After a noticeable jump in interest rates last week, the average 30-year fixed rate is now back under 7%. Despite the fact that these rates are the highest we’ve seen since January, there are some extremely positive signs in the market that indicate strength and opportunity for the summer ahead.

Inventory is Highest It’s Been in Years

New home sales jumped 4.8% in April, signaling continued momentum in builder activity. In fact, overall inventory rose 31% YoY, marking 18 months of inventory growth. Buyers are starting to see more options—and that will help moderate home price growth.

Sellers Are More Flexible Than You Think

More than 30% of sellers have cut their list prices, and homes are sitting on the market slightly longer than they were earlier this year. That means motivated buyers are often in a stronger negotiating position—especially when they come in with financing lined up.

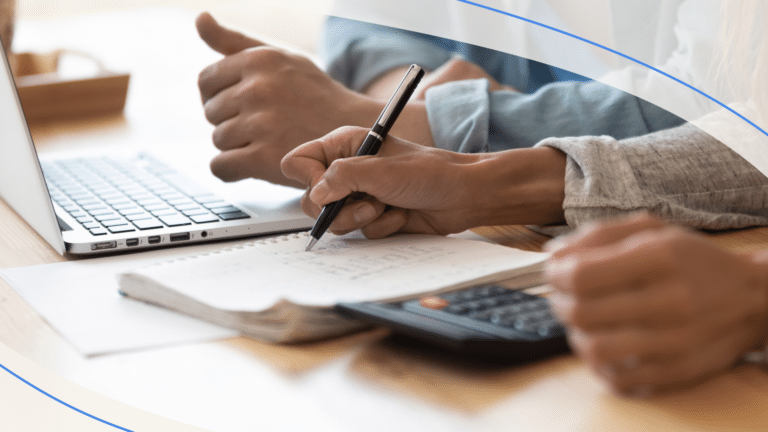

Affordability is Still a Challenge, But There Are Workarounds

Higher rates have pushed monthly payments up, leading to a dip in mortgage applications. But many buyers are turning to creative strategies like temporary rate buydowns, adjustable-rate mortgages (ARMs), non-QM loans or even pairing down payment assistance with a HELOC after purchase to keep things manageable.

What’s Next?

Economists expect that mortgage rates will remain volatile in the near term. Markets are closely watching the Federal Reserve for signs of easing, but recent inflation data has delayed hopes for immediate rate cuts. That said, many still expect conditions to improve later in the year—making now a good time to get ahead of future competition.

Not sure how to approach today’s market? Our team is here to help you navigate your options—whether that means learning about non-QM options, exploring a HELOC, or strategizing for a future purchase.