We’ve made it even easier for loan officers to keep deals moving and assist clients at every stage of the mortgage journey.

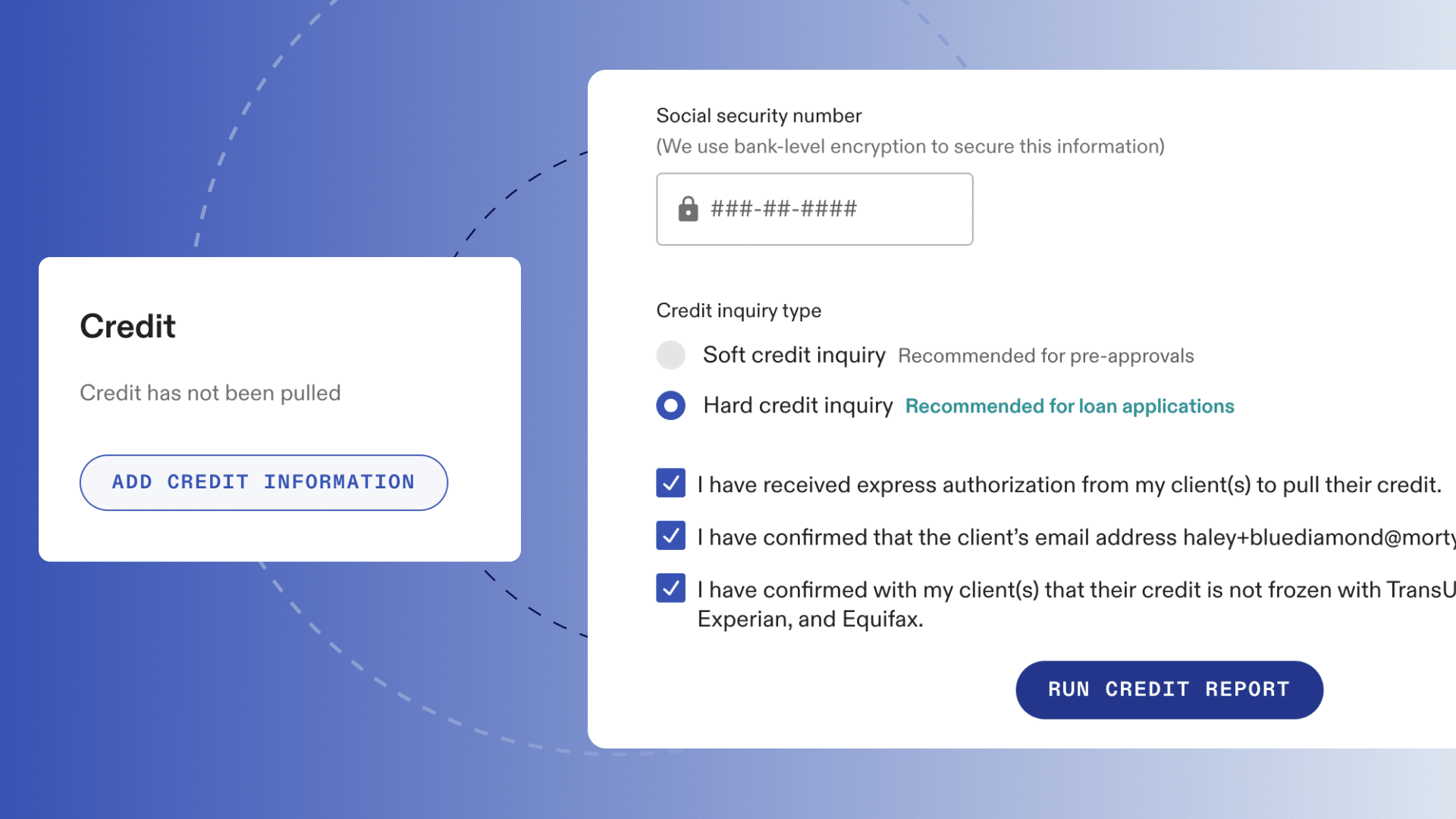

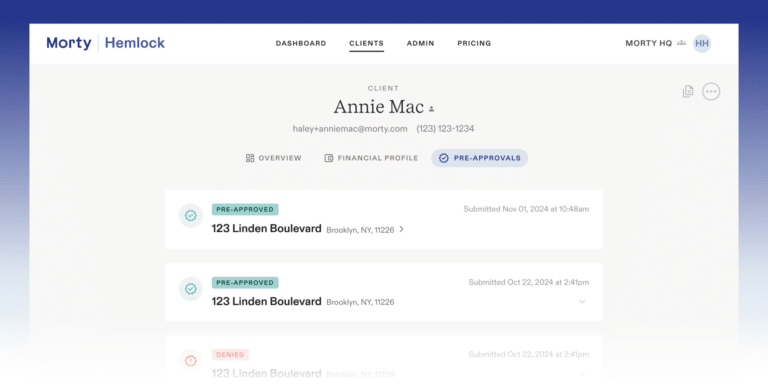

With our latest update, you can now pull credit directly from your client’s financial profile in Hemlock, no need to wait on your borrower to take action. Whether they’re experiencing issues completing the credit pull themselves or simply prefer you to take the lead, you’re now in control.

A Smoother, Faster Mortgage Workflow

This update is designed to save time and reduce friction for both you and your borrowers. Here’s what you can do:

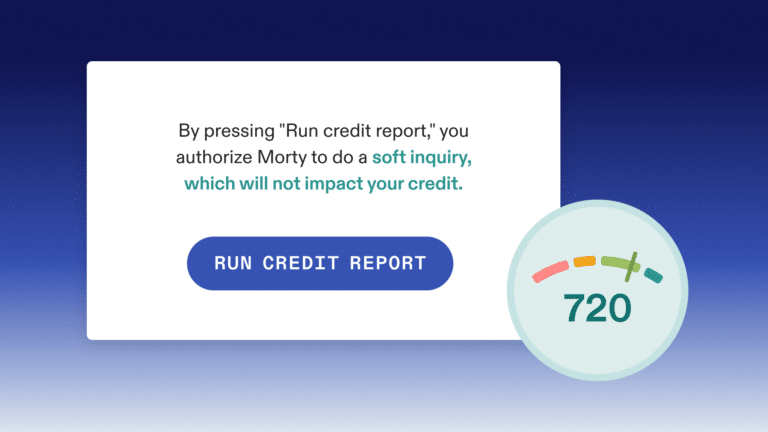

- Initiate credit pulls directly from Hemlock. Soft or hard pulls are fully supported.

- Bypass email verification. If your client hasn’t verified their email yet, pulling credit will automatically skip that step, no more unnecessary delays.

- Support for client-led or LO-led workflows. Whether your borrower is hands-on or hands-off, you can now tailor the experience to fit their preference.

Why This Matters

When a borrower is stuck or simply wants you to handle it, credit pulls can become a bottleneck. Now, you can step in with confidence, ensuring that applications stay on track and nothing slips through the cracks.

This is especially helpful for:

- Clients who struggle with tech

- Borrowers who prefer a white-glove approach

- Urgent deals where time is critical

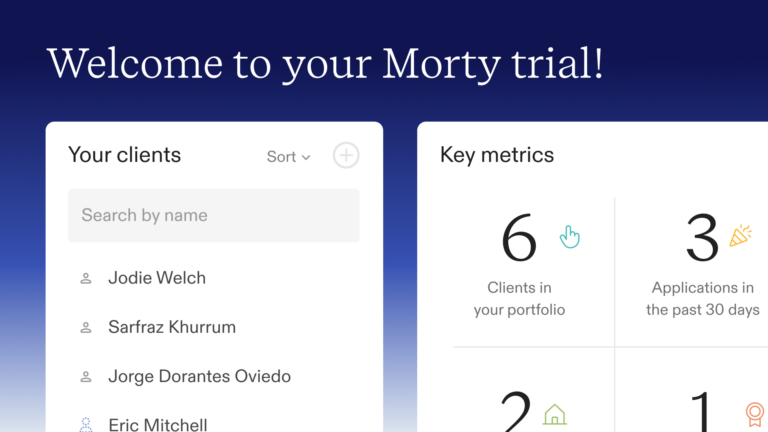

Available Now in Hemlock

This feature is live and ready for use across all Hemlock accounts. Just head to your client’s financial profile, and you’ll see the new option to pull credit directly.