documentation and no deficiencies, it typically takes 30–60 days. Incomplete applications or missing uploads will delay the process.

Can I update my MU1 after submission? Yes. Any material change (ownership, control persons, address) requires an MU1 amendment. These updates must be submitted promptly to remain in compliance.

Do I need a lawyer to file the MU1? Not necessarily. While legal or compliance professionals can help, many applicants successfully file on their own or with support from platforms like Morty.

The MU1 is a key step in launching your mortgage company in Georgia. While the process can feel daunting, being prepared and detail-oriented goes a long way. If you want to fast-track the setup process, Morty’s platform and compliance experts can help you go from application to licensed in days—not months.

Want to see what’s included? Check our pricing or learn how we help you start your mortgage business.

Need help with your MU1 filing? Talk to our team by filling out the form below and we’ll reach out ASAP.