Florida’s real estate market is extremely vibrant and active with 256,977 home sales in 2022, well over the single-state 2022 average of 51,651 homes sales. As a mortgage loan officer (MLO) or a dual-licensed real estate agent in the Sunshine State, your success is not just about intuition; it’s about understanding the market deeply and leveraging the power of data. Let’s explore the keys to thriving in this growing industry.

Mastering the Art of Networking: 224,016 Realtors and 26,855 Loan Officers in Florida

Florida’s real estate arena is rich with professionals – 224,016 realtors and 26,855 loan officers, to be precise. Networking isn’t just a strategy; it’s a necessity. Engage with fellow real estate professionals to stay updated on market trends and collaborate effectively. Remember, your network is your net worth in this industry.

Continuous Learning in a Diverse Market: $402,500 Average Purchase Price and $346,762 Average Mortgage Amount

With an average purchase price of $402,500 and an average mortgage amount of $346,762, Florida’s market caters to a diverse clientele. Continued learning is your passport to success; staying abreast of ever-changing market dynamics from luxury properties to affordable housing options will keep you in “the know” and enable you to provide the best service for your clients. Tailoring your approach to different financial brackets sets you apart as an expert in the field.

Get a leg up with licensing.

Morty’s can help you prep and pass your SAFE Mortgage Loan Originator exam.

Effective Communication: 5.53% Average Commission on Real Estate Transactions

In a market where the average commission on real estate transactions is 5.53%, effective communication is paramount. Clearly explain your value proposition to clients. Help them understand how your expertise translates into a seamless and valuable experience for them. Demonstrating your worth is not just about words; it’s about tangible results.

Exceptional Customer Service: Your ticket to expanded business

Beyond the numbers, real estate transactions are about guiding and supporting homebuyers through the largest transaction of their life. Provide exceptional customer service to your clients. Be proactive, anticipate their needs, and address concerns promptly. Satisfied clients become your brand ambassadors, driving your success through referrals and positive reviews.

Leveraging Technology: Mortgage Professionals in the Digital Age

In a state with over 250,000 home sales, technology is your ally. Utilize advanced tools, from real time mortgage quotes and fully digital pre-approvals to marketing tools and virtual tour platforms. Establish a strong online presence to reach a wider audience. Technology not only enhances your efficiency but also showcases your commitment to providing cutting-edge service.

Upholding Professional Ethics: Building Trust in Every Transaction

Amidst the numbers and transactions, professional ethics are your guiding light. Uphold the highest standards of integrity and transparency. Building trust is not just a goal; it’s the foundation of your success. Clients need to feel confident that they are in the hands of a professional who values their interests above all else.

Your Path to Lasting Success

In the dynamic world of Florida’s real estate, success is not an accident; it’s a result of strategic planning, continuous learning, ethical conduct, and a commitment to excellence. If you’re interested in becoming a dual-licensed real estate professional, you’d have the unique opportunity to blend your expertise as a realtor and loan officer, shaping dreams and financial realities simultaneously.

Remember, every statistic is more than a number – it’s a story, a client, and an opportunity waiting to be explored. By understanding the market deeply and embracing the keys to success, you can navigate the complexities of the Sunshine State’s real estate landscape with confidence and achieve a lasting and prosperous career.

How Can Morty Help?

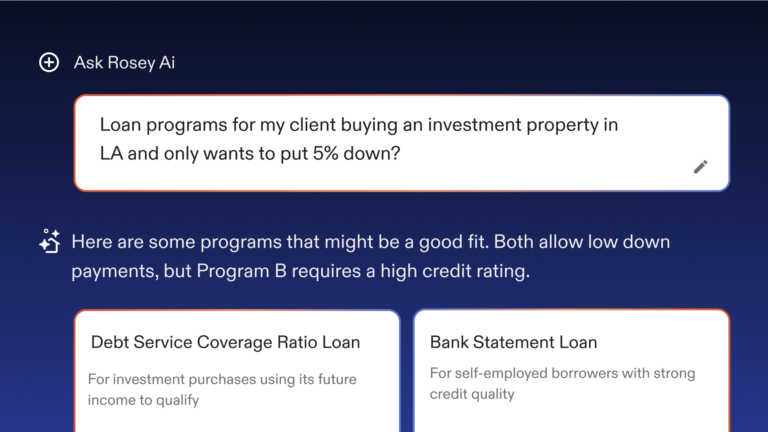

Glad you asked! Morty is a technology-enabled online licensed mortgage broker. Morty offers loan officers, and their clients, a better, more seamless mortgage experience through our lender marketplace, competitive pricing, affordability tools, underwriting technology, along with the built-in support from our processing and fulfillment teams.

Morty makes it quick and easy to for licensed MLOs to get sponsored and work off our platform. Take a look at our Platform Business Tiers. These tiers are specifically designed to give you the independence to start or scale your mortgage brand with the resources, infrastructure and technology you need to be profitable in today’s mortgage industry.

Complete the form below to get in touch with us and learn more!