The non-QM market is growing—but for many brokers, offering these loans still feels out of reach.

Between fragmented lender access, complicated guidelines, and manual documentation processes, non-QM lending has long been seen as high-effort, high-risk, and hard to scale. But it doesn’t have to be that way.

At Morty, we’ve built an integrated tech platform and support system that makes it easier to offer non-QM loans—so you can serve more borrowers and grow your business.

Who non-QM loans are for—and why brokers are leading the charge

Non-QM lending isn’t fringe—it’s increasingly mainstream. As borrower profiles become more complex, non-QM loans are helping more people qualify for the financing they need.

These are the types of borrowers driving non-QM demand today:

- Self-employed professionals with strong income but limited W-2s

- Real estate investors with rental income or complex ownership structures

- Retirees who are asset-rich but have lower monthly income

- Borrowers with recent credit events who don’t meet agency overlays

- Gig workers and freelancers who can’t show traditional job history

Many of these borrowers are financially stable—they just don’t fit the conventional mold. That’s why brokers, with access to alternative products, are in the best position to serve them.

Broker vs. lender: Who can do non-QM?

Traditional retail lenders often have limited non-QM offerings, if any. Their systems and underwriting processes are built for agency loans—and their loan officers are often incentivized to stick to conforming deals.

Independent brokers, on the other hand, can work with a broader range of wholesale lenders offering non-QM options. That flexibility, combined with access to the right tech and support, puts brokers in a strong position to own this growing segment.

Morty’s platform is designed to give brokers the best of both worlds: wide access to non-QM lenders and the tools to manage it all efficiently.

Why offering non-QM is hard for most brokers

Non-QM lending fills a critical gap in the market: borrowers who fall outside of traditional underwriting standards. Think: self-employed borrowers, investors, retirees, or people with recent credit events.

The opportunity is real—but so are the operational hurdles:

- Lenders each have their own rules. You may be juggling multiple portals, paperwork formats, and submission workflows.

- Guidelines are complex and opaque. Unlike agency loans, there’s no single standard. Determining product fit often means reaching out to an AE—or guessing.

- Processing is manual. Income documentation might require months of statements, P&Ls, or third-party letters. Submissions and conditions can drag on for weeks.

- There’s little support. Most broker shops are left to figure it out on their own—slowing things down and increasing the risk of errors or fallout.

These challenges leave many brokers avoiding non-QM altogether—or doing only a few deals a year despite high demand.

Morty makes it simpler from intake to close

We’ve rethought non-QM from the ground up. Our goal: remove friction, reduce guesswork, and help you confidently serve more non-QM borrowers.

Here’s how Morty helps:

✅ Smart borrower intake through Morty’s POS

Our Point-of-Sale system captures the details that matter for non-QM products—including income type, employment structure, and property goals—up front.

That means fewer back-and-forths with the borrower and cleaner files from day one.

🔄 Fulfillment support for non-QM

Our processing and fulfillment team is trained on the nuances of non-QM.

We help with:

- Validating 12–24 months of bank statements

- Collecting CPA letters, P&Ls, or other alt-docs

- Managing lender conditions and overlays

We’ve helped close bank statement and reverse mortgage deals in under 3 weeks—and we’re just getting started.

🔗 Built-in access to non-QM lenders

Our lender network includes a growing number of non-QM providers. That means you can offer a variety of products—including bank statement, interest-only, and reverse mortgages.

All deals flow through a unified workflow—giving you more visibility and control, with less chaos.

What makes Morty different

Morty isn’t just a submission portal or a lender marketplace. We’re a fully integrated mortgage OS designed to help you grow.

- You don’t need to be an expert. We guide you with smart tools and expert support.

- You can scale without bottlenecks. Non-QM doesn’t have to slow you down—our system is built to handle volume.

- You can close faster. We’ve seen non-QM files close in <3 weeks with the right prep and support.

- You can expand your reach. More self-employed borrowers. More retirees. More investors. More approvals.

Non-QM becomes a driver of growth—not a burden.

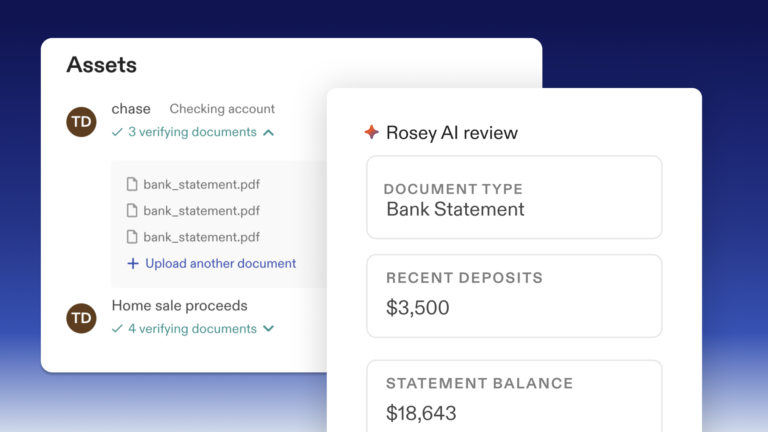

Spotlight Technology: Rosey AI for Non-QM Lending

Morty’s Rosey AI is your built-in guide for navigating non-QM with confidence. Trained on lender guidelines and product matrices, Rosey helps you get answers fast—without second-guessing or waiting on an AE.

Whether you’re on a call or prepping a file, you can ask Rosey:

- “What lenders accept 12-month bank statements?”

- “Does this borrower qualify for an interest-only loan?”

- “What’s the max DTI for a DSCR product?”

Rosey responds in real time, drawing from Morty’s lender data and documentation rules. It’s like having a non-QM expert on your team—helping you qualify clients faster and with more accuracy.

And since it’s fully integrated with Morty’s POS and workflows, you can go from insight to action instantly.

What you can do with Morty today

Morty is live and ready to help you expand your non-QM offering:

- Submit non-QM deals directly through the POS

- Use Rosey AI to determine product fit and documentation needs

- Get support from our fulfillment team on income validation and lender overlays

- Work with a network of vetted non-QM lenders across product types

- Match borrowers to the right non-QM loan with real-world scenarios

Let’s grow your non-QM business

If you’re not offering non-QM—or only doing it sporadically—you’re leaving volume on the table.

Morty makes it easy to start, scale, and succeed with non-QM. Talk to our team