Customize the Client Experience: New Dashboard Configuration Options Now Live for Business Tier Partners

At Morty, we know that no two mortgage businesses are the same and now, your client dashboard doesn’t have to be either.

We’re excited to roll out new configuration options for Business Tier partners and above, giving you full control over which point-of-sales tools your clients see in their Morty dashboard. Whether you want to guide clients straight from application to closing or provide a more exploratory experience up front, the choice is now yours.

What’s New: Tailor the Client Journey

With our latest update, you can customize the entire borrower experience inside Elroy, Morty’s consumer platform. Choose which of Morty’s core tools appear in the client dashboard based on how you work and what best serves your borrowers.

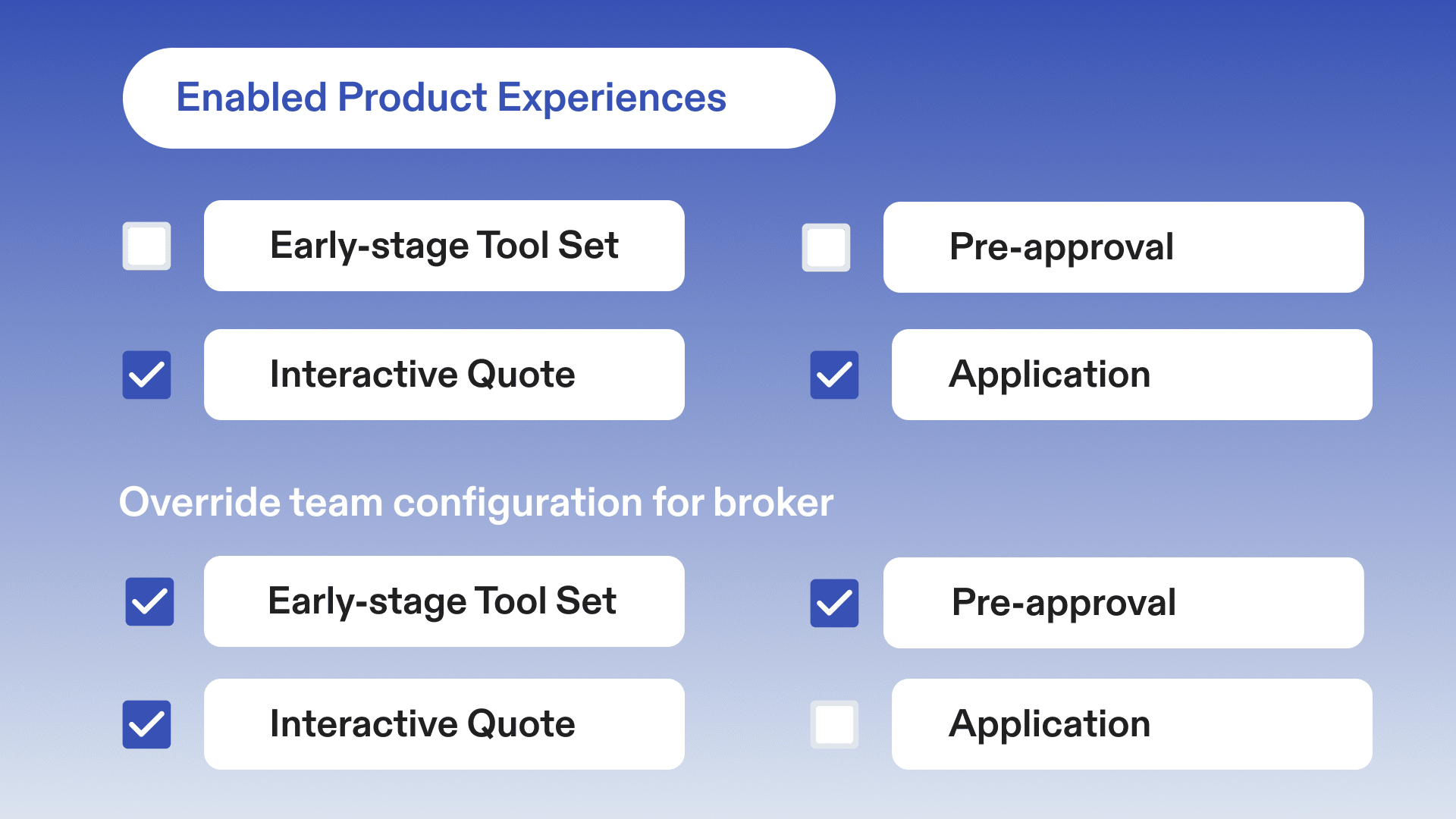

Here’s what you can turn on or off:

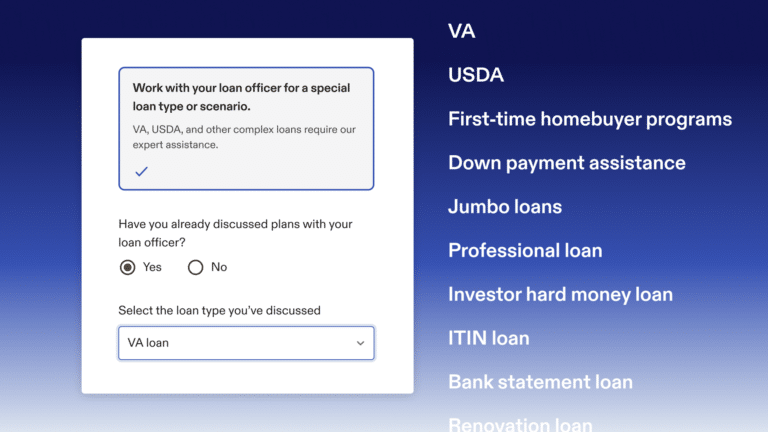

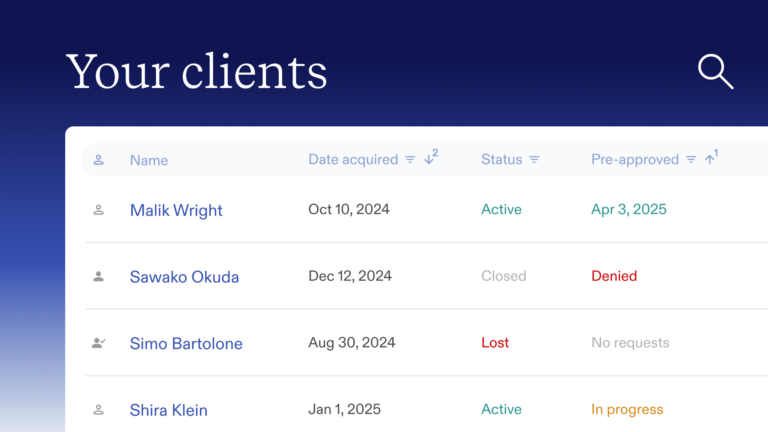

- Pre-Approval: Ideal for borrowers at the very beginning of their journey.

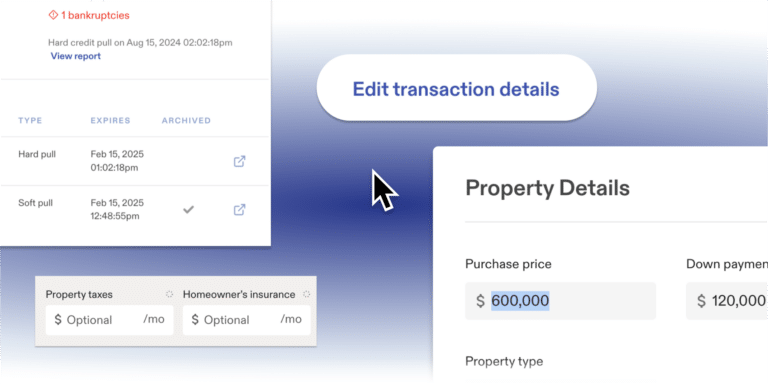

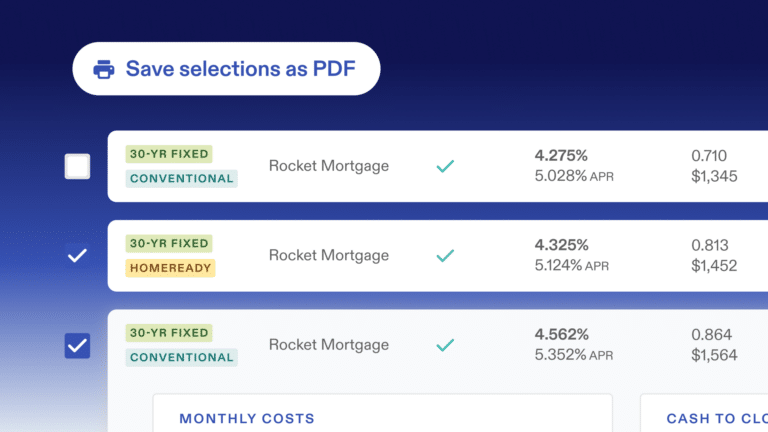

- Interactive Quote: Give clients an easy way to compare rates and explore loan options—or keep things streamlined.

- Application: Enable direct access to the loan application when they’re ready to move forward.

- Closing Tracker: Help clients stay informed as they approach the finish line.

- Cost Explorer (Early-Stage Toolset): Perfect for early-stage buyers who want to understand their affordability before diving deeper.

These settings can be configured at both the team and individual loan officer (MLO) level, giving your brokerage the flexibility to standardize the client experience across your team or personalize it even further.

Streamline or Expand, It’s Your Call

For partners who want a more direct, high-intent workflow—like going straight from loan application to closing—you can now hide exploratory tools like the pre-approval or quote comparison features from the dashboard entirely. If a client attempts to access a removed tool directly, they’ll be redirected to their main dashboard view, keeping the experience clean and focused.