Rundown by rates

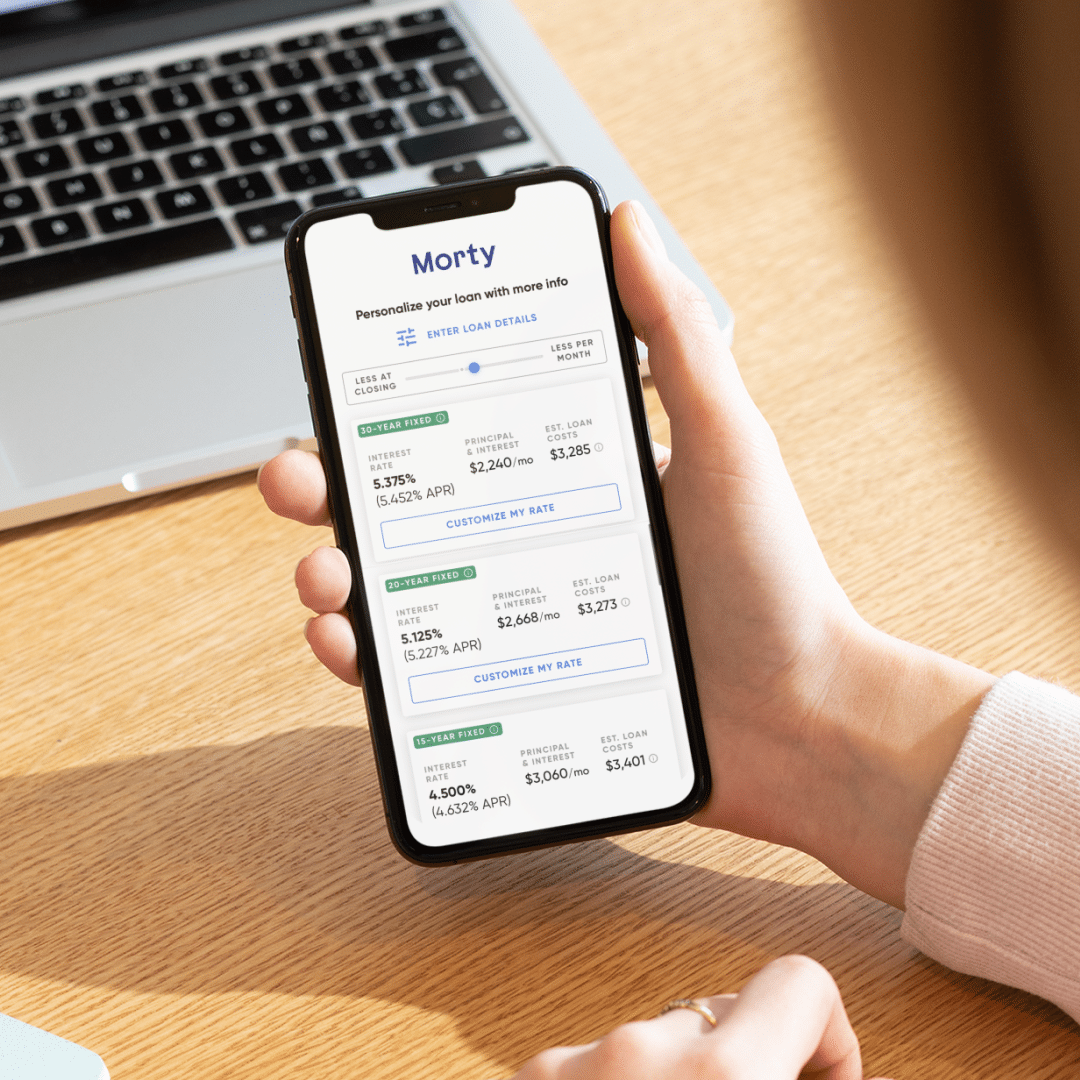

We hope your week is off to a good start. There’s no question that rates are high right now as they hover around 7%, on par with the levels we saw late in 2022.

That said, the market remains active at many levels with many buyers continuing to navigate the market and compete for the (often limited) properties available.

While it’s understandable that some buyers are skittish about moving forward at the moment, we’re here to help those buyers that are in the market navigate it as best as possible and get the most competitive options. Especially right now, buyers should look into conventional loan programs that sometimes fly under the radar, like HomeReady and HomePossible. Put simply, these have more flexible down payment requirements that can make them strong options for improving affordability for those who qualify, despite high rates.

In terms of where rates head from here, there’s still little to suggest we’ll see significant improvement anytime soon. That said, it’s also unlikely rates will rise significantly higher, especially given the expectations that the Fed will not issue another rate hike at its upcoming June meeting.

-Robert Heck, VP of Mortgage @ Morty

Buyer Question

We’ve been looking for a larger home near our current one (owned since 2011) for the past few months. I’ve heard about others going through the process who have run into issues with appraisals for homes they’ve made an offer on coming in too low. This wasn’t an issue when we were last in the market. Why is this and what can we do if we find ourselves in this scenario?

– Elizabeth B., Lagrangeville, NY

While there’s a number of reasons that an appraisal might come in low, it’s most likely that the appraised value hasn’t kept up with changes in demand within your local market. This is especially likely if there are homes selling for above asking price.

If an appraisal does come in low, you have a few options you might pursue:

- Submit a reconsideration of value to ask that the appraisal be redone, along with examples of recently closed sales that support your purchase price

- Make up the difference between the appraised value and the agreed upon offer price in cash, if possible.

- Negotiate with the seller to bring the price down to the appraised value.

While it might hurt your chances of winning out in a competitive market, you could also ask your agent to help you negotiate appraisal contingencies that could protect your deposit in the event that the appraisal comes back lower than the contract price. This could mean that if the appraisal does come in low, you as a buyer can walk away without penalty.