New in Hemlock: More Control Over the Loan Application Process

Every client is different and now you can give each one the right level of support during the application process. With our latest update to Hemlock, loan officers can customize how applications are reviewed, submitted, and managed, putting you fully in control of the borrower workflow.

What’s New: Customizable Loan Application Settings

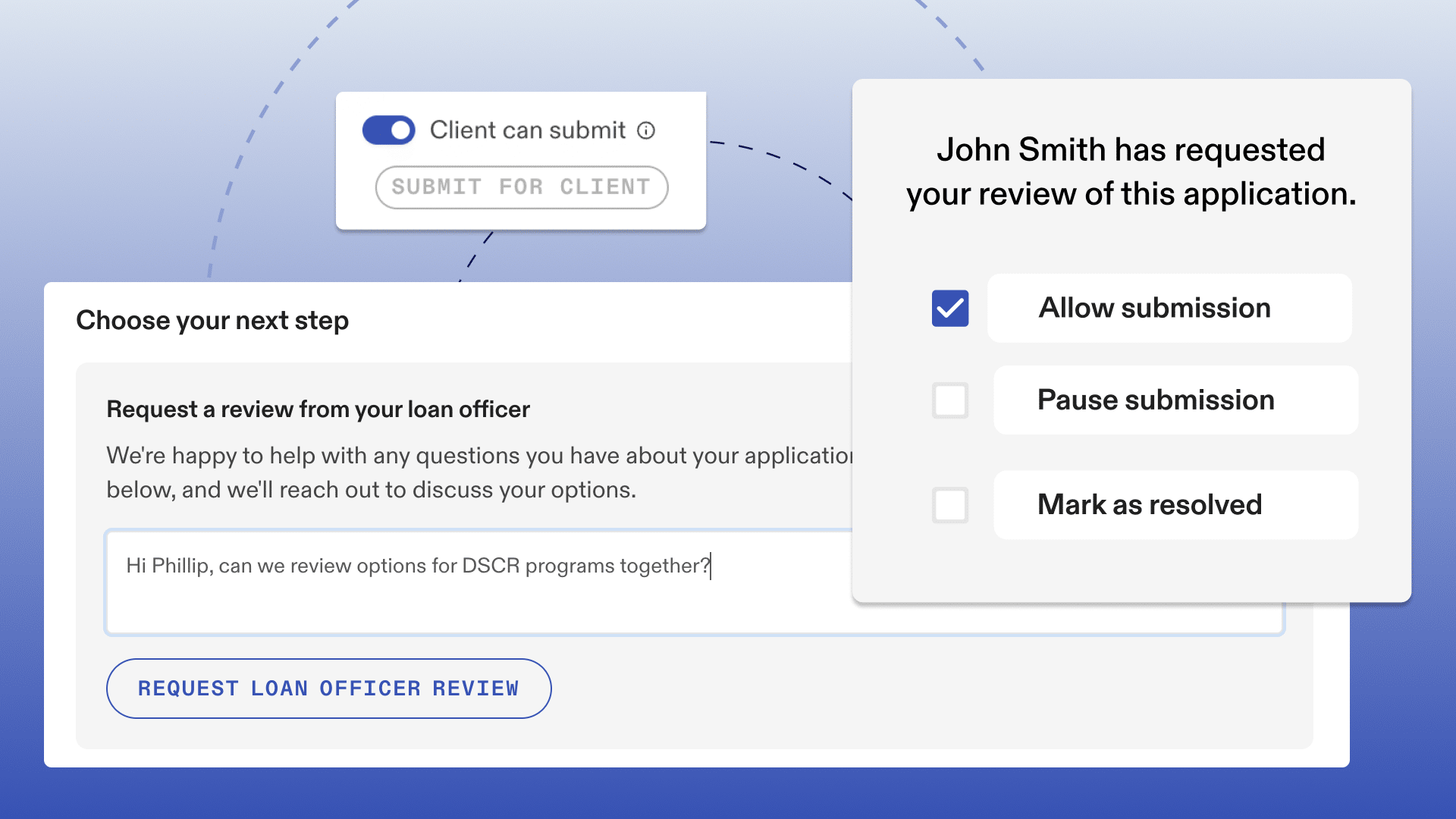

You now have the ability to determine:

- Whether clients can submit applications on their own

- Whether an LO review is optional or required before submission

- Who submits the final application: you or the borrower

This means you can tailor the experience to each client’s needs. Prefer a hands-on approach? Require your review before submission. Working with a more self-directed borrower? Let them submit on their own.

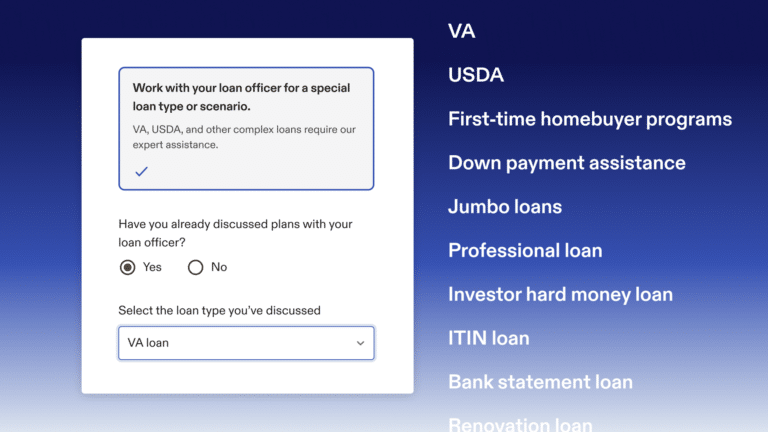

Application Review Options Built for Flexibility

At the final step of the application, clients will now see two clear paths:

- Request Loan Officer Review: Ideal for clients who want guidance on selecting a loan program or need help reviewing their inputs.

- Submit Application: For confident borrowers ready to move forward on their own.

Loan officers can also choose to submit the application on the client’s behalf directly from Hemlock, no need to wait on the client to act.

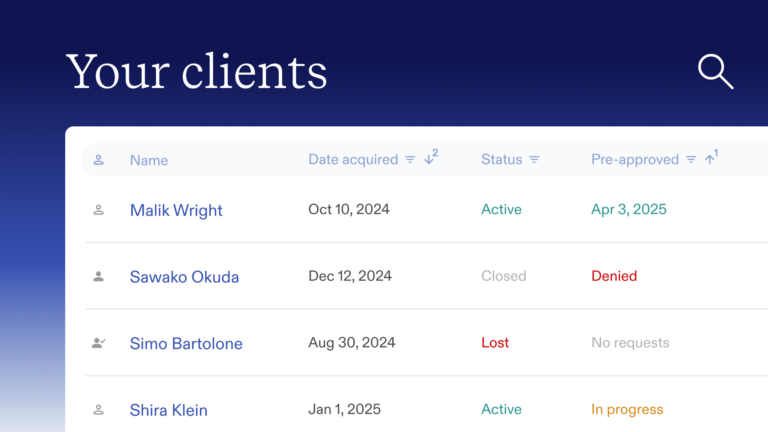

Control Submission Settings at the Broker or Client Level

You can now configure application permissions at two levels:

- Broker-level default: Set your preferred default in Hemlock: allow or restrict client self-submission without review.

- Client-specific overrides: Need a different workflow for a specific borrower? Override the default at the individual application level.

This gives you a powerful mix of standardization and personalization, especially useful if your pipeline includes both seasoned buyers and first-timers who need more support.

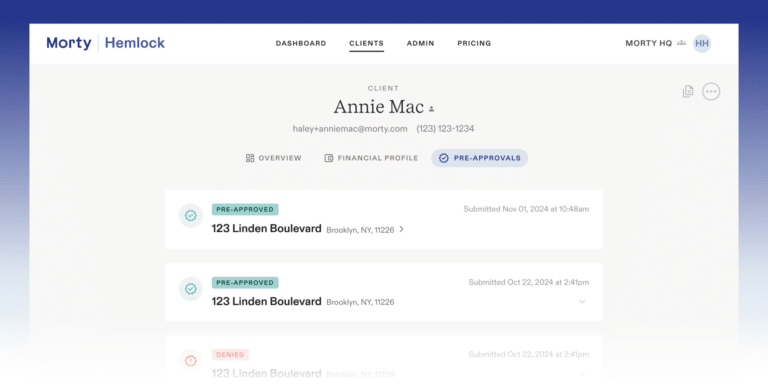

Better Tracking and Communication

When a client requests a loan officer review, Hemlock will now capture and persist:

- The associated application

- An optional client note

- Timestamps for the request and resolution

- The status of the review (open/closed)

This ensures nothing falls through the cracks and keeps your team aligned on next steps.