Loan Officer Resources > Loan Officers

Being a loan officer at a mortgage broker is different from being a loan officer at a mortgage lender. Each can differ significantly in terms of their roles, responsibilities, and operations. Here’s a breakdown of the primary differences:

Nature of Business

Mortgage Broker: Act as intermediaries between borrowers and lenders. They do not lend money directly but rather help borrowers find the best loan options for them by shopping their loan application around to multiple lenders or leveraging an online mortgage marketplace, among other tools.

Mortgage Lender: Directly lend money to borrowers. Loan officers at a mortgage lender work for the lending institution and offer only the loan products that the institution provides.

Range of Products

Mortgage Broker: Typically have access to a wide range of loan products from multiple lenders. This allows them to tailor loans to the borrower’s specific needs and circumstances.

Mortgage Lender: Offer only the loan products that their institution has. Their product range might be limited compared to brokers.

Compensation

Mortgage Broker: Their compensation typically comes directly from the lender in the form of a commission percentage.

Mortgage Lender: Loan officers at a mortgage lender might receive a base salary plus commissions or bonuses based on the volume or value of loans they originate.

Approval and Underwriting Process

Mortgage Broker: Once a suitable lender is found for a borrower’s needs, the loan application is sent to that lender for approval and underwriting. The broker may have specialists that assist with the processing and fulfillment of the loan.

Mortgage Lender: The process is typically in-house. The loan officer works closely with underwriters.

Customer Relationship

Mortgage Broker: Often have a closer, more personal relationship with borrowers since they work closely with them to find the best loan option. The relationship is usually more consultative and tailored to the borrower’s needs.

Mortgage Lender: The relationship is direct, but it might be more transactional in nature, especially if the lending institution is larger.

Training and Licensing

Mortgage Broker: Must be licensed to operate, with requirements varying by state. The licensing often requires coursework and exams.

Mortgage Lender: Loan officers must also be licensed, but the emphasis might be more on the specific products and processes of the lending institution.

Flexibility and Independence

Mortgage Broker: Usually operates with more independence. They have the flexibility to choose from a range of lenders and products based on what’s best for the client.

Mortgage Lender: There’s typically less flexibility since loan officers are bound by the products and policies of their institution.

Both of these roles play essential parts in the mortgage industry. Choosing between being a loan officer at a broker or a lender will depend on individual preferences, career goals, and the desired working environment.

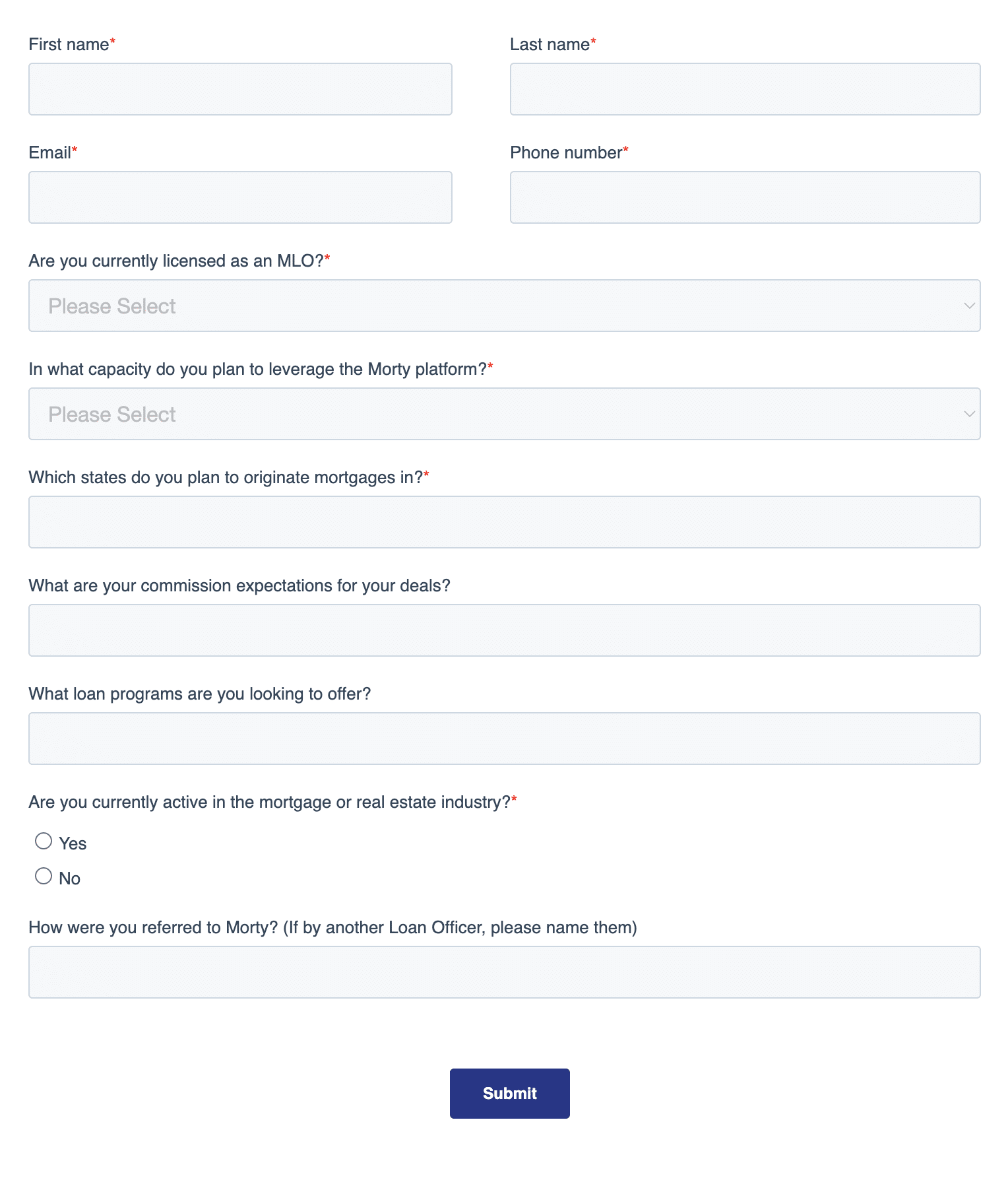

If you’re looking to become a loan officer at an online mortgage broker, Morty makes it quick and easy to get sponsored and work off our platform. This allows you to leverage our lender marketplace, tech, and support from our processing and fulfillment teams.

Learn about joining the Morty platform.

Take a look at our Platform Business Tiers. These tiers are specifically designed to give you the independence to start or scale your mortgage brand with the resources, infrastructure and technology you need to be profitable in today’s mortgage industry.