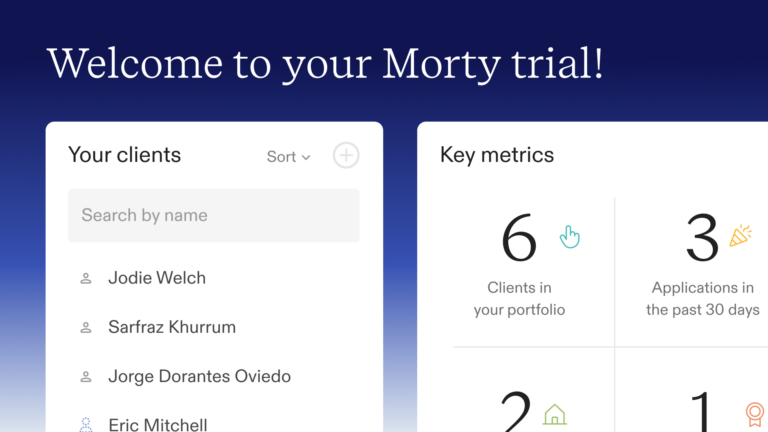

New Tools, Smarter Workflows

This month, we rolled out several updates designed to help users work faster, stay organized, and close more loans with confidence.

OCTOBER 27 • LOAN ORIGINATION SYSTEM

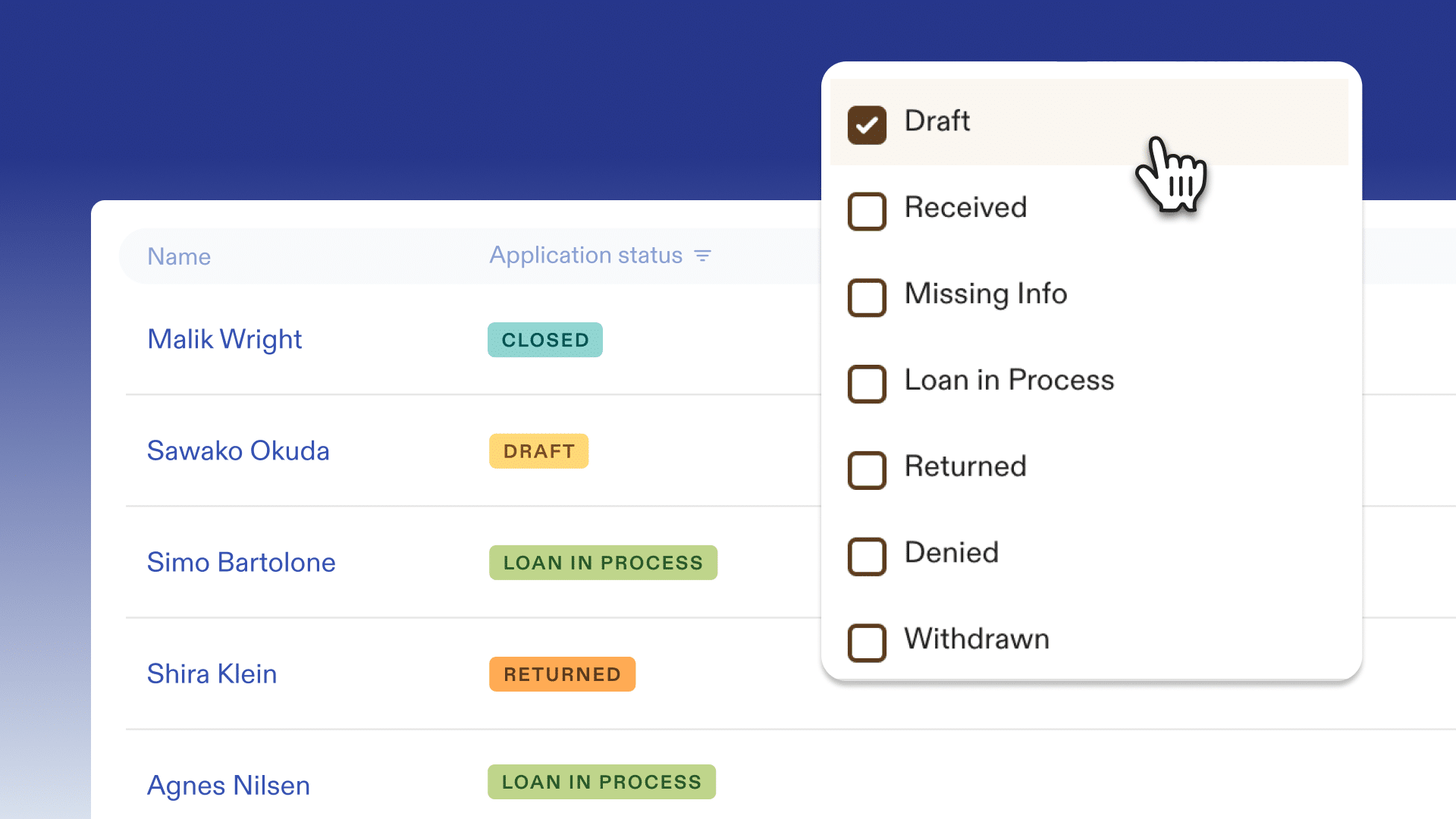

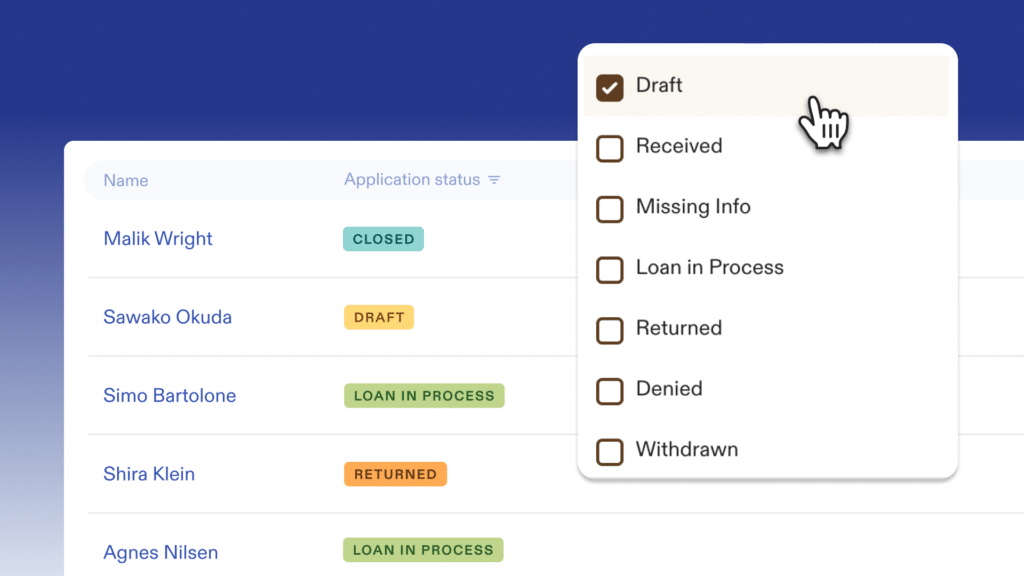

Application Statusing = More Visibility, Better Pipeline Tracking

We’ve introduced a major enhancement to how applications are tracked in Hemlock. The new Application Statusing system gives loan officers and admins more visibility into where each loan stands, all within Hemlock.

- Centralized Status Tracking: View the current state of any loan application directly in Hemlock — no more switching between tools.

- Terminal Status Safeguards: Once an application is marked as Denied or Withdrawn, its status can no longer be changed, ensuring data accuracy.

- Pipeline Insights: Status data now feeds into reporting and pipeline metrics, helping you manage your business more effectively from one dashboard.

OCTOBER 23 • MORTGAGE INFRASTRUCTURE

NFTYDoor added to our lender network

We’ve added NFTYDoor to our lender network, expanding Morty’s product access to mortgage capabilities to specialty products like HELOCs. NFTYDoor is a fully digital application powered by AI and automation, and funding can happen in as little as 5 days.

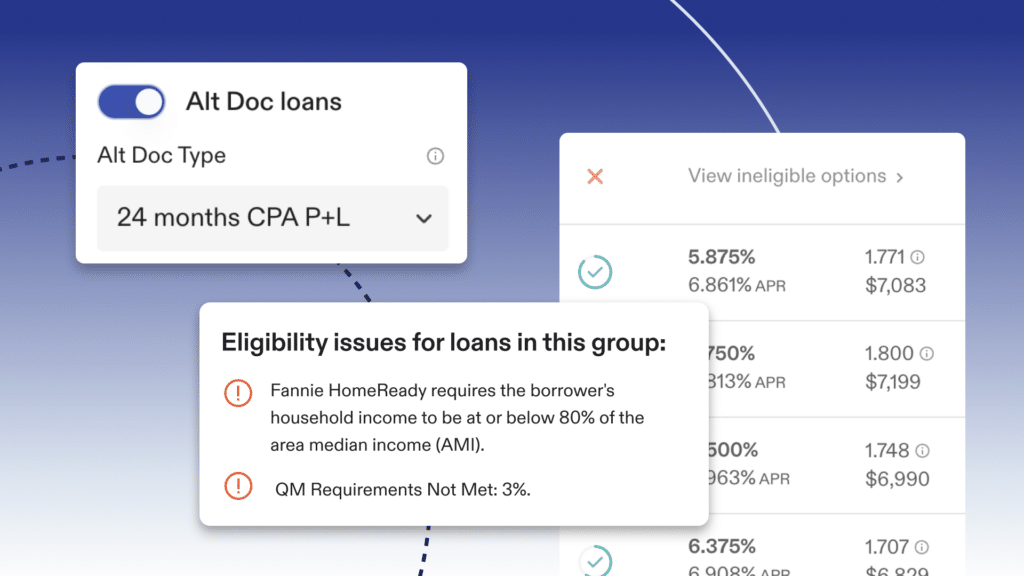

OCTOBER 15 • PRODUCT & TECH

Eligibility Messaging Now Live for Alt Doc Options

We’ve added eligibility messaging to Alt Doc loan options in Hemlock, giving loan officers greater clarity when reviewing and structuring non-traditional borrower scenarios. This update helps brokers work more efficiently with self-employed and alternative-income clients, ensuring every borrower gets matched with the right solution, faster.

- Greater transparency: Instantly see why a client’s scenario may not align with a specific program.

- Faster troubleshooting: Identify and correct issues upfront, before submitting to lenders.

- Streamlined workflows: Generate fee sheets and manual PA letters directly.

- Smarter client communication: Explain complex program criteria with confidence and guide borrowers through eligibility issues in real time.

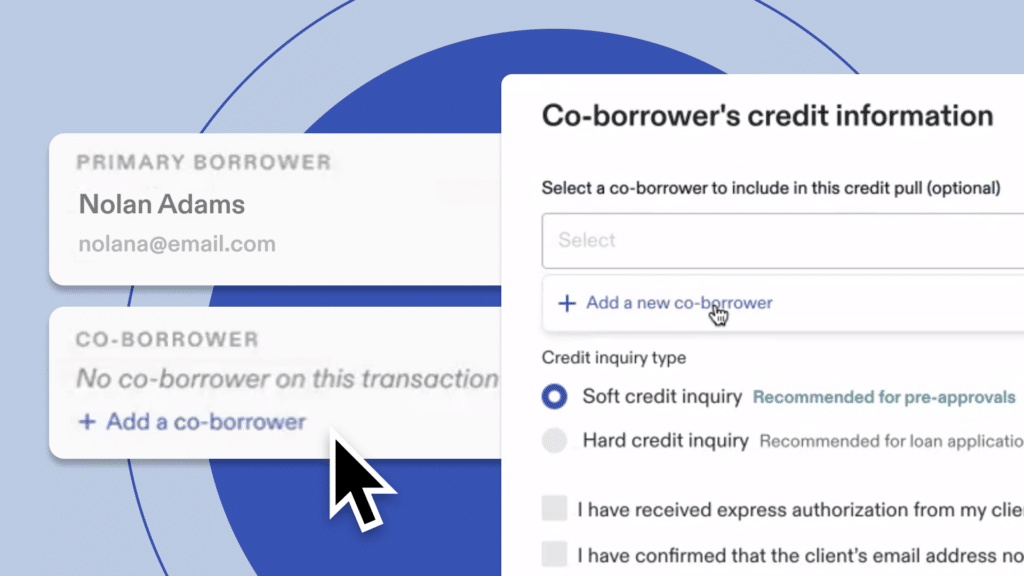

OCTOBER 6 • PRODUCT & TECH

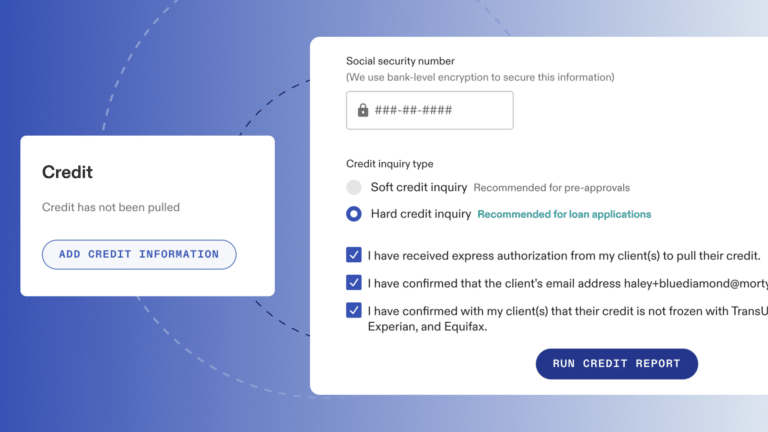

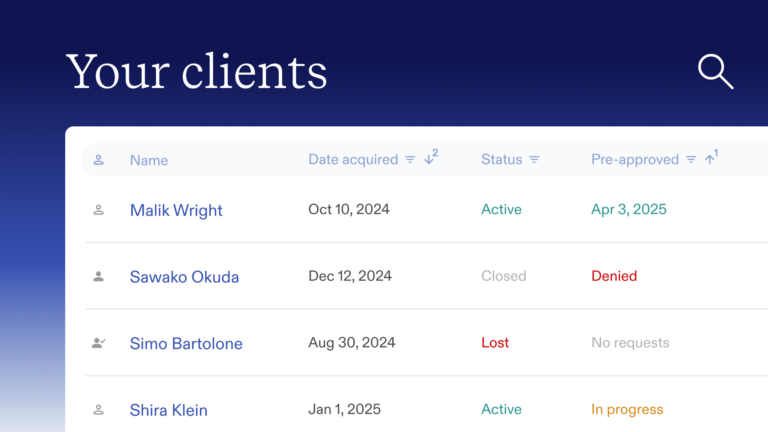

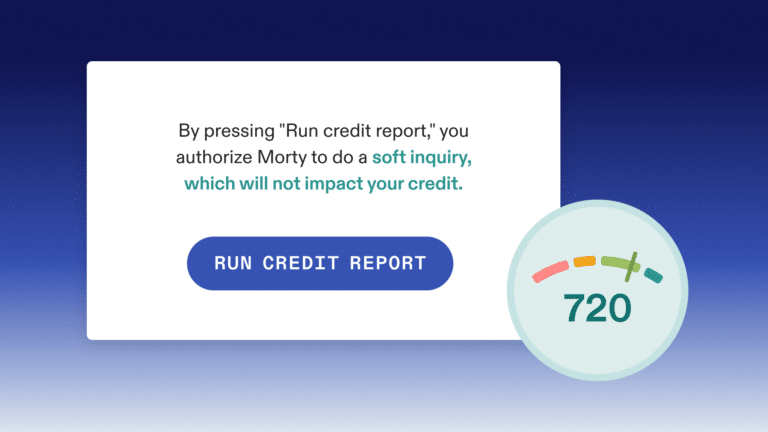

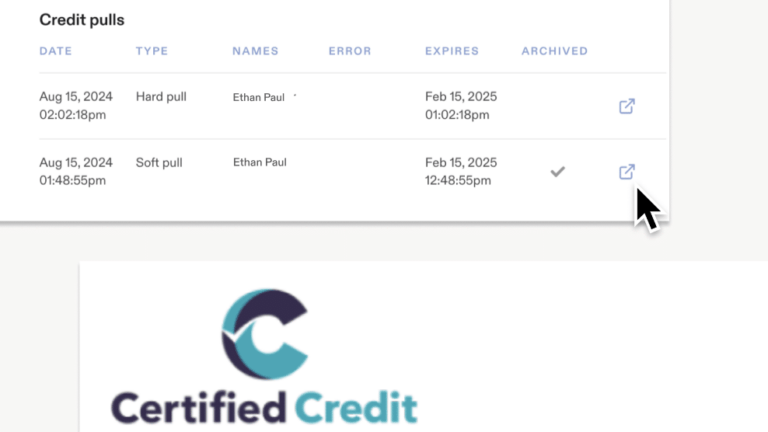

Expanded credit pulls and co-borrower management

Simplify credit pulls and co-borrower management. We’ve expanded how credit works in Hemlock, giving you more flexibility to qualify early-stage borrowers and keep your pipeline moving.

- Pull credit for any client, even before a property or transaction is created.

- Add and manage co-borrowers directly from the financial profile or credit pull modal.

- Run credit for different co-borrower combinations to see how profiles compare.

- Clients can manage co-borrowers details within the pre-approval and application at any time.